GDIV: A Calming Influence

July 27, 2023

With signs of an economic slowdown emerging, investors may be left wondering where best to allocate their money given the changing economic environment. While not a given in terms of timing or length, at some point investors will endure downturns in the market in one way or another. As recessionary concerns linger at present, we believe it is the right time to consider products for your portfolio that have a proven ability to absorb macro noise and volatility and nonetheless have produced solid returns for their investors.

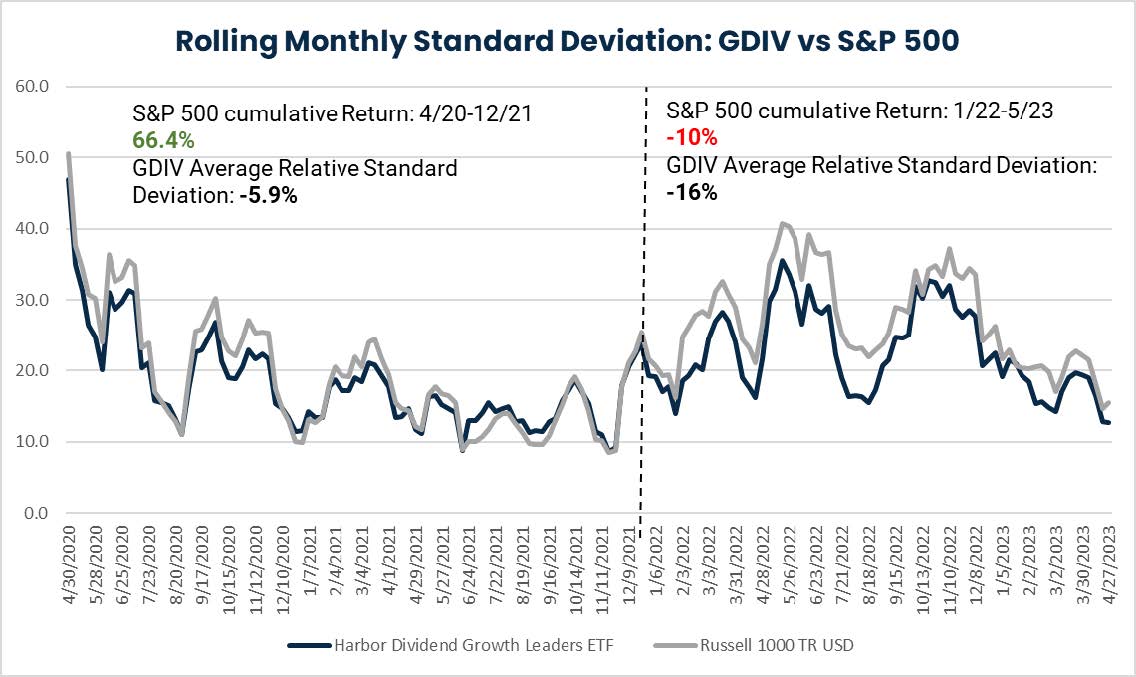

As shown in the graph below, Harbor’s Dividend Growth Leaders ETF (GDIV) presents itself as one such solution.

Source: FactSet Research Systems, May 2023

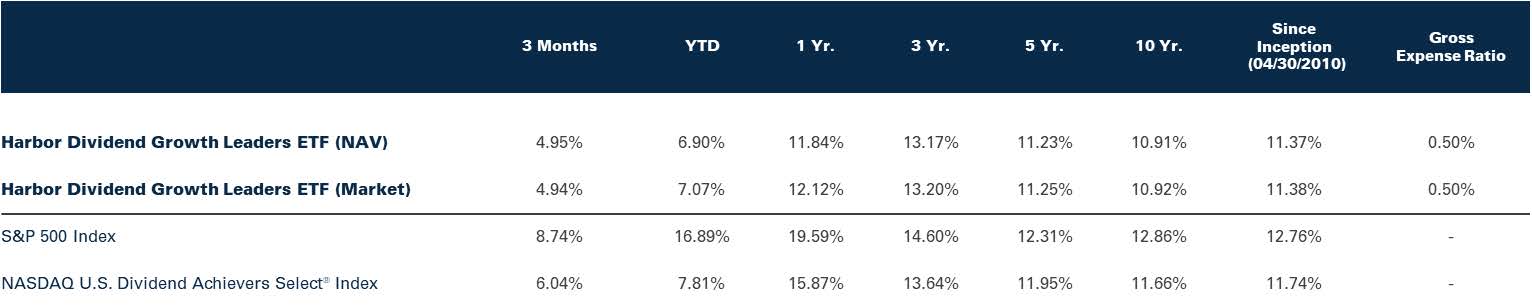

Average Annual Returns as of 06/30/2023

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050. For the Fund's most current performance click here.

ETF performance prior to 5/23/22 is attributable to the Westfield Capital Dividend Growth Mutual Fund, Institutional Share class and/or Westfields private investment vehicle. The historical NAV of the predecessor are used for both NAV and Market Offer Price performance from inception to ETF listing date. Performance periods since GDIV listing date may contain NAV and MOP data of both the newly formed ETF and the predecessor fund performance. Please refer to the Fund prospectus for further details.

