Why Harbor Scientific Alpha High-Yield ETF?

May 09, 2023Why Now for High-Yield?

Although rising interest rates have recently posed challenges for fixed income investors, it also presents opportunities for skilled active managers. High-yield bonds hold particular promise in our view. Rates have risen to levels that may indicate attractive returns in the coming years. We believe that history has shown that current yields have done a solid job at forecasting subsequent realized returns. As of March 31, 2023, the current yield on the ICE BofA U.S. High Yield Index stood at 8.3%, meaning the index may be poised for healthy returns in the future.

What’s more, this possible return outlook is accompanied by a stronger risk profile. The credit composition of the high-yield universe has improved thanks in part to increased issuance from BB-rated issuers (the highest credit tier in the universe) and upgrades of major bond issues that were previously rated CCC.

ICE BofA U.S. High Yield Index Credit Quality | ||

|---|---|---|

Credit Rating Tier | December 2007 | March 2023 |

BB | 38% | 50% |

B | 43% | 39% |

CCC and lower | 19% | 11% |

Source: ICE as of March 31, 2023. | ||

Why Go Active?

When it comes to high yield, we think investors should favor active strategies over index funds. We believe active managers tend to have the skills and flexibility to select issuers with better credit profiles and construct portfolios that allocate the most to bonds with the most appealing risk/reward characteristics. In contrast, many passive strategies are weighted by market capitalization, meaning they place the greatest weight on those issuers with the most debt. Consequently, passive strategies can be more vulnerable to periods of economic stress.

Furthermore, index funds’ rules-based approach may not allow for the flexibility required to optimally manage risk. For example, index funds may have to hold deteriorating credits as long as they remain in the index. Similarly, when a bond falls out of the index, index funds may be forced to sell at an inopportune time when liquidity is most challenged. In contrast, active managers can try to avoid troublesome creditors in the first place, and by closely monitoring portfolio holdings, active managers can strive to eliminate weakening issuers long before they are dropped from the index. Active managers also have the ability to time their purchases and sales to take advantage of forced sellers like index funds.

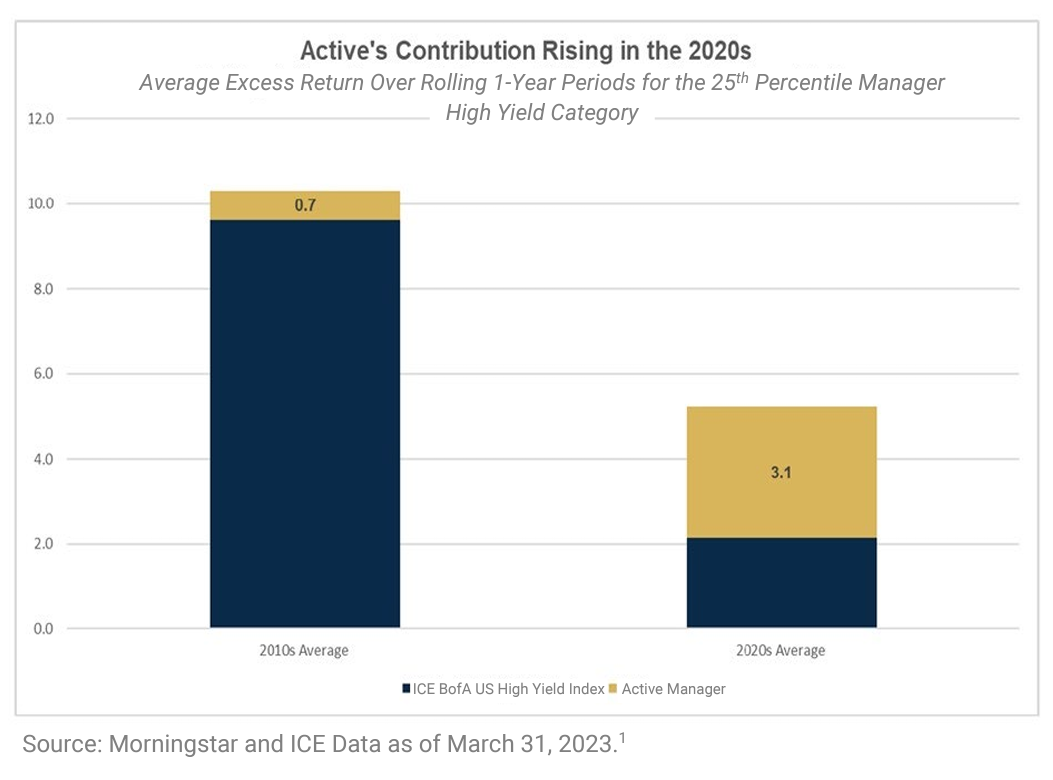

Unlike their equity peers who’ve struggled to beat the S&P 500, high-yield active managers have had an easier time outperforming the broad asset class benchmark, the ICE BofA U.S. High Yield Index. In recent years, the best performing active managers have been able to capitalize on increased dispersion in the asset class and improve their value add, as shown in the chart to the right.

