The Long-Term Case for Commodities

December 11, 2023

Executive Summary:

- Commodities can provide valuable long-term diversification benefits to a portfolio.

- Structural supply/demand dynamics may be supportive of long-term commodity returns.

- Commodities can also be helpful to portfolios during inflationary periods; however, it requires a flexible approach because not all inflation regimes are equal.

The Case for a Strategic Allocation to Commodities

Portfolio diversification has often proven critical in achieving investment objectives over longer-term horizons given the unpredictability and variability of market conditions. Commodities are a relatively distinct asset class, as price movements in the space have typically been driven by the balance of supply and demand and are generally less sensitive to stock and bond market returns. In a diversified portfolio, maintaining a strategic allocation to assets such as commodities, which are less correlated with other investments, may help reduce overall portfolio volatility and provide the potential to enhance returns over time, in our view.

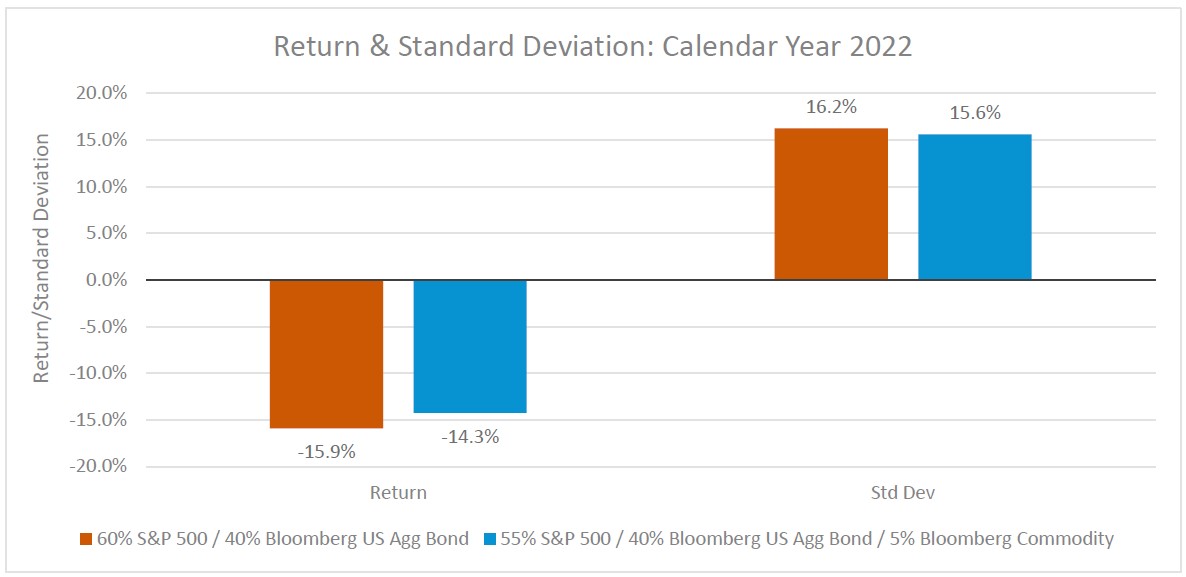

The diversification benefits of commodities were never more apparent than in 2022 when they proved a strong source of inflation hedge and provided positive returns within a highly turbulent backdrop for equities and fixed income securities.

Source: Morningstar Direct. Performance data shown represents past performance and is no guarantee of future results.

