The Case for Small Caps – Spotlight on Health Care

March 03, 2024

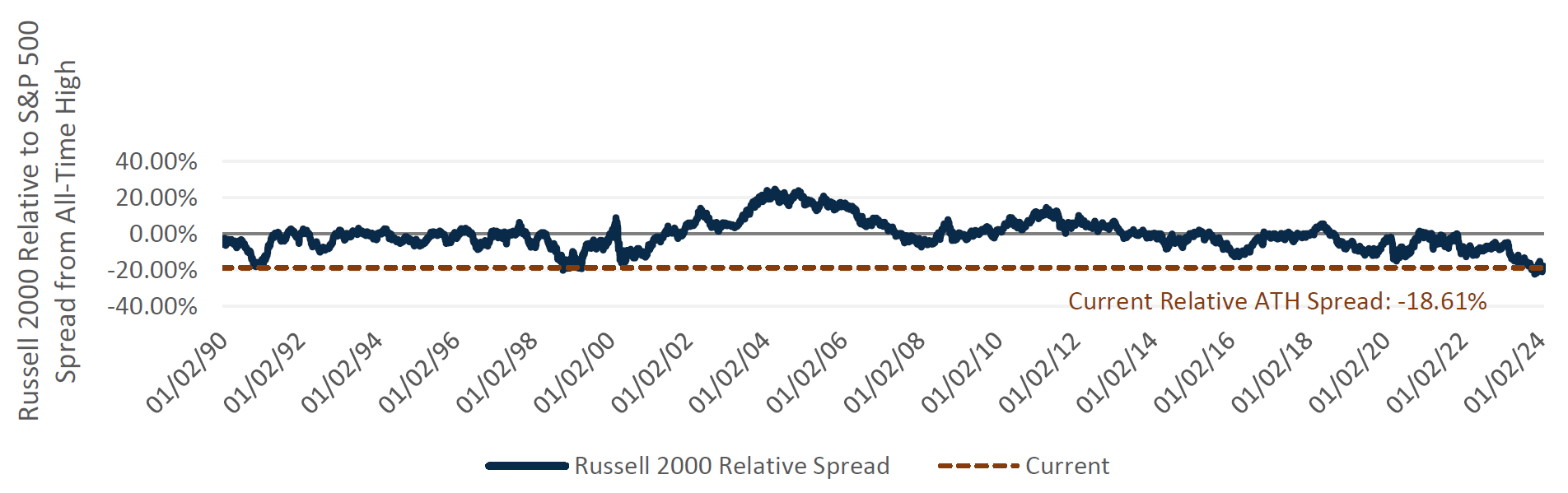

In a recent conversation with Westfield Capital Management, subadvisor for the Harbor Small Cap Growth Fund, we discussed why small cap equities now appear attractively priced, trading at a discount relative to their large cap counterparts.

1/1/1990 - 1/31/2024

Source: FactSet Research Systems.

Performance data shown represents past performance and is no guarantee of future results.

