Finding Diversification Within Non-U.S. Equities

January 22, 2024

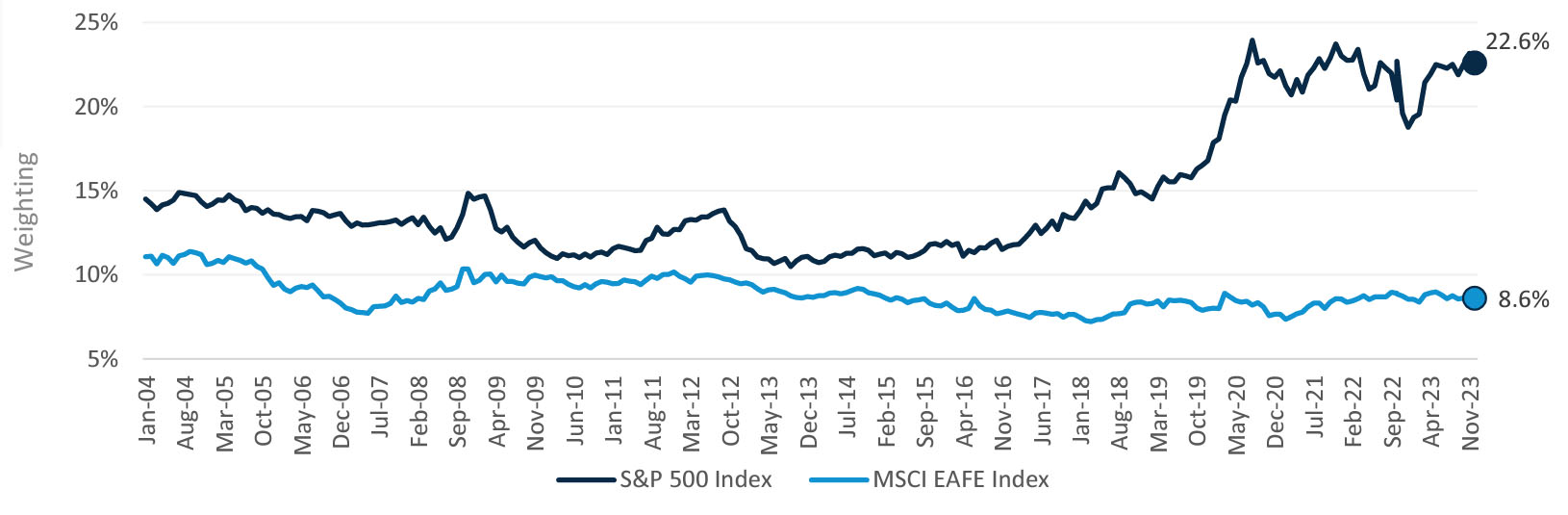

Given the recent relative outperformance of the Magnificent Seven, as well as other factors, the S&P 500 Index has become more concentrated in only a handful names. In fact, the Index’s top five holdings had a weighting of 22.6% as of 12/31/2023.

Jan 2004 - December 2023

Source: FactSet Research Systems, January 2024. Performance data shown represents past performance and is no guarantee of future results.

The MSCI EAFE Index finished the year less concentrated than its U.S. counterpart with an only 8.6% weighting in the benchmark’s top five holdings as of 12/31/2023. In addition, we find that the MSCI EAFE Index is more stylistically exposed to cyclical/value sectors such as financials and industrials, whereas the S&P 500 Index is more tilted towards growthier sectors such as information technology. As investors potentially seek to become less tethered to the performance fluctuations of bellwether U.S. mega cap growth companies, we believe non-U.S. equities represent a compelling asset class opportunity in 2024 and beyond.

A Potential Solution

In our view, the Harbor International Compounders ETF (OSEA) employs a superior approach in the non U.S. space given its stringent, 30-stock limit that forces a competition for capital among the most attractive sustainable-growth companies. The competition fosters discipline, enables focus on the risks to each business, and allows each individual compounder to meaningfully impact performance. To learn more, please visit our website.

Important Information

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

The Subadvisor considers certain ESG factors in evaluating company quality which may result in the selection or exclusion of securities for reasons other than performance and the Fund may underperform relative to other funds that do not consider ESG factors.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

Diversification does not assure a profit or protect against loss in a declining market.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals. They may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

The Magnificent Seven refers to Apple, Alphabet, Microsoft, Amazon.com, Meta, Tesla, and NVIDIA.

C WorldWide is the subadvisor for the Harbor International Compounders ETF (OSEA).

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. The MSCI EAFE Index is a broad market index of stocks located within countries in Europe, Australasia, and the Far East (East Asia). Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

3342637