Commodities Have Helped Hedge Against Inflation

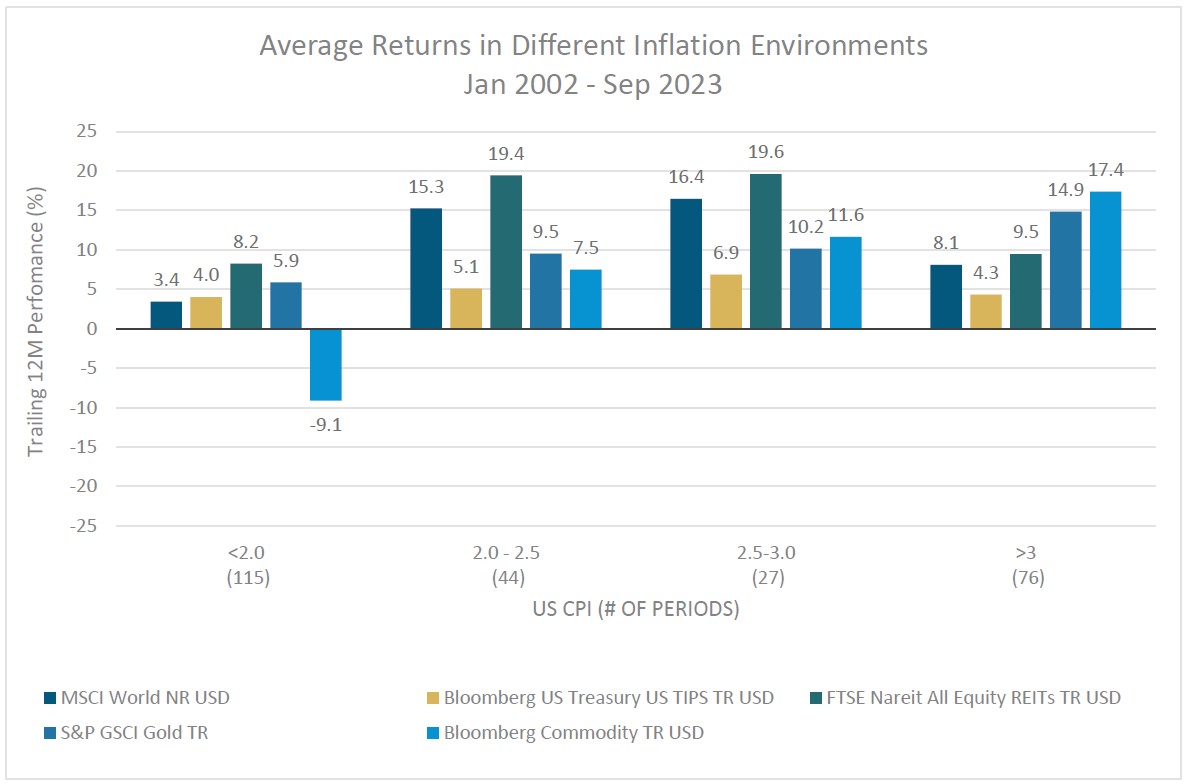

We believe commodities should be included in investors’ inflation hedging toolkit. When inflation has run the hottest, commodities have outperformed other traditional inflation hedging asset classes.

Source: Morningstar Direct. Performance data shown represents past performance and is no guarantee of future results.

Not all inflationary regimes are equal. In some inflationary periods, prices rise due to scarcity of supply at a time when the world is demanding more consumable commodities, such as oil, corn or copper. At other times, commodity prices rise because of weakness in the US dollar. In such periods of currency debasement, a robust inflation hedge is a store of value, such as gold.

Timing commodity allocations to capitalize on the shift between scarcity1 and debasement2 environments can prove challenging, underscoring the importance of employing in a broader-based commodities solution that dynamically adjusts its portfolio to account for these different market environments and regimes.

Commodities Have the Potential to Provide a Source of Long-Term Returns

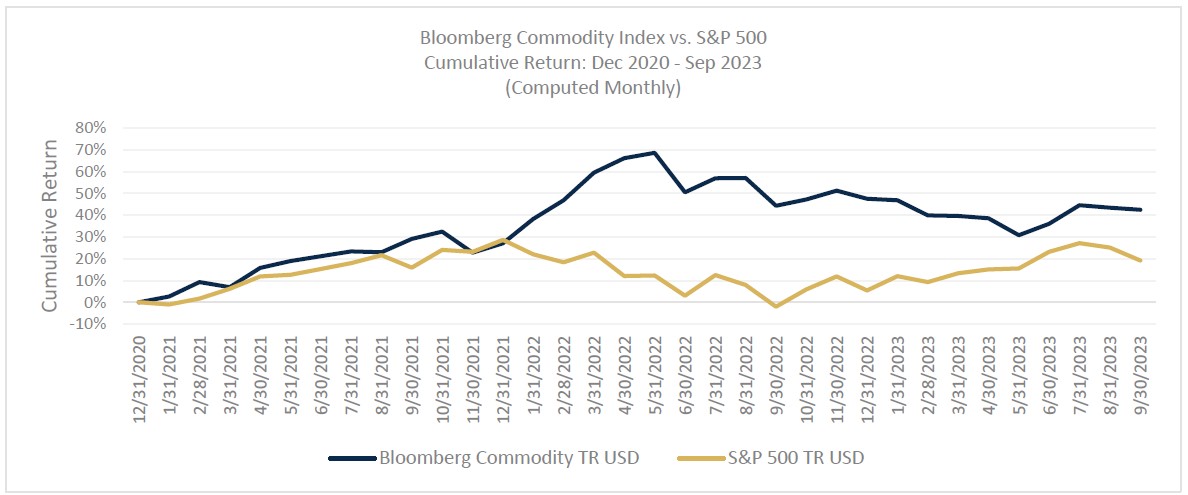

Commodities have performed strongly over the past few years. They moved in lockstep with the stock market for much of 2021 then pulled ahead of equities beginning in early 2022 (see chart below). This performance strength has been supported by favorable supply/demand dynamics. Chronic underinvestment has led to supply side constraints while geopolitical pressures continue to mount, potentially further supporting the asset class. We believe these are long-term trends that could continue to support commodity performance over the coming years.

Source: Morningstar Direct. Performance data shown represents past performance and is no guarantee of future results.

Important Information

1 Scarcity means that the demand for a good or service is greater than the availability of the good or service.

2 Debasement refers to lowering the value of a currency.

For Institutional Use Only – Not For Distribution to the Public.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to purchase a particularsecurity. The information provided in this presentation is for informational purposes only.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

The Bloomberg Commodity Index (“BCOM”) is designed to be a highly liquid and diversified benchmark for commodity investments via futures contracts. The S&P GSCI® (“SPGSCI”) is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. The FTSE NAREIT All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property. Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

3274707