Harbor International Small Cap Fund: A Big Fish in a Little Pond

October 11, 2023.png)

The Harbor International Small Cap Fund, subadvised by Cedar Street Asset Management, is managed with a disciplined and consistent value investment philosophy. In our view, Cedar Street’s seasoned and purpose-built investment team has developed a strong track record within the non-U.S. small cap value equity universe. Its multicultural, cross disciplinary analyst team possesses local market knowledge and timely insights, while its high-alpha, bottom-up approach focuses on quality business fundamentals.

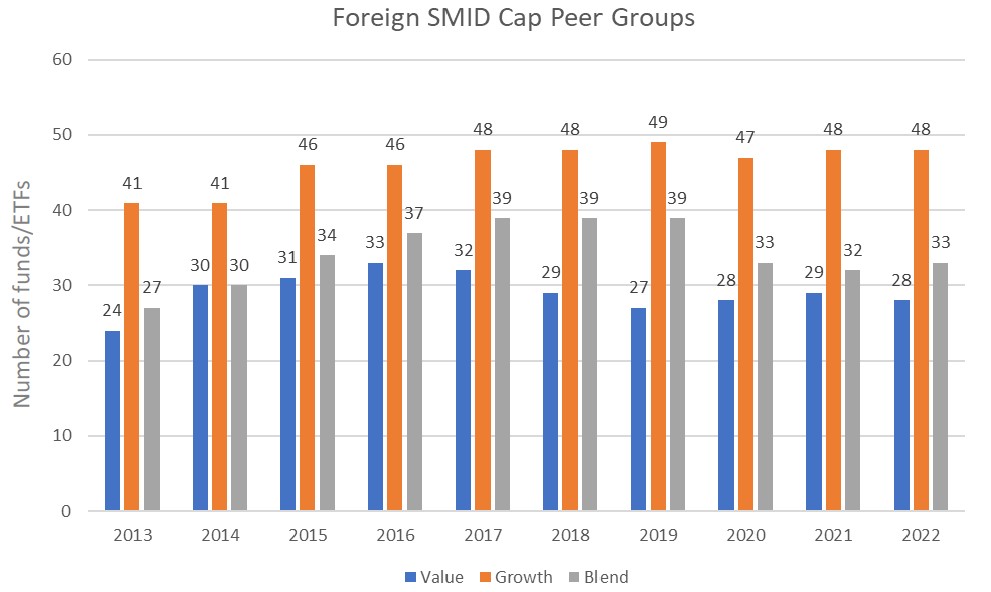

We believe Cedar Street’s commitment to quality in both its operations and investing sets it apart in what is an already-shrinking competitor pool in recent years. The chart below shows the number of mutual funds and ETFs within Morningstar’s Foreign Small- and -Mid Cap (SMID) style categories over the past 10 years. The number of growth options have remained relatively stable over the last decade. However, the number of value-oriented offerings within this space have declined from a high of 33 in 2016 to 28 at the end of 2022. Notably, these 28 funds only make up a quarter of the total foreign SMID universe.

Source: Morningstar Direct SMID stands for small- and mid-cap categories, as designated by Morningstar. Foreign Small/Mid includes the following Morningstar Categories: Foreign Small/Mid Growth, Foreign Small/Mid Blend, Foreign Small/Mid Value and represents all funds and ETFs categorized as such by Morningstar.

Looking ahead, we think non-U.S. small value equities will likely enable enhanced diversification benefits and alpha opportunities. We believe the characteristics of this vast and less efficient investment universe position active managers well, and we point to Cedar Street as an attractive option within this highly specialized space. To learn more about the Harbor International Small Cap Fund, please visit our website.

Important Information

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Diversification does not assure a profit or protect against loss in a declining market.

Alpha is used in finance as a measure of performance, indicating when a strategy, trader, or portfolio manager has managed to beat the market return or other benchmark over some period.

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or recommendation to purchase or sell a particular security.

Distributed by Harbor Funds Distributors, Inc.

3162530