Seeking A Steady Hand Amidst Volatility

January 24, 2024

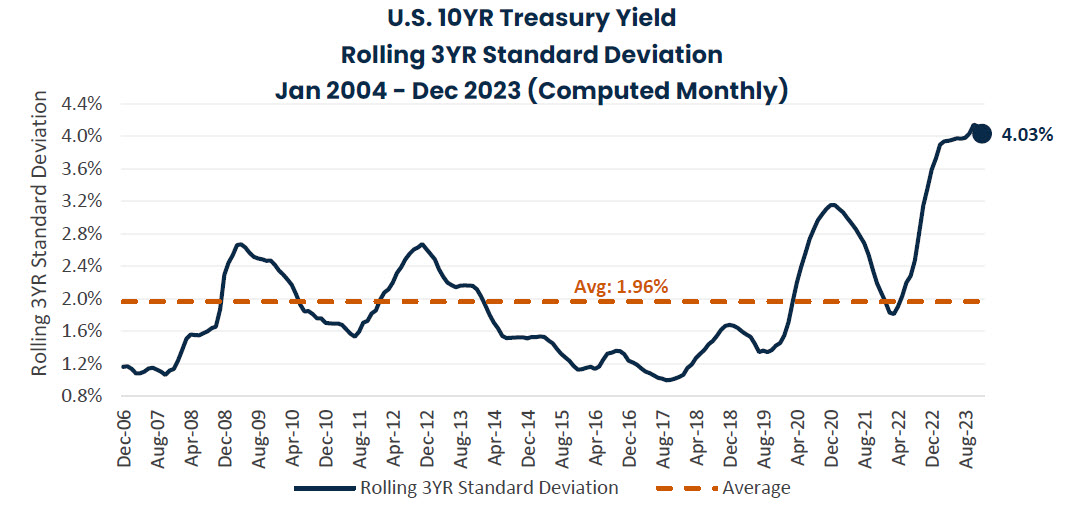

Fixed income markets have been impacted by elevated interest rate volatility over more recent periods. The chart below presents rolling 3-year standard deviation (a statistical measure of volatility) for the U.S. 10-year Treasury yield, which recently trended above 4.00% and was more than double its 20-year average at the end of 2023.

Source: FactSet Research Systems. Performance data shown represents past performance and is no guarantee of future results.

