The Harbor Capital Appreciation Fund: An Active Alliance

August 23, 2023

“Coming together is a beginning. Keeping together is progress. Working together is success.”

– Henry Ford

A Storied Syndicate

Several decades ago, Harbor Capital and Jennison Associates united in a partnership that has stood the test of time. The notable byproduct of that union, the Harbor Capital Appreciation Fund, features Jennison’s stability of philosophy and process driven by its talented investment team. At its core, the Harbor Capital Appreciation Fund seeks to identify and invest in exceptional companies with sustainable competitive advantages that have the potential to create long-term growth in economic value and generate attractive returns for shareholders.

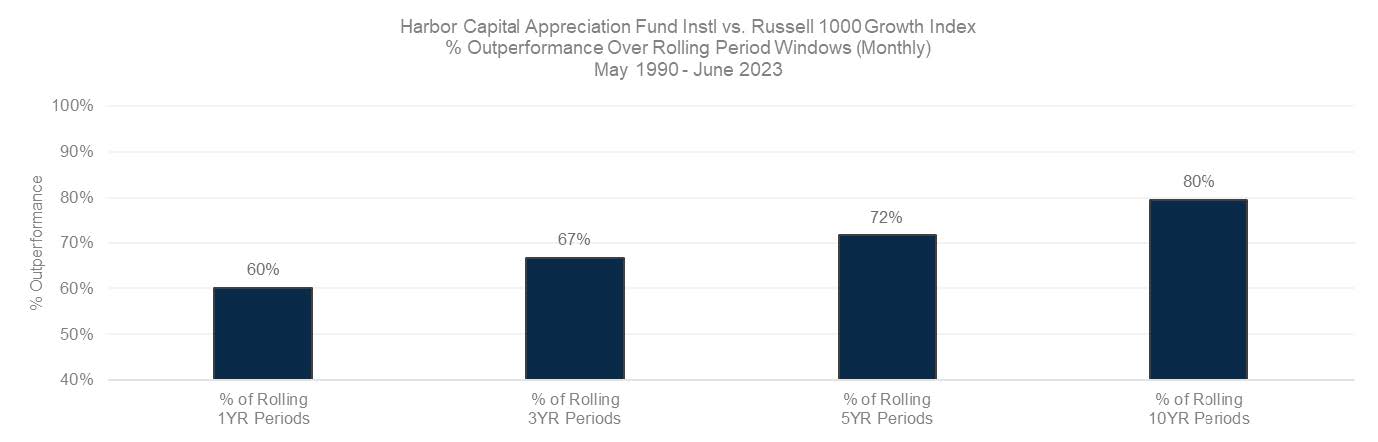

Typical fund holdings possess a combination of proprietary advantages, solid positioning to benefit from secular trends, strong company fundamentals and balance sheets, and skilled management teams. The team identifies these investments with the help of rigorous research and monitoring, as well as collaboration amongst the research team to identify trends and structural changes. Our belief that growth of earnings should ultimately drive performance over a long-term horizon has thus far led to increasingly strong performance over longer time periods, as exhibited below:

Starting date of May 1990 reflects the date in which Jennison Associates assumed management of the Harbor Capital Appreciation Fund.

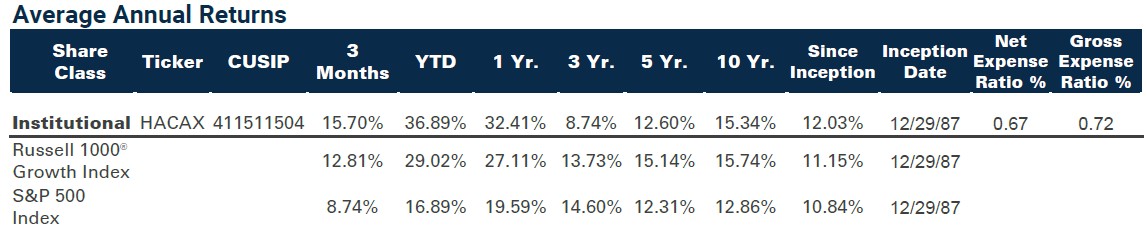

As of 06/30/23. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050. The net expense ratios for this Fund are subject to a contractual management fee waiver through 02/29/2024.

As shown above, the Fund has outperformed the Russell 1000 Growth Index in 60% of rolling 1YR periods, in 67% of rolling 3YR periods, in 72% of rolling 5YR periods, and in 80% of rolling 10YR periods since assuming management of the Fund in May 1990. With the passage of time and continuous investment, investors of the Harbor Capital Appreciation Fund have historically been rewarded for their patience.