Why BlueCove?

BlueCove is a specialist boutique founded in 2018 and custom-built to create market leading scientific fixed-income solutions for investors. Quantitative investing in fixed income has been made possible by meaningful evolutions in the bond market, such as increases in the quantity and quality of data and lower trading costs driven in part by increased use of electronic trading. BlueCove has capitalized on these changes to become one of the originators of systematic fixedincome investing.

At the core of BlueCove’s scientific approach is a robust, thorough and risk-conscious model built by an experienced team of investment professionals and technical engineers. These models have the capacity to harness large data sets to construct a portfolio that offers multifactor exposure across sentiment, fundamental, and valuation signals. This substantially increases the breadth of the opportunity set, allowing for more potential alpha opportunities as well as broad diversification.

Harbor Scientific High Yield ETF (SIHY)

Harbor Capital has partnered with BlueCove to offer investors a disciplined and distinctive way to add high-yield exposure to their portfolios. SIHY is:

Scientifically Driven. Powered by an investment process that is evidenced based, data-driven, economically intuitive, and grounded in the scientific method.

Alpha Oriented. Actively managed to target outperformance versus the benchmark by applying proprietary quantitative investment insights to help drive returns while seeking to deliver a competitive yield. The portfolio is constructed with the goal of maximizing alpha potential, controlling risk, and minimizing transaction costs.

Risk Managed. Structured to target compelling risk-adjusted returns versus the benchmark in a liquid diversified portfolio, while seeking to maintain a risk profile similar to the benchmark.

Important Information

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

All investments involve risk including the possible loss of principal. Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the value of your investment in the Fund may go down. As interest rates rise, the values of fixed income securities held by the Fund are likely to decrease and reduce the value of the Fund’s portfolio. There is a greater risk that the Funds will lose money because they invest in below-investment grade fixed income securities and unrated securities of similar credit quality (commonly referred to as “high-yield securities” or “junk bonds”). These securities are considered speculative because they have a higher risk of issuer default, are subject to greater price volatility and may be illiquid. Because the Funds may invest in securities of foreign issuers, an investment in the Funds is subject to special risks in addition to those of U.S. securities. These risks include heightened political and economic risks, greater volatility, currency fluctuations, higher transaction costs, delayed settlement, possible foreign controls on investment, possible sanctions by government bodies of other countries and less stringent investor protection and disclosure standards of foreign markets.

Diversification does not assure a profit or protect against loss in a declining market.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals. They may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Ratings are based on Moody’s, S&P or Fitch, as applicable. If securities are rated differently by the ratings agencies, the highest rating is applied. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P or Fitch (Baa or higher by Moody’s) are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” are not rated by the national ratings agencies stated above.

The ICE BofA U.S. High Yield Index (H0A0) Index is an unmanaged index that tracks the performance of below investment grade U.S. Dollar-denominated corporate bonds publicly issued in the U.S. domestic market. All bonds are U.S. dollar denominated and rated Split BBB and below. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Alpha is a measure of risk (beta)-adjusted return.

Current yield is an investment's annual income divided by the current price of the security.

Diversification in an individual portfolio does not assure a profit.

Dispersion refers to a statistical measure of the range of potential outcomes for an investment based on its historical volatility or returns.

1 The data is the average excess return over rolling 1-year periods for the 25th percentile manager in the Morningstar HY category. Starting with a one-year period. Percentile Rank all HY managers based on one-year excess returns for that period. Measure the excess return of the 25th percentile manager for that period. Repeat for all one-year periods in the decade. Take the average of the 25th percentile manager’s excess returns over all periods in the decade. Managers in scope of rank could vary by period. 2010s periods 2/1/2009-1/31/2010 until 1/1/2019-12/31/2019 2020s periods 2/1/2019 until 4/1/2022-3/31/2023.

BlueCove is a third-party subadvisor to the Harbor Scientific Alpha High-Yield ETF and the Harbor Scientific Alpha Income ETF.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

2895527