The Upside of Higher Interest Rates

October 16, 2023

The Federal Reserve’s tightening campaign has contributed to increased volatility in the bond market. Although that has likely caused investors some consternation over the past several months, there are some upsides to higher rates. First, long-term bond investors benefit from higher reinvestment rates. What’s more, because the bulk of a bond returns come from the interest payout, coupon income typically more than offsets negative price return when rates rise. Thus, today’s higher income payouts provide a cushion to help mitigate further downside price risks.

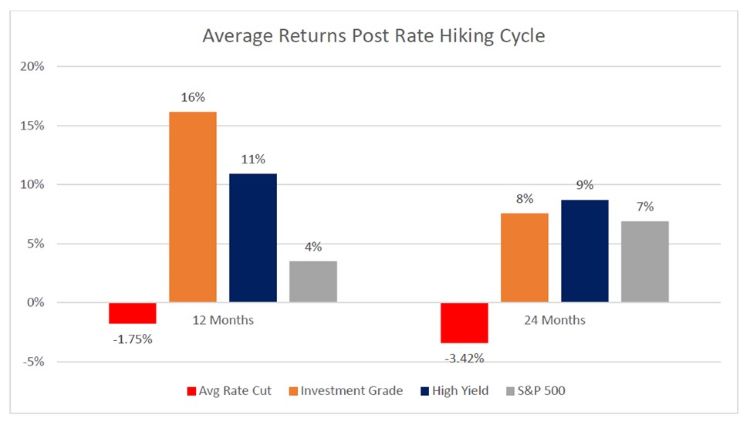

We believe that the Fed may be near the end of its tightening cycle, which has historically set up favorable conditions for bond investors. After the last three Fed rate hiking cycles (2000, 2006, 2018), rates were cut on average 1.75% over the following 12 months and 3.42% over 24 months. Investors in fixed income have been rewarded (see chart below) during these periods, while US equities have lagged. If the future unfolds in a similar fashion, the environment may become more welcoming for bonds in the coming months.

Source: Y-charts. FRED Economic Data, St. Louis Fed. As of April 30, 2023.

Source: Y-charts. FRED Economic Data, St. Louis Fed. As of April 30, 2023.Investment Grade proxy: Bloomberg US Aggregate Bond Index

High Yield proxy: Bloomberg US Corporate High Yield Index

Performance data shown represents past performance and is no guarantee of future results.

We think today’s higher interest rates may portend better times ahead for bond investors, and therefore we believe it could be a good time to top-up your clients’ bond allocations.

Important Information

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, should not be considered investment advice or a recommendation to purchase a particular security.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Fixed income investments are affected by interest rate changes and the creditworthiness of the issues held. As interest rates rise, the values of fixed income securities held are likely to decrease and reduce the value of a portfolio.

The Bloomberg US Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year.

The Bloomberg US Corporate High Yield Index covers performance for United States high yield corporate bonds. This index serves as a benchmark for portfolios that include exposure to riskier corporate bonds that might not necessarily be investment grade.

Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

Harbor Capital Advisors, Inc.

3173220