Harbor Scientific High Yield ETF (SIHY): Applying Systematic, Risk-Controlled High Yield Exposure

April 26, 2024

Harbor partnered with BlueCove Limited to offer the Harbor Scientific High-Yield ETF (SIHY), an alpha1-oriented, risk-managed solution for high-yield exposure. SIHY is structured to target compelling risk-adjusted returns while seeking a competitive yield.

BlueCove is a pioneer in quantitative fixed income investing. The company was founded in 2018, capitalizing on the growing potential of systematic investing in the bond market. The team and all firm resources are aligned behind this endeavor. BlueCove's 'scientific' approach is evidenced based, data driven, economically intuitive and grounded in the scientific method.

The quantitative models behind SIHY are created and overseen by seasoned professionals with decades of experience in high-yield markets. Their experience positions them to construct models grounded on long-term, enduring investment principles and economically intuitive factors, rather than temporarily correlated non-financial data. BlueCove's models use many of the same inputs that traditional discretionary bond managers apply but in a systematic fashion.

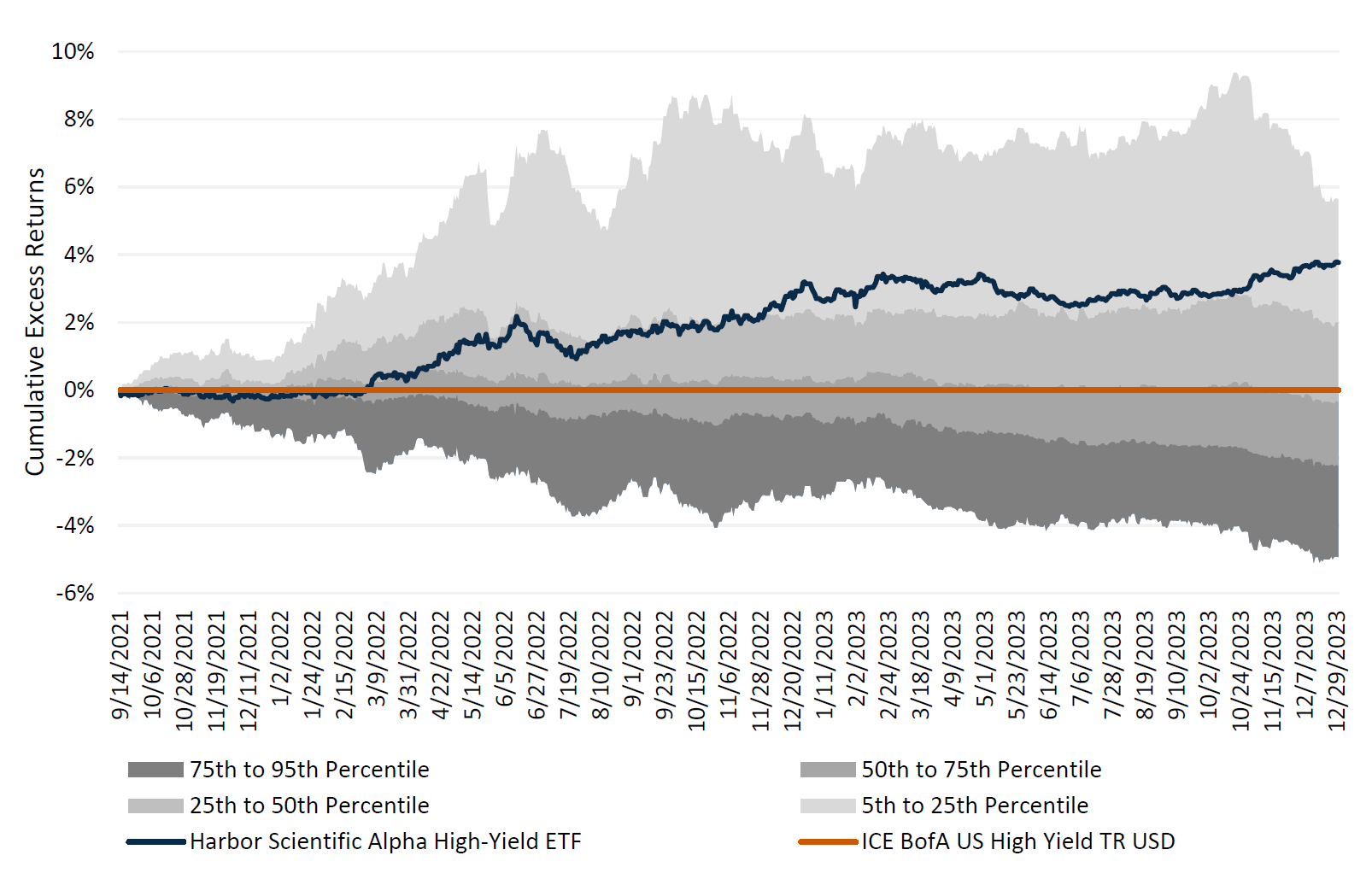

Amidst the recent volatility in the bond market, SIHY has delivered compelling returns as the chart that follows shows.

1 Alpha is a measure of risk (beta)-adjusted return.

| Average Annual Returns as of 3/31/2024 | ||||||||

|---|---|---|---|---|---|---|---|---|

| 1 Yr. | 5 Yr. | 10 Yr. | Gross Expense Ratio | Inception Date | ||||

| Harbor Scientific Alpha High-Yield ETF (NAV) | 11.52% | N/A | N/A | 0.48% | 09/14/2021 | |||

| Harbor Scientific Alpha High-Yield ETF (Market) | 11.33% | N/A | N/A | 09/14/2021 | ||||

| ICE BofA US High Yield Index (H0A0) | 11.04% | N/A | N/A | 09/14/2021 | ||||

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050.

For the most current Fund performance, please click here.

1 Alpha is a measure of risk (beta)-adjusted return.

Morningstar US High Yield Bond Category

vs. ICE BofA US High Yield TR USD

Cumulative Excess Returns: 9/15/2021 - 12/31/2023 (Daily)

Source: Morningstar Direct - The Morningstar Rankings are based on total returns, with distributions reinvested and operating expenses deducted. Morningstar does not take into account sales charges. Harbor Scientific Alpha High-Yield ETF was ranked against Morningstar’s US Fund High Yield Bond category, quarterly, based on total returns, over the following time periods: 123 out of 666 investments in the category for the 1-year period as of 3/31/2024. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. Past rankings are no guarantee of future rankings.

