Dividend Growth Investing: Like a Bridge Over Troubled Water

October 06, 2023.png)

As we round into the back end of 2023, U.S. equity investors are left weighing current valuations with the potential for more persistent inflationary forces, a longer-than-expected Fed pause, a higher for longer interest rate backdrop, and U.S. recession risk. Looking ahead, we believe dividend growth equities are well positioned given their generally higher quality profiles, prudent management teams, and performance history in later phases of the market cycle.

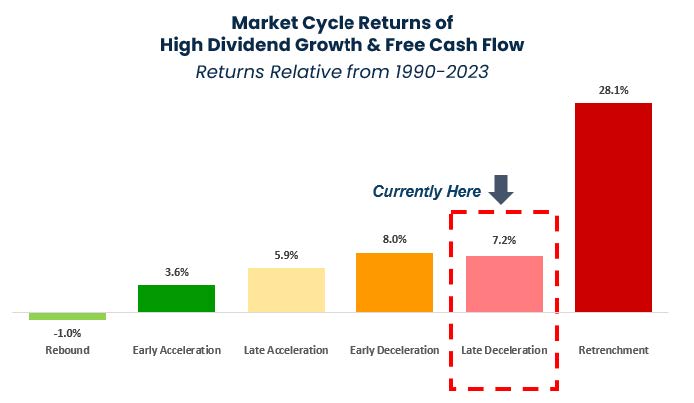

In the graph below, we can see that dividend growth equities have performed well during a variety of phases of the market cycle. Importantly, dividend growth equities have produced their strongest returns in periods marked by economic deceleration and retrenchment. Amidst the current backdrop of weakening growth, tighter liquidity, and elevated inflation, we believe dividend growth equities could likely serve as a strong core allocation within investor portfolios for the uncertain road ahead.

Past performance is no guarantee of future results. For illustrative purposes only. Universe is largest 1,000 market cap companies ex Financials and Real Estate. Includes companies that are in the top 20% relative to sector for both dividend growth (LTM) and free cash flow yield. Dividend Growth & Free Cash Flow Yield on a sector neutral basis. Market cycle returns have been annualized. Returns time periods are 1990-06/30/2023.

Sources: Wolfe Research Portfolio Strategy; Company filings; Bloomberg; Standard & Poor’s; FactSet.

