Magnifying Mid Caps with EARNEST Partners

August 29, 2023

Mid cap stocks often remain in the shadows, sandwiched between their larger and smaller counterparts. However, in a discussion with Director Aaron Kirchoff of EARNEST Partners, subadvisor for the Harbor Mid Cap Fund, we explored why mid caps might just be the “sweet spot” of the U.S. equity market and a potential enhancement for investment portfolios.

We point to three distinct reasons that mid caps might be worth your attention at present:

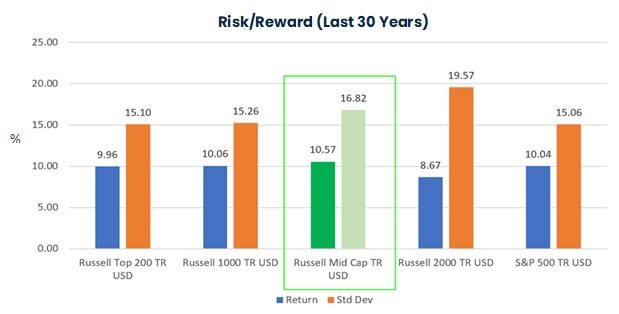

Risk/Reward Benefit

In our view, mid caps give clients the opportunity to have the best of both worlds. The chart below highlights annualized returns and standard deviation for mid-cap stocks vs. small- and large-cap equities over the last 30 years, ending June 2023. As you can see, mid-cap stocks have generated the highest returns, with standard deviation, a measure of volatility that is more closely associated with large caps than with more volatile small caps.

Source: Morningstar Direct, June 2023. Standard Deviation (Std Dev) - Amount of variation or dispersion of a set of values. The green color used above signifies the benchmark for the Harbor Mid Cap Fund. The light green color (right) reflects the standard deviation and the dark green color (left) reflects the return. Performance data shown represents past performance and is no guarantee of future results.

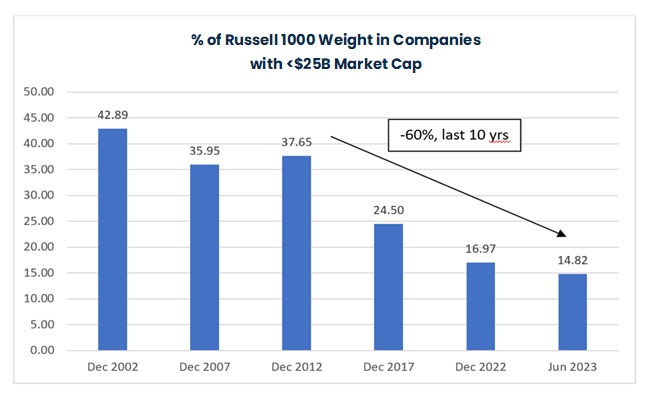

Under Owned

From our perspective, the main reason that investors under own mid caps is that they do not allocate directly to the space, believing that they are obtaining market cap diversification in allocating to large- and small-cap funds. However, we believe the market’s preference for mega caps over the last few years is making this a less appropriate approach than in the past given the significant impact on the composition of the large-cap universe. We find that large-cap indices primarily include mega cap names, while mid caps (defined as less than $25 billion in market cap) have fallen by 40% in the Russell 1000 Index over the last five years and by 60% over the last 10 years, as the largest companies have dominated this market cap weighted benchmark.

Source: FactSet, June 2023.

Opportunity in Active Management

We believe the mid cap universe features plenty of potential rising stars, as well as large cap stocks that are currently in secular decline. An active manager and time-tested partner such as EARNEST Partners can help identify winners and avoid the laggards to help navigate this investment universe in an effort to uncover the hidden gems.

Specifically, we believe the Harbor Mid Cap Fund offers a compelling investment opportunity, given EARNEST’s experienced professionals that have been actual practitioners in the industries they cover. In this way, they are well positioned to ask better questions of management and offer elevated expertise and insights into their respective coverage areas, in our estimation. Moreover, EARNEST’s in-depth fundamental research process that utilizes quantitative data and downside deviation analysis aims to minimize the probability of underperformance without truncating its ability to outperform, providing a compelling investment opportunity, in our view.

Important Information

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice. This material is for informational and illustrative purposes only. This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Stocks of mid cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance.

Downside deviation is a measure of downside risk that focuses on returns that fall below a minimum threshold or minimum acceptable return (MAR).

Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

The Russell Top 200 Index tracks the stock market performance of the largest 200 companies in the Russell 3000 index. The Russell 1000 Index is a stock market index used as a benchmark by investors. It is a subset of the larger Russell 3000 Index and represents the 1000 top companies by market capitalization in the United States. The Russell Mid Cap Index is an unmanaged index generally representative of the U.S. market for medium capitalization stocks. The Russell 2000 index is a market index comprised of 2,000 small-cap companies. The Russell Indices and Russell are trademarks of Frank Russell Company. The Standard & Poor's 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. These unmanaged indices do not reflect fees and expenses and are not available for direct investment.

EARNEST Partners LLC is an independent subadvisor to the Harbor Mid Cap Fund.

3083651