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050.

The Harbor Scientific High Yield ETF (SIHY) brings BlueCove’s innovative, systematic, riskmanaged approach to investors seeking to add to their high-yield exposure. For more information about BlueCove and SIHY, please visit our website.

Important Information

Risks

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Harbor ETFs are new and have limited operating history to judge.

Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

All investments involve risk including the possible loss of principal. Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the value of your investment in the Fund may go down. There is a greater risk that the Fund will lose money because they invest in below- investment grade fixed income securities and unrated securities of similar credit quality (commonly referred to as “high-yield securities” or “junk bonds”). These securities are considered speculative because they have a higher risk of issuer default, are subject to greater price volatility and may be illiquid. Because the Fund may invest in securities of foreign issuers, an investment in the Fund is subject to special risks in addition to those of U.S. securities. These risks include heightened political and economic risks, greater volatility, currency fluctuations, higher transaction costs, delayed settlement, possible foreign controls on investment, possible sanctions by government bodies of other countries and less stringent investor protection and disclosure standards of foreign markets.

Benchmarks

The ICE BofAML US High Yield Index (H0A0) is an unmanaged index that tracks the performance of below investment grade U.S. Dollar-denominated corporate bonds publicly issued in the U.S. domestic market. All bonds are U.S. dollar denominated and rated Split BBB and below. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

© 2024 Morningstar, Inc. All rights reserved. The information contained herein:(1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, should not be considered investment advice or a recommendation to purchase a particular security.

Investors should carefully consider the investment objectives, risks, charges and expenses of a fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

BlueCove Limited is a third-party subadvisor to the Harbor Scientific Alpha High-Yield ETF.

3542053