ETF Creation & Redemption

In a watershed event, the first mutual fund in the U.S. was created in 1924, revolutionizing how investors could purchase and sell baskets of stocks, bonds, or commodities. More recently, the U.S. launched its first ETF with an updated structure that allows for more tax efficiency.

Although both mutual funds and ETFs are typically structured as open-end funds, the later initiation of ETFs into this investment structure family means that they feature some differences versus mutual funds. Namely, ETFs are eligible to be traded on an exchange and throughout the trading session.

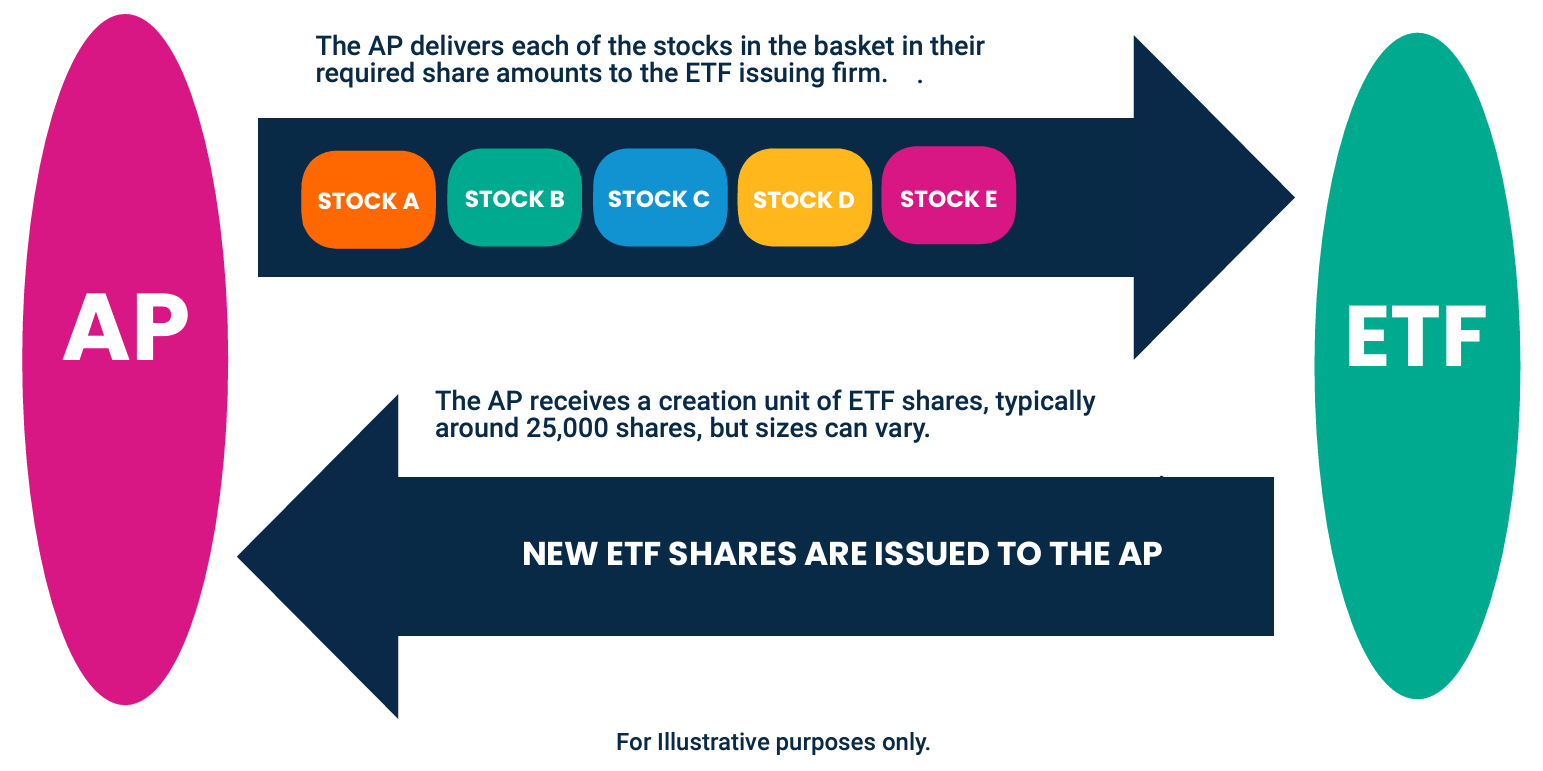

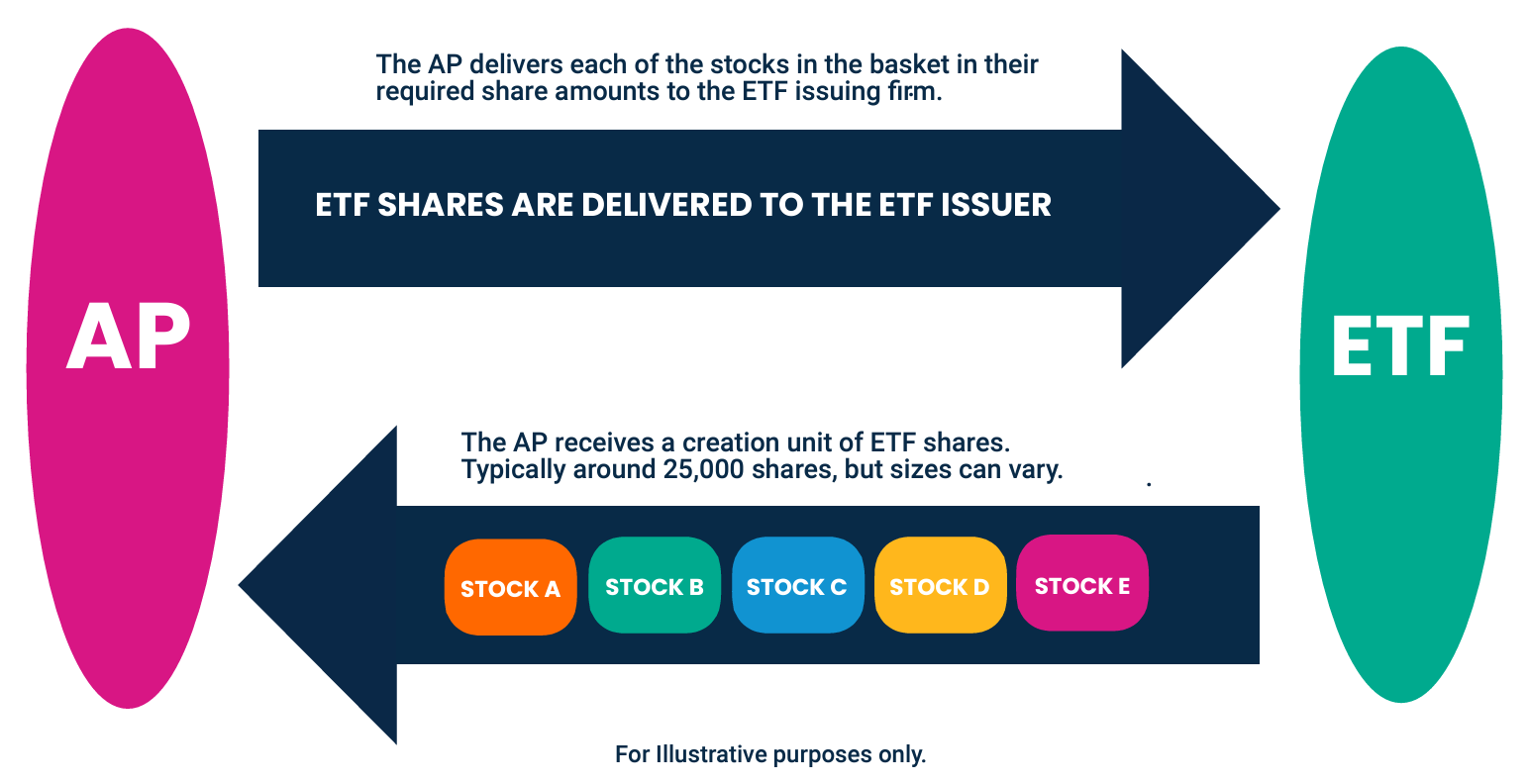

This occurs with the help of an authorized participant (AP), or “middle person,” that stands between the ETF and the investor, who typically provides a two-sided market on the exchange for the ETF. The AP is authorized to transact with the ETF to either create or redeem shares of the ETF.

Here is a diagram of how a typical ETF creation works:

Here is a diagram of how a typical ETF redemption works:

Harbor Capital Advisors

Harbor Capital Advisors is an asset manager known for curating an intentionally select suite of active ETFs from boutique managers. Advisors looking for distinct and differentiated investment options for their clients' portfolios often connect with our passionate obsession to find what we believe to be the best - bold solutions that have the potential to produce compelling, risk-adjusted returns.

For more information, visit www.harborcapital.com.

Important Information

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold.

Please refer to the appropriate Prospectus, or the Tax Center for general tax information about any of the Harbor funds. The information provided should not be construed as specific tax, legal or investment advice. If you have questions, please consult with your tax adviser to determine the appropriate use of this information for your tax situation.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

3632278