The Case for the Harbor Commodity All-Weather Strategy ETF

March 13, 2023

Executive Summary:

- Commodities can provide valuable diversification benefits to a portfolio.

- Current supply/demand dynamics may be supportive of long-term commodity returns.

- Commodities can also be helpful to portfolios during inflationary periods, but it is important to recognize that not all inflation regimes are equal. That’s why we believe long-term investors are better served by the flexible approach offered by Harbor Commodity AllWeather Strategy ETF (HGER).

- HGER’s approach was designed by industry veterans from Quantix Commodities, who have navigated several economic cycles over many years.

The Case for a Strategic Allocation to Commodities

Portfolio diversification has proven critical in achieving investment objectives over longer-term horizons given the unpredictability and variability of market conditions. Commodities are a relatively distinct asset class, as price movements in the space are mainly driven by the balance of supply and demand and are generally less sensitive to stock and bond market returns. In a diversified portfolio, maintaining exposure to assets such as commodities, which are less correlated with other investments, we believe can reduce overall portfolio volatility and enhance returns over time.

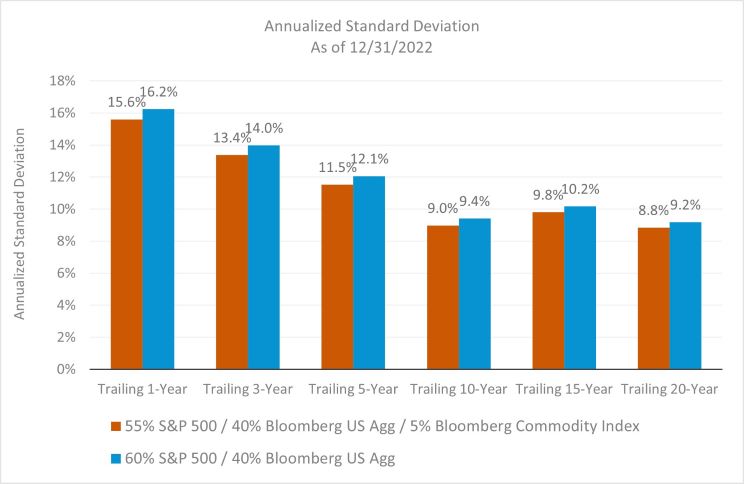

We examine the historical impact of shifting 5% of the equity component of a traditional 60/40 balanced portfolio to the Bloomberg Commodity Index (BCOM), a broadly diversified index of commodities. Per the chart below, this shift in asset mix reduced volatility as measured by standard deviation over the 1-year, 3-year, 5year, 10-year, 15-year and 20-year annualized time periods.

Source: Morningstar Direct

Source: Morningstar DirectPast performance is not indicative of future results. These indices are unmanaged and do not reflect fees and expenses and are not available for direct investment.

