The Commodities Constant: Why the Time May Be Right to Rethink Your 60/40 Allocation

November 03, 2023

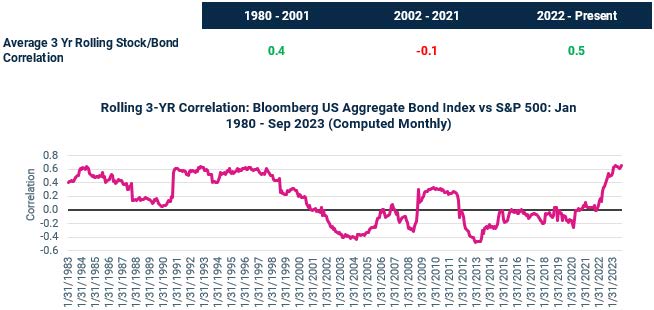

Through much of the last two decades, investors in 60/40 portfolios have benefited from negative correlations between stocks and bonds. For instance, over the period from 2002 – 2021, the average rolling 3-year correlation between stocks and bonds was -0.1, providing sufficient diversification to a 60/40 portfolio. Sparked by higher inflation and higher interest rates, we believe we have transitioned to a new regime with elevated correlations between stocks and bonds. Since 2022, the average rolling 3-year correlation between stocks and bonds has been 0.5, looking more like the environment we had seen through the 1980s and 1990s than the last two decades. In this new regime, we believe 60/40 portfolios would likely benefit from additional sources of diversification.

Source: Morningstar Direct

Benefits of Employing Commodities Within a 60/40 Portfolio

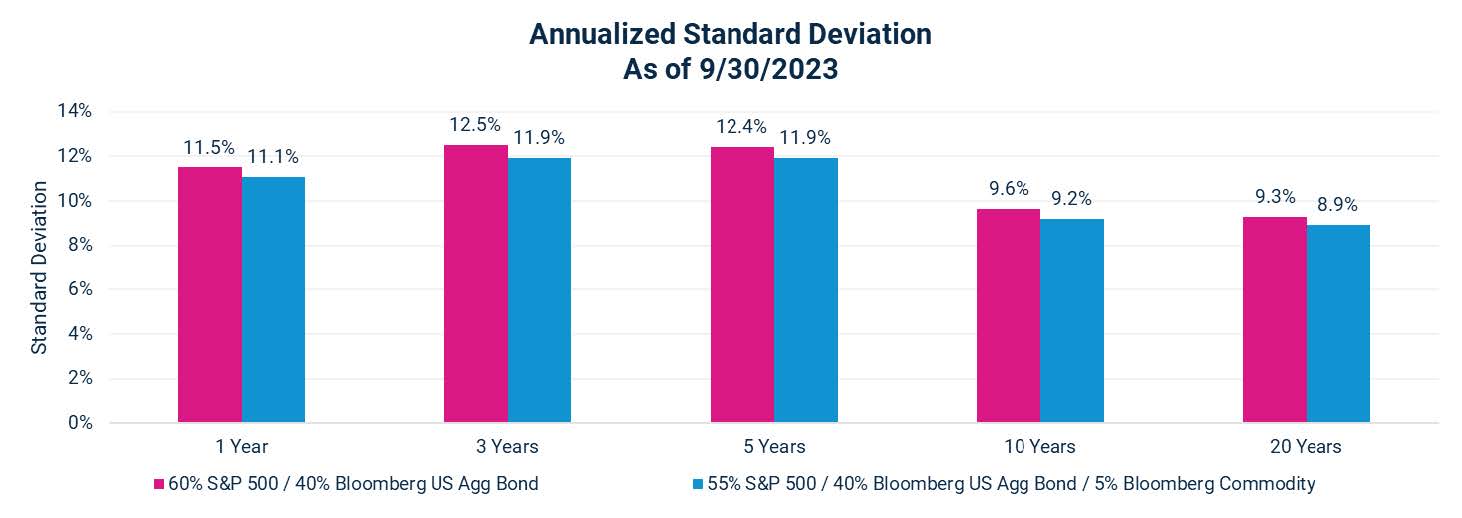

We believe commodities provide strong diversification benefits to a stock and bond portfolio as commodity prices are mainly driven by the balance of supply and demand. As a result, commodities have generally been less sensitive to stock and bond market returns. Including a 5% weighting in commodities within a 60/40 portfolio (taken from equities) has historically reduced overall portfolio volatility across a variety of annualized time periods, serving as a risk dampener within a portfolio of stocks and bonds.

Source: Morningstar Direct. Performance data shown represents past performance and is no guarantee of future results.