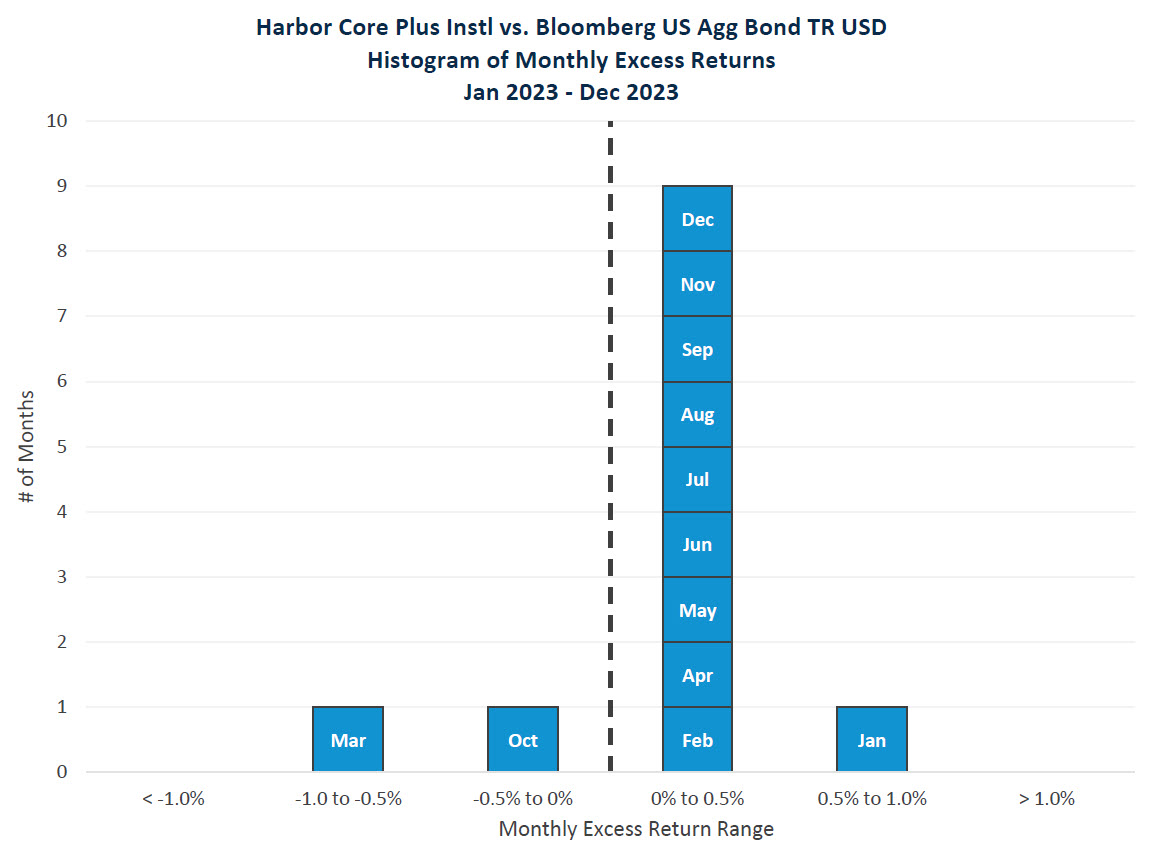

Despite a backdrop of heightened interest rate turbulence, the team from Income Research + Management (IR+M), subadvisors to Harbor Core Plus Fund, maintained their track record of delivering outperformance versus the Bloomberg US Aggregate Bond Index in 2023. The chart on the following page shows the Fund’s monthly excess returns versus the Bloomberg US Aggregate Bond Index in 2023. Harbor Core Plus outperformed the index in 10 of 12 months in 2023 and outperformed for six months in a row from April through September, demonstrating the steady nature of IR+M’s bond-by-bond approach even amidst more volatile conditions.

Source: Morningstar Direct. Performance data shown represents past performance and is no guarantee of future results.

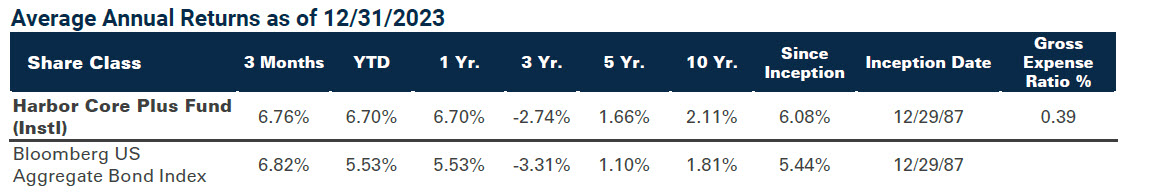

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050.

IR+M’s investment philosophy is based on the belief that careful security selection and active risk management provide superior results over the long term. Rather than attempting to predict the path of interest rates, IR+M believes it can deliver more consistent results relative to the benchmark by focusing their efforts on rigorous bottom-up research within a duration neutral, risk managed framework. We believe IR+M’s skill, specialization, and disciplined approach has the potential to enable steadier returns within an important asset category for many investors, particularly for the potentially uncertain road ahead. To learn more, please visit our website.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals. They may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

There is no guarantee that the investment objective of the Fund will be achieved. Fixed income investments are affected by interest rate changes and the creditworthiness of the issues held by the Fund. As interest rates rise, the values of fixed income securities held by the Fund are likely to decrease and reduce the value of the Fund's portfolio.

There may be a greater risk that the Fund could lose money due to prepayment and extension risks because the Fund invests, at times, in mortgage-related and/or asset backed securities.

The Bloomberg US Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Standard deviation measures the dispersion of a dataset relative to its mean.

Income Research + Management is an independent subadvisor to the Harbor Core Bond Fund and Harbor Core Plus Fund.

3348180