Accentuating the Importance of Active

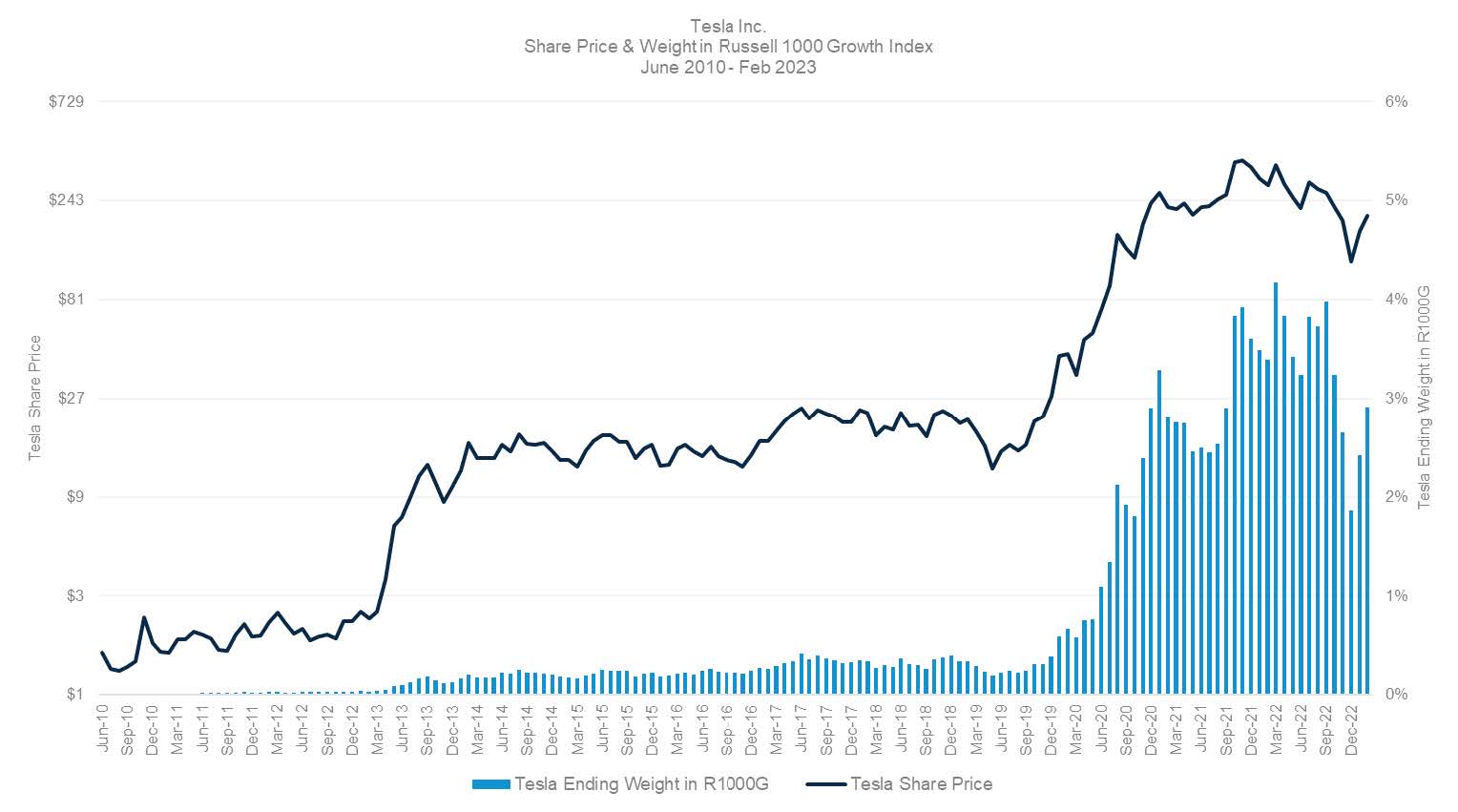

In addition to its distinction amongst large cap growth equity options over longer time periods, we also point to the benefits of the Harbor Capital Appreciation Fund’s active approach as a differentiator. Importantly, an active approach affords the ability to analyze forward-looking indicators and rebalance accordingly. As we can see in the chart below highlighting the growth of Tesla, flexibility to take on active share and stray from benchmark weightings and positioning can situate investors to act on secular trends, disruptions in technologies or services, or expanding addressable markets:

Source: FactSet Research Systems

For Illustrative purposes only. This information should not be considered as a recommendation to purchase or sell a particular security. R1000G is an abbreviation for the Russell 1000 Growth Index.

In our view, active managers can better identify attractive opportunities and implement meaningful position sizes in an effort to enhance return potential. As a whole, amongst actively managed, large cap growth options, we believe the Harbor Capital Appreciation Fund presents a compelling investment opportunity relative to its peers given its approach, its processes and its active mentality. To learn more about the Harbor Capital Appreciation Fund, please click here: Harbor Capital Appreciation Fund.

Important Information

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

The Russell 1000® Growth Index is an unmanaged index generally representative of the U.S market for larger capitalization growth stocks. The Russell 1000® Growth Index and Russell® are trademarks of Frank Russell Company. These unmanaged indices do not reflect fees and expenses and are not available for direct investment.

This material may reference countries which may be generally the subject of selective sanctions programs administered. Readers of this commentary are solely responsible for ensuring that their investment activities in relation to any sanctioned country are carried out in compliance with applicable laws, rules or policies.

Active Share is a measure of the percentage of stock holdings in a manager's portfolio that differs from the benchmark index.

Rolling returns, also known as "rolling period returns" or "rolling time periods," are annualized average returns for a period, ending with the listed year.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

3070749