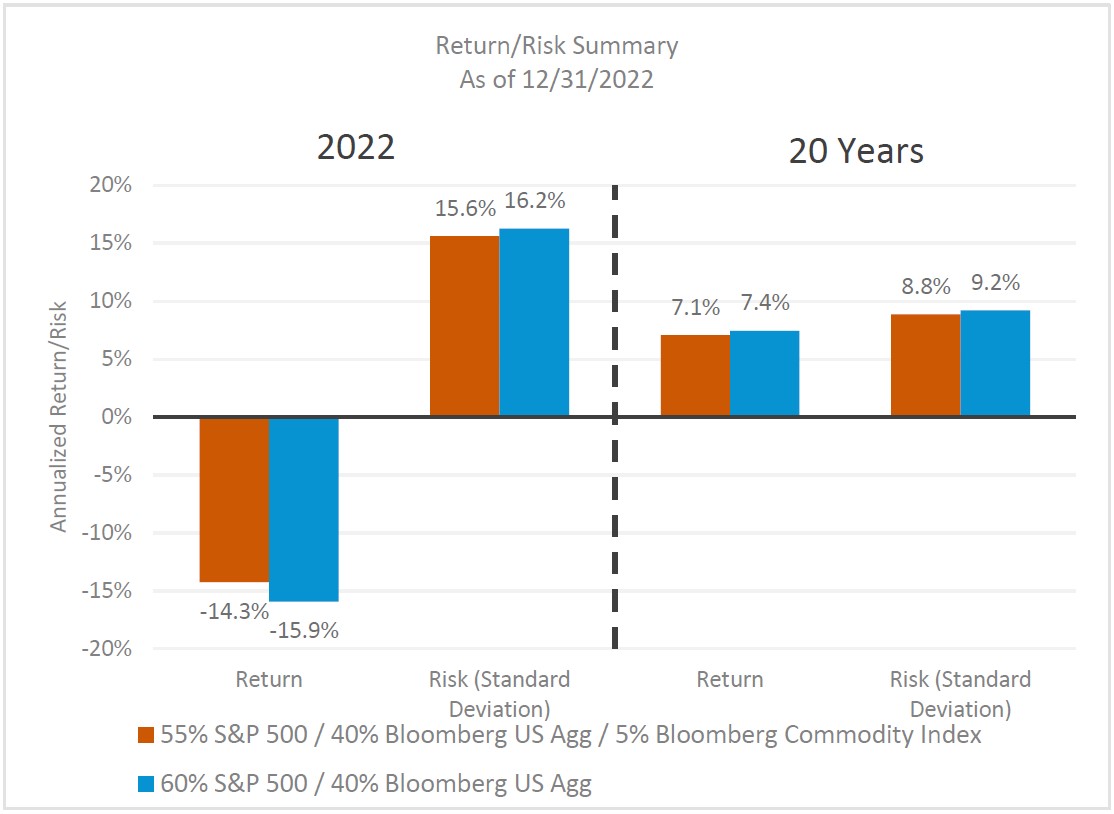

The diversification benefits of commodities were never more apparent than in 2022, as they proved a strong source of an inflation hedge and provided positive returns within a highly turbulent backdrop for equities and fixed income securities. Per the chart, applying the same 5% allocation to BCOM at the expense of equities would have aided returns by +1.6% versus a traditional 60/40 portfolio and reduced risk (standard deviation) in 2022.

Importantly, maintaining this allocation over the last 20 years would have resulted in only slightly lower annualized return as a 60/40 portfolio but with lower standard deviation. As such, maintaining 5% allocation to commodities has enhanced a diversified portfolio’s risk/reward profile. Said differently, maintaining a 5% allocation to a broad basket of commodities would have produced similar returns relative to a 60/40 portfolio over a long-term horizon, but it would have meaningfully aided aggregate returns when investors needed it the most (such as in 2022).

Source: Morningstar Direct

Source: Morningstar DirectPast performance is not indicative of future results. These indices are unmanaged and do not reflect fees and expenses and are not available for direct investment.

Commodities Can Help Hedge Against Inflation

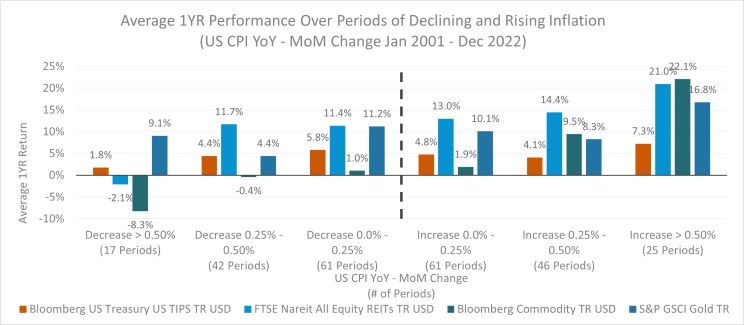

We believe commodities should be included in investors’ inflation hedging toolkit. When inflation has run the hottest, commodities have outperformed other traditional inflation hedging asset classes.

Source: Morningstar Direct

Source: Morningstar DirectPast performance is not indicative of future results. These indices are unmanaged and do not reflect fees and expenses and are not available for direct investment.

Not all inflationary regimes are equal. In some inflationary periods, prices rise due to scarcity of supply at a time when the world is demanding more consumable commodities, such as oil, corn or copper. At other times, commodity prices rise because of weakness in the US dollar. In such periods of currency debasement, a robust inflation hedge is a store of value, such as gold.

Timing commodity allocations to capitalize on the shift between scarcity and debasement environments can prove challenging, underscoring the importance of employing in a broader-based commodities solution that dynamically adjusts its portfolio to account for these different market environments and regimes.

Commodities Can Provide a Potential Source of Long-Term Returns

Chronic underinvestment has led to supply side constraints while geopolitical pressures continue to mount, potentially further supporting the asset class. In addition, commodities have exhibited a history of performance cyclicality versus broad market equities (S&P 500 Index). For instance, commodities exhibited sustained outperformance relative to equities in the 2000’s. Conversely, equities outperformed commodities in the 2010’s.