Narrowing in on Heatlh Care

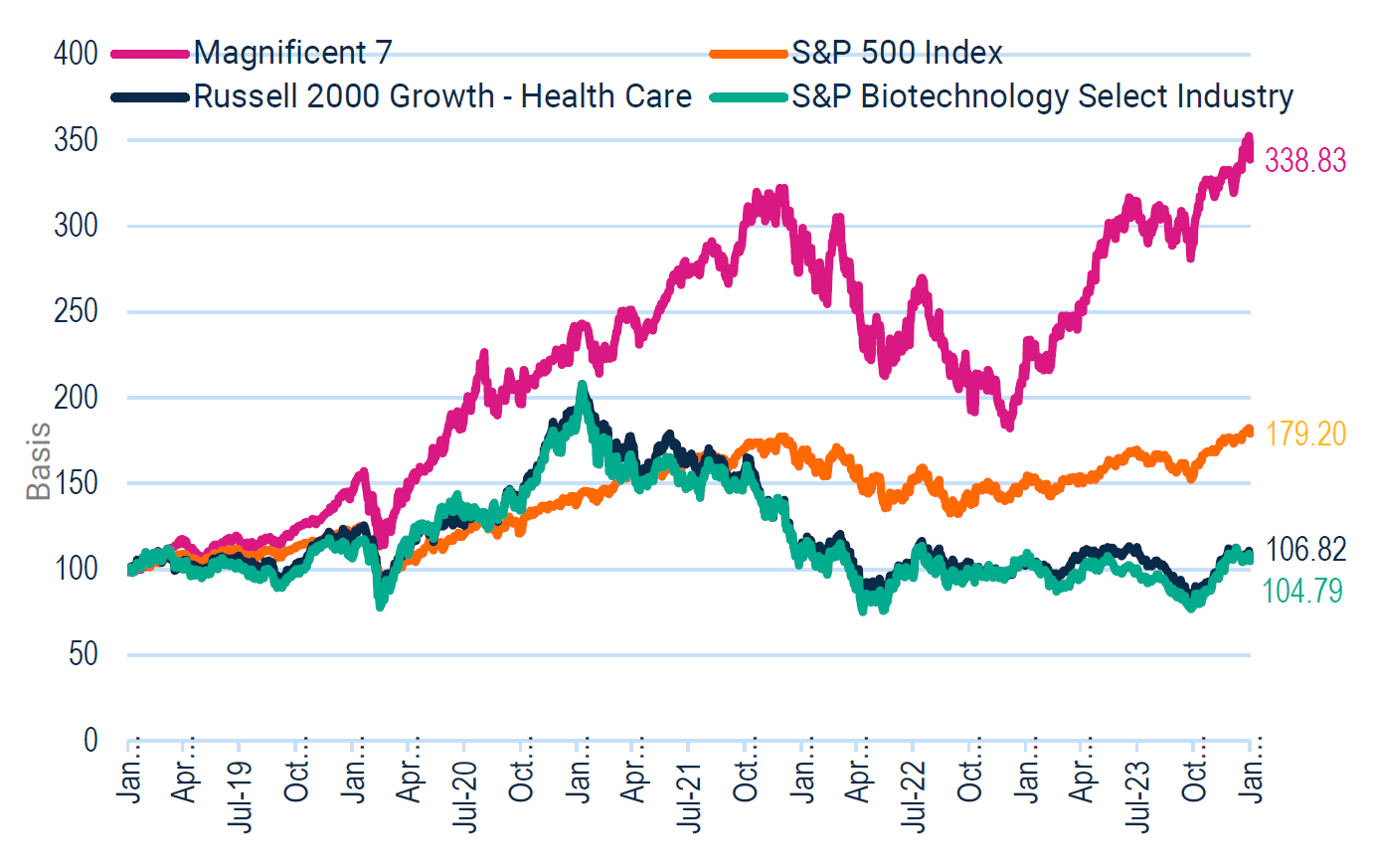

In particular, small cap health care and biotech companies have lagged the broader market in recent years, creating opportunities for skilled, active managers to close the valuation gap.

Given this market phenomenon, we believe Westfield’s rich history of health care investing across the capitalization spectrum positions it well to participate in this inefficient market segment with opportunity for alpha.

the Broader Market and Mega Caps

Performance data shown represents past performance and is no guarantee of future results.

Source: Westfield, FactSet Research Systems, as of 1/31/2024. “Magnificent 7” represents Alphabet Inc. Class A/C (GOOG/GOOGL), Amazon.com, Inc. (AMZN), Apple Inc. (AAPL), Meta Platforms Inc. Class A (META), Microsoft Corporation (MSFT), NVIDIA Corporation (NVDA) & Tesla (TSLA). Russell 2000 Growth – Health Care represents health care sector holdings within the index.

Westfield seeks to invest in companies benefiting from the secular growth and innovation of the U.S. health care system while aiming to achieve alpha relative to the broader health care sector by investing in quality businesses with differentiated products, technologies, and services which meet its disciplined valuation criteria. We appreciate Westfield’s ability to pivot and react quickly to changes in the opportunity set, helping it to ensure that the Harbor Small Cap Growth Fund reflects its best ideas.

Small Cap Health Care Opportunity into the Future

Looking forward, Westfield believes there are a number of compelling factors contributing to the attractiveness of small caps in health care, including:

- Abatement of sustained elevated interest rates

- Bottoming out of small cap valuations after a 2.5 year drawdown

- An influx of cash to drive the next leg of innovation in biopharma

- Acceleration of merger and acquisition activity as larger company patent cliff needs to become more acute

- Buying opportunities created by weight loss drug hysteria that contributed to carnage in highquality, high-growth med tech stocks

For more information on Westfield’s approach and the Harbor Small Cap Growth Fund, please visit our website.

Important Information

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice. This material is for informational and illustrative purposes only. This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Alpha refers to excess returns earned on an investment above the benchmark return when adjusted for risk.

Basis points are a standard measure for interest rates and other percentages in finance.

The Russell 2000 Index is a market index comprised of 2,000 small-cap companies. The Russell Indices and Russell are trademarks of Frank Russell Company. The Russell 2000 Growth Index measures the performance of Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values. The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. These unmanaged indices do not reflect fees and expenses and are not available for direct investment.

Investors should carefully consider the investment objectives, risks, charges and expenses of a fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

Westfield Capital Management Company, L.P. is an independent subadvisor to the Harbor Small Cap Growth Fund.

Distributed by Harbor Funds Distributors, Inc.

3424966