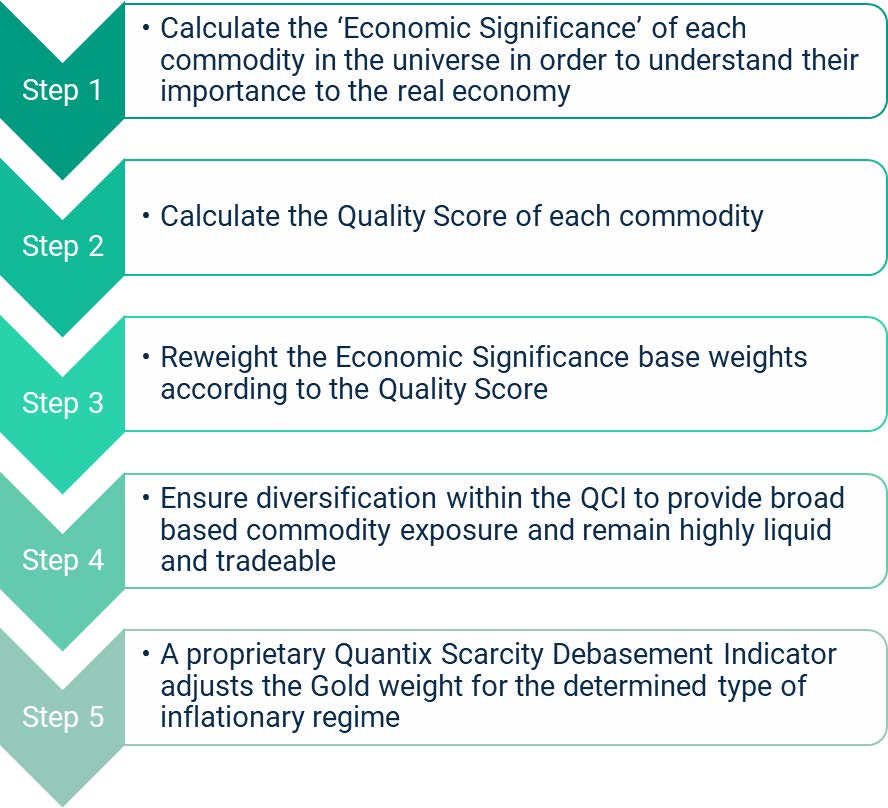

Quantix Commodity Index (QCI): More Thoughtful, Dynamic Approach

For illustrative purposes only.

For a differentiated approach to commodities investing, Harbor’s All-Weather Strategy ETF (HGER), an index ETF based on the QCI, offers a long-term allocation solution that considers the relative inflation sensitivity, roll yield dynamics and the type of inflationary regime presented by the current environment and positions the strategy accordingly.

The QCI aims to optimize basket weights to increase inflation sensitivity and long-term returns through a Quality Score. The QCI targets a higher sensitivity to inflation by weighting toward commodities which have a higher Quality Score: relatively high pass-through costs, higher correlations to CPI, and a lower cost to hold and roll the exposure.

Overall, we believe HGER’s thoughtful approach to commodities enables investors to maintain a strategic allocation to the asset class, benefitting from the diversification benefits and performance potential of commodities. Its ETF wrapper also provides liquidity for this cost-effective solution which seeks to enhance overall risk and returns for the everyday portfolio. Learn more on our website.

Important Information

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

Commodity Risk: The Fund has exposure to commodities through its and/or the Subsidiary’s investments in commodity-linked derivative instruments. Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Commodity-Linked Derivatives Risk: The Fund’s investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities.

Diversification does not assure a profit or protect against loss in a declining market.

The Bloomberg Commodity Index (“BCOM”) is designed to be a highly liquid and diversified benchmark for commodity investments via futures contracts. The Bloomberg US Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. The Quantix Commodity Index (“QCI”) is calculated on a total return basis, which combines the returns of the futures contracts with the returns on cash collateral invested in 13-week U.S. Treasury Bills. This unmanaged index does not reflect fees and expenses and is not available for direct investment. The Quantix Inflation Index was developed by Quantix Commodities LP and is owned by Quantix Commodities Indices LLC. These indices are unmanaged and do not reflect fees and expenses and are not available for direct investment.

A 60/40 portfolio is generally one that has a 60% allocation to stocks and a 40% allocation to bonds.

Correlation is a statistic that measures the degree to which two variables move in relation to each other.

Standard deviation is a mathematical concept that measures volatility in the market or the average amount by which individual data points differ from the mean.

Roll yield is the amount of return generated in the futures market after an investor rolls a short-term contract into a longer-term contract and profits from the convergence of the futures price toward a higher spot or cash price.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals. They may not be reflective of current opinions, are subject to change without prior notice, should not be considered investment advice or a recommendation to purchase a particular security.

Quantix Commodities LP (“Quantix”) is a third-party subadvisor to the Harbor Commodity All-Weather Strategy ETF.

3198585