Setting the Table for Success in International Small Caps

October 11, 2023

Thus far in 2023, markets continue to contend with persistent inflationary forces, the implications of central bank decision making, and a backdrop of slower economic growth. Within this environment, broad U.S. large cap equity index concentration has burgeoned as investors have generally sought more mature domestic businesses and the beneficiaries of increased artificial intelligence adoption. As concerns mount around U.S. equity index concentration risk, investors are now left weighing non-U.S. equity allocation decisions in the search for diversification. For investors seeking added non-U.S. exposure, we believe international small caps warrant closer attention looking ahead.

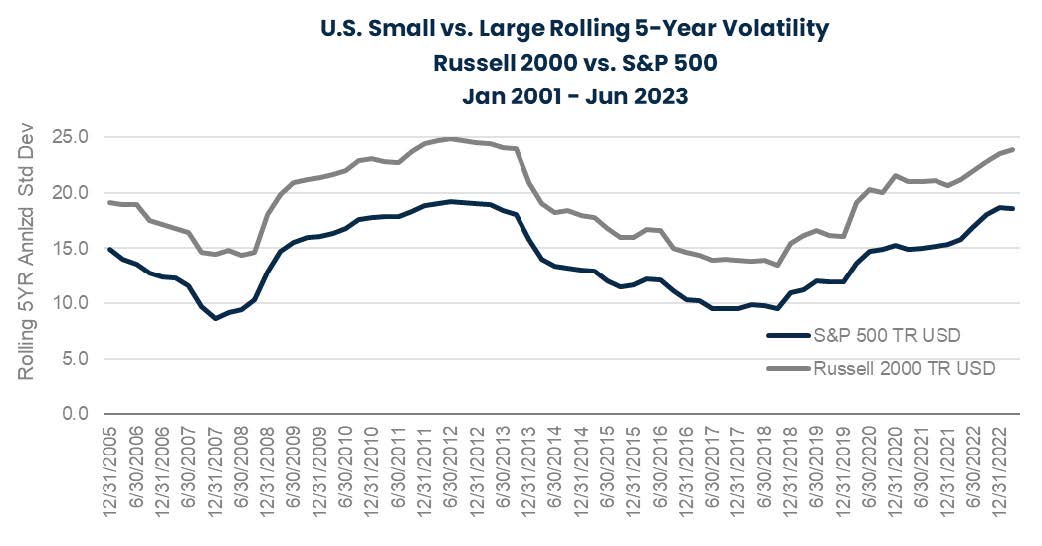

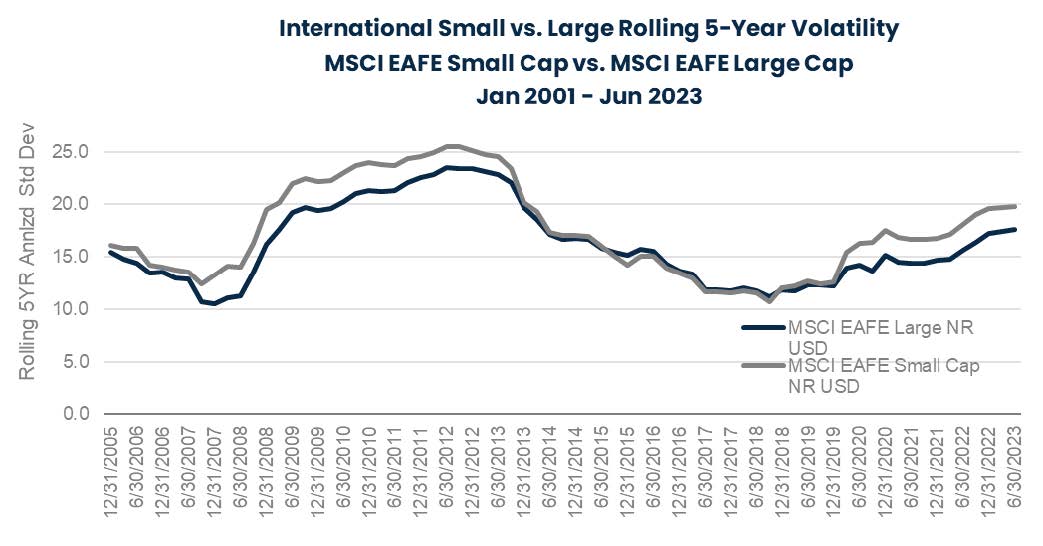

Developed non-U.S. market dynamics differ from U.S. markets with respect to small caps vs. large caps. While small caps in the U.S. are often associated with higher risk and higher levels of volatility, the dynamic is notably different abroad where the MSCI EAFE Small Cap Index has largely been in-line with or slightly elevated to the volatility of its large cap counterpart.