Thus far in the 2020’s, commodities have meaningfully outperformed broad market equities. Given the magnitude and longevity of previous cycles, we may still be in the early stages of a cycle of commodities outperformance.

Why Harbor Commodity All-Weather Strategy ETF (HGER)

We believe that commodities offer meaningful benefits to investor portfolios, but it is a complex and heterogeneous asset class that requires a flexible and thoughtful approach. In our view, HGER offers several advantages that make it particularly appealing for gaining long-term strategic commodities exposure.

- Veteran Management. Quantix Commodities is a specialist boutique focused solely on commodity investing. Quantix was founded by an experienced team of investors who have worked together for many years trading across commodity markets.

- Intelligent Design. The seasoned professionals at Quantix designed HGER’s approach based on their many years observing the nuances and complexities of commodities markets. The result is what we believe to be an intelligent index construction that improves its inflation-hedging properties (by tilting toward the most inflation-sensitive commodities) and effectively manages market frictions (futures contract roll costs).

- Flexible Allocation and Volatility Management. The ETF is distinguished by its proprietary process for calibrating its asset allocation to suit the economic environment by increasing the gold weight in periods marked more by debasement driven inflation. We believe that this distinctive design element makes this ETF ideal for a strategic allocation to commodities as it helps minimize the need for investors to self-manage and time individual exposures such as gold.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

There is no guarantee that the investment objective of the Fund will be achieved. Commodities may subject an investor to greater volatility than traditional securities such as stocks and bonds and can fluctuate significantly based on political, regulatory, market and economic conditions. Derivatives may be more volatile and less liquid than traditional investments and are subject to market, interest rate, credit, leverage, counterparty, and management risks.

The Fund’s investments in commodity-linked derivative instruments and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities. The Fund has a limited number of institutions that may act as authorized participants and engage in creation or redemption transactions directly with the Fund. There is no assurance that authorized participants will establish or maintain an active trading market for the Shares. This risk may be heightened during periods of volatility or market disruptions.

A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political, or regulatory occurrence than a more diversified portfolio.

Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Commodity Risk: The Fund has exposure to commodities through its and/or the Subsidiary’s investments in commodity-linked derivative instruments. Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Commodity- Linked Derivatives Risk: The Fund’s investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities.

The Bloomberg Commodity Index (“BCOM”) is designed to be a highly liquid and diversified benchmark for commodity investments via futures contracts. The S&P GSCI® (“SPGSCI”) is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property. The Quantix Commodity Index (“QCI”) is calculated on a total return basis, which combines the returns of the futures contracts with the returns on cash collateral invested in 13-week U.S. Treasury Bills. This unmanaged index does not reflect fees and expenses and is not available for direct investment. The Quantix Commodity Index was developed by Quantix Commodities LP and is owned by Quantix Commodities Indices LLC. These indices are unmanaged and do not reflect fees and expenses and are not available for direct investment.

The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of Quantix Commodities LP (“Quantix”). The information in this material is only current as of the date indicated and may be superseded by subsequent market events or for other reasons. Any statements of opinion constitute only current opinions of Quantix, which are subject to change and which Quantix does not undertake to update. Statements concerning financial market trends are based on current market conditions, which will fluctuate. No representation is made that the investment theses posited in this presentation are or have been profitable or that they will be profitable in the future.

Nothing herein constitutes an offer to sell, or solicitation of an offer to purchase, any securities. Any offer of securities may be made only by means of a formal confidential offering memorandum that includes a comprehensive list of potential risk factors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment. Some information contained herein has been obtained from third party sources and has not been independently verified by Quantix. Quantix believes such information to be accurate but makes no representations as to the accuracy or the completeness of such third-party information.

All charts and data are for illustrative purposes only. The views expressed herein are those of Quantix and may not be reflective of their current opinions or future actions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only. The information provided in this article should not be considered as a recommendation to purchase or sell a particular security. The weightings, holdings, industries, sectors, and countries mentioned may change at any time and may not represent current or future investments.

Quantix Commodities LP (“Quantix”) is a third-party subadvisor to the Harbor Commodity All-Weather Strategy ETF.

Foreside Fund Services, LLC is the Distributor of Harbor Commodity All-Weather Strategy ETF (HGER).

2789612