A Distinct Opportunity for Active

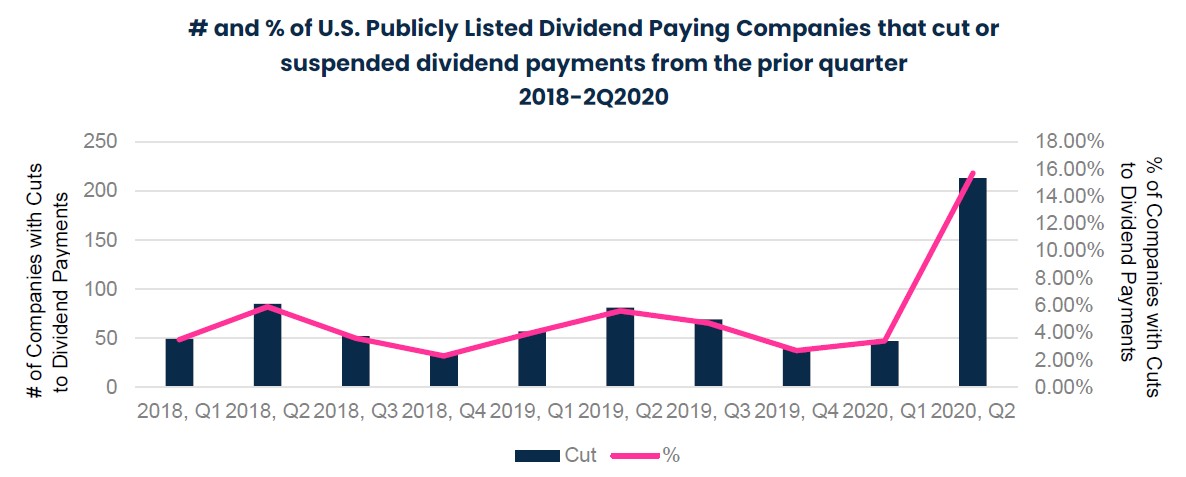

Notably, the recent pandemic likely resulted in a diminished opportunity set for rules-based, passive dividend growth strategies. Out of nearly 1,400 U.S.-listed, dividend-paying firms, over 300 firms either cut or omitted dividends entirely in the second quarter of 2020. That said, according to S&P, many of those 300 firms resumed paying and growing their dividends in the quarters that followed.

Source: The Impact of the COVID Pandemic on Dividends, Kevin Krieger Ph.D, Nathan Mauck Ph.D, Stephen Pruitt, Ph.D; National Institute of Health. Performance data shown represents past performance and is no guarantee of future results.

Those that implemented dividend cuts and omissions in 2020 likely no longer qualify for inclusion in passive dividend strategies that require a multi-year streak of uninterrupted dividend growth (often five to 10 years), even though the pauses or reductions were prompted by extenuating circumstances.

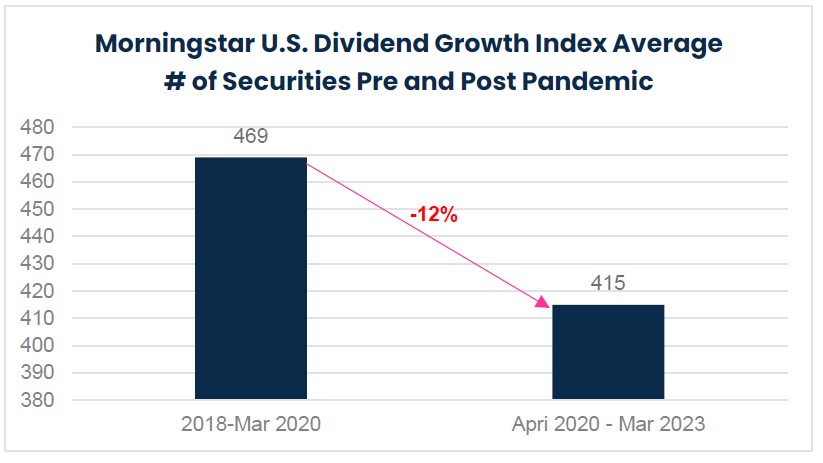

For example, the Morningstar U.S. Dividend Growth Index requires a minimum of five years of uninterrupted annual dividend growth to be considered for inclusion in the index. However, as a result of the pandemic, the average number of securities held withing the index shrank by 12% by the end of the pandemic.

Source: Morningstar Direct.

We believe that the greater flexibility enabled by active management in the space affords an edge in current conditions. Particularly as backward-looking, rules-based dividend strategies may be excluding what we perceive to be solid fundamental dividend growth opportunities due to the anomalies induced by the pandemic.

Important Information

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to purchase or sell a particular security.

Investing entails risk and there can be no assurance that any investment will achieve profits or avoid incurring losses. There is no guarantee any company or investing strategy will pay dividends.

All investments involve risk including the possible loss of principal. Stock prices can fall because of weakness in the broad market, a particular industry, or specific holdings. At times, a growth investing style may be out of favor with investors which could cause growth securities to underperform value or other equity securities.

The Morningstar U.S. Dividend Growth Index tracks U.S.-based securities with a history of uninterrupted dividend growth. The index is a subset of the Morningstar US Market Index, a broad market index representing 97% of U.S. equity market capitalization. This Index does not incorporate Environmental, Social, or Governance (ESG) criteria.

Alpha is used in finance as a measure of performance, indicating when a strategy, trader, or portfolio manager has managed to beat the market return or other benchmark over some period.

Index listed is unmanaged and does not reflect fees and expenses and is not available for direct investment.

3156026