Source: Morningstar Direct, June 2023

Performance data shown represents past performance and is no guarantee of future results.

In our view, the different dynamic abroad is primarily driven by the relative quality and profitability profile of non-U.S. small caps compared to non-U.S. large caps.

Source: Morningstar Direct, June 2023

Performance data shown represents past performance and is no guarantee of future results.

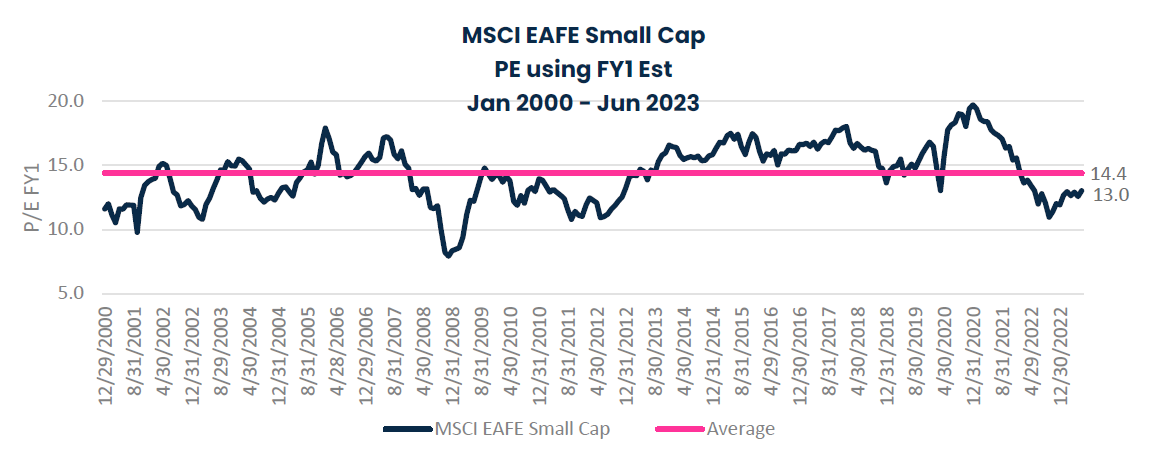

These factors have led to non-U.S. small caps consistently outperforming non-U.S. large caps, as seen above. Since the inception of the MSCI EAFE Small Cap Index (through 6/30/2023), small caps have delivered a cumulative return of 380% vs. 139% for the MSCI EAFE over the same time period. As of 6/30/2023, non-U.S. small cap valuation levels sit at one of the lowest levels in more than a decade.

Source: Morningstar Direct, June 2023

FY1 denotes current unreported year.

Performance data shown represents past performance and is no guarantee of future results.

Overall, for those looking abroad for diversification within equities, we believe international small caps likely offer compelling advantages relative to their larger cap brethren.

Important Information

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to purchase or sell a particular security.

Investing entails risk and there can be no assurance that any investment will achieve profits or avoid incurring losses.

All investments involve risk including the possible loss of principal. Stock prices can fall because of weakness in the broad market, a particular industry, or specific holdings.

Stock prices can fall because of weakness in the broad market, a particular industry, or specific holdings. Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions.

Diversification does not assure a profit or protect against loss in a declining market.

Standard Deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance.

Price-to-earnings (P/E) is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS).

Earnings per share is calculated as a company's profit divided by the outstanding shares of its common stock.

The MSCI EAFE (ND) Index is an unmanaged index generally representative of major overseas stock markets. The MSCI EAFE Small Cap (ND) Index is an equity index which captures small cap representation across developed market countries around the world, excluding the U.S. and Canada. The index incepted on December 29, 2000. The Standard & Poor's 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. The Russell 2000® Value Index is an unmanaged index representing the smallest 2000 stocks with the lowest price-to-book ratio and future earnings. The Russell 2000® Value Index and Russell® are trademarks of Frank Russell Company. These unmanaged indices do not reflect fees and expenses and are not available for direct investment.

3162469