Current 30-Day Yields are for the Institutional Class and represent the average annualized income dividend over the last 30 days excluding gains and losses as defined by the SEC. Current 30-Day Yield-Unsub is the Current 30-Day Unsubsidized SEC Yield and does not reflect reimbursements or waivers of fees currently in effect.

The FactSet Dividend Yield is calculated on a quarterly basis by taking the annual dividends per share, for each of the underlying securities held as of the report date, and dividing by the ending price.

In the above, we can see that GDIV becomes less volatile on a relative basis (vs. the S&P 500 Index) during market downturns, though it does maintain its lower-than-benchmark volatility in both up and down markets. As such, we believe GDIV offers attractive growth potential with investments in quality businesses that have the capacity to grow their dividends, while also providing a hedge during down markets and less volatility when investors need it the most.

Steady As She Goes

Furthermore, we find that companies that have a historical track record of regularly increasing their dividends may prove more resilient to periods of economic weakness. For example, of the names held at the end of a volatile 2020, 100% of GDIV holdings increased or maintained their dividends from 2019 levels. Conversely, 15% of dividend payers within the S&P 500 cut or suspended dividends in 2020 during the early stages of the pandemic.

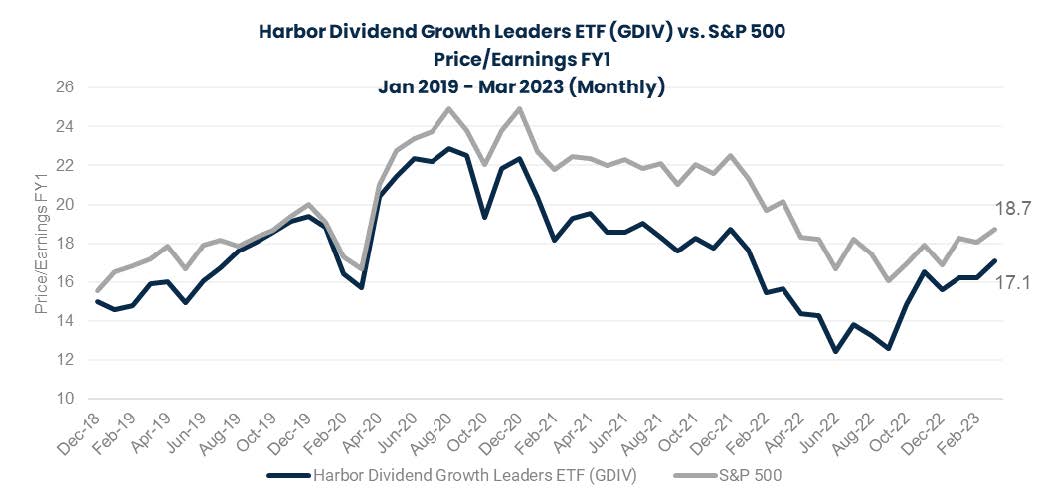

Source: FactSet Research Systems, April 2023

As equities represent a more volatile asset class than fixed income in terms of sourcing income, we believe they have valuation support that can potentially act as a hedge amidst volatile markets.

In summation, we think GDIV is well suited for a core allocation in an investors’ portfolio given its rare combination of income, capital growth and volatility protection. Learn more about GDIV on our website.

Important Information

This material is authorized for use only when preceded or accompanied by the current Harbor Capital funds prospectus or summary prospectus, if available.

ETF performance prior to 5/23/22 is attributable to the Westfield Capital Dividend Growth Mutual Fund, Institutional Share class and/or Westfields private investment vehicle. The historical NAV of the predecessor are used for both NAV and Market Offer Price performance from inception to ETF listing date. Performance periods since GDIV listing date may contain NAV and MOP data of both the newly formed ETF and the predecessor fund performance. Please refer to the Fund prospectus for further details.

Investments involve risk including the possible loss of principal. There is no guarantee the investment objective of the Fund will be achieved. The Fund's emphasis on dividend paying stocks involves the risk that such stocks may fall out of favor with investors and under-perform the market. There is no guarantee that a company will pay or continually increase its dividend. The Fund may invest in a limited number of companies or at times may be more heavily invested in particular sectors. As a result, the Fund's performance may be more volatile, and the value of its shares may be especially sensitive to factors that specifically effect those sectors. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuation, political instability, government sanctions, social and economic risks. Foreign currencies can decline in value and can adversely affect the dollar value of the fund.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

Standard deviation is a statistical measurement in finance that, when applied to the annual rate of return of an investment, sheds light on that investment's historical volatility.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals. They may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice. The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. The Russell 1000® Total Return Index is an unmanaged index generally representative of the 1000 largest publicly traded companies in the U.S. The Russell 1000® Total Return Index and Russell® are trademarks of Frank Russell Company. These unmanaged indices do not reflect fees and expenses and are not available for direct investment.

Westfield Capital Management, L.P. is the subadvisor for the Harbor Dividend Growth Leaders ETF Foreside Fund.

3023967