The Harbor International Small Cap Fund Seeks to Efficiently Take on Inefficient Markets

September 27, 2023

There are certainly distinct risks in overseas investing – especially when it comes to smaller, less established companies. Small cap investing internationally can pose challenges ranging from lack of transparency to language barriers to political and regulatory risks. For some, these challenges lead to avoiding the asset class altogether. However, as stated by the brilliant mind of Albert Einstein, “In the middle of difficulty lies opportunity.”

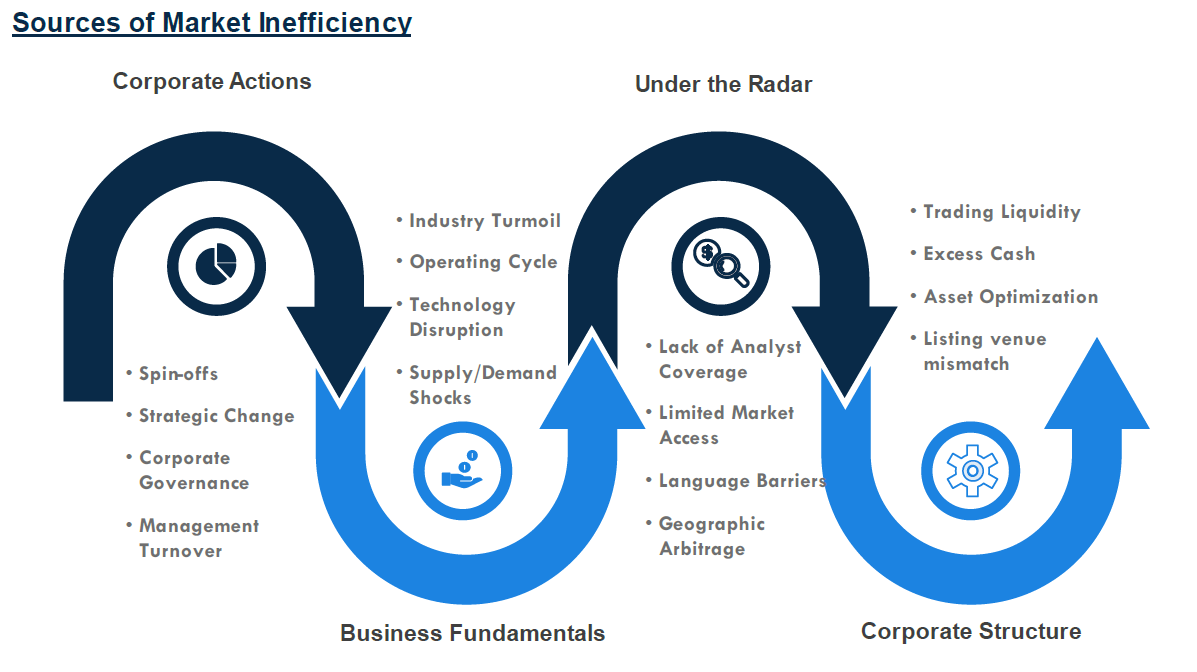

While the inefficient market of international small caps can be fraught with challenges and obstacles, that also means there may be potential for attractive returns and long-term growth. The key is understanding how to define these inefficiencies and then working to create a sound plan to address them. This may come across as a daunting task to investors, which is why it is our view that active management is so critical in this space. Furthermore, our partners at Cedar Street Asset Management LLC (Cedar Street) who subadvise the Harbor International Small Cap Fund have deep expertise in the space and employ an investment process that seeks to exploit these inefficiencies.

Source: Cedar Street Asset Management LLC.

For Illustrative purposes only.

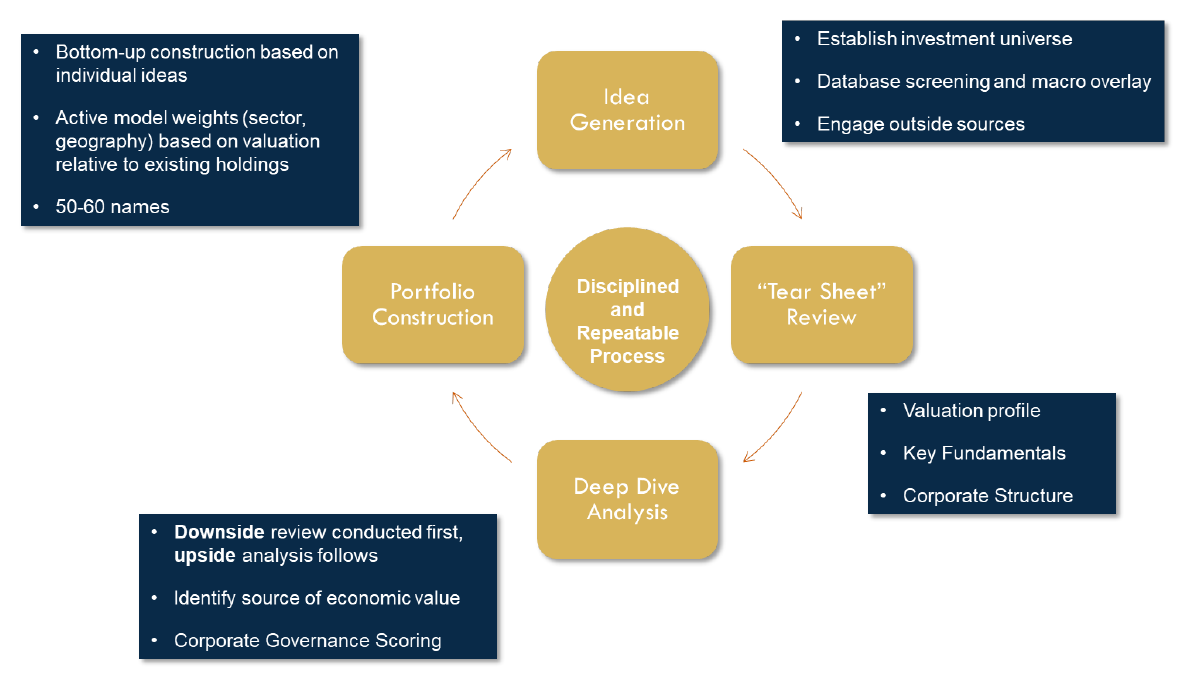

Understanding these inefficiencies, Cedar Street employs a consistent and repeatable investment philosophy as the foundation of their investment process. From Idea Generation through Portfolio Construction, Cedar Street seeks to leave no stone unturned.

Source: Cedar Street Asset Management LLC.

For Illustrative purposes only.

At Harbor, we’re dedicated to finding the true masters of their craft. We scour the globe to curate what we believe is an elite cohort of boutique managers with bold solutions that have the potential to produce compelling, risk-adjusted returns. There aren’t many of them, and we are intentionally selective. We believe Cedar Street meets these criteria – as their exclusive focus on international small cap investing along with their diverse and tenured portfolio management team seek to bring an element of efficiency to an otherwise inefficient asset class. To learn more about Cedar Street and the potential benefits of active management in overseas markets, check out: Harbor International Small Cap Fund Seeks to Help Navigate International Waters.

Important Information

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

This material may reference countries which may be generally the subject of selective sanctions programs administered. Readers of this commentary are solely responsible for ensuring that their investment activities in relation to any sanctioned country are carried out in compliance with applicable laws, rules or policies.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

3134399