The Case for Growth Equities: Harbor Long-Term Growers ETF (WINN)

August 31, 2023Growth investing is a popular investment strategy that focuses on companies expected to grow earnings at an above average rate relative to the broader market. Due to their favorable characteristics, growth stocks and strategies often represent a significant portion of a strategic equity portfolio.

Potential Benefits of Growth Investing

|  |  |  |

| High Return Potential | Access to Industry Leaders | Exposure to Secular Growth Opportunities | Capital Appreciation |

| Because growth strategies focus on companies with outsized potential to increase and accelerate earnings, their ability to deliver higher returns is expected to be greater than the broader market. | More established growth companies often exhibit market leadership positions within their particular industries. Often times, these companies have extremely high competitive advantages, making it difficult for competitors to penetrate market share. | Growth strategies typically enable exposure to companies addressing unmet needs across industries that possess long duration growth opportunities and strong long-term alpha potential. | Unlike value stocks, which often return capital back to shareholders in the form of dividends, growth companies reinvest capital back into their businesses. This gives growth stocks the advantage of greater price appreciation potential. |

The Harbor Long-Term Growers ETF (WINN)

We believe WINN offers several advantages that make it particularly appealing for gaining access to companies that exhibit compelling prospects for long-term growth. WINN is managed by Jennison Associates, an active manager with over five decades of experience identifying companies with sustainable competitive advantages and long-term growth potential.

- Long-Term Growth Investing:

Active manager with five decades of experience identifying companies with sustainable competitive advantages and long-term growth potential. The team’s investors attempt to exploit market inefficiencies by investing in companies with underappreciated multi-year, structural growth opportunities. - Research-Centric Expertise:

Jennison’s investment edge is driven by in-depth fundamental research conducted by teams of portfolio managers and research analysts with decades of experience following their respective sectors. These investors engage with multiple levels of company management and industry participants to build a strategic understanding of companies and identify potential growth catalysts and impediments to growth. They search for companies with significant competitive advantages and management teams able to execute on their growth opportunities. - Systematic Portfolio Construction:

Jennison conducts portfolio optimization to incorporate the investment teams’ fundamental insights and to ensure the portfolio is aligned with the Fund’s desired characteristics.

Why Harbor Long-Term Growers ETF (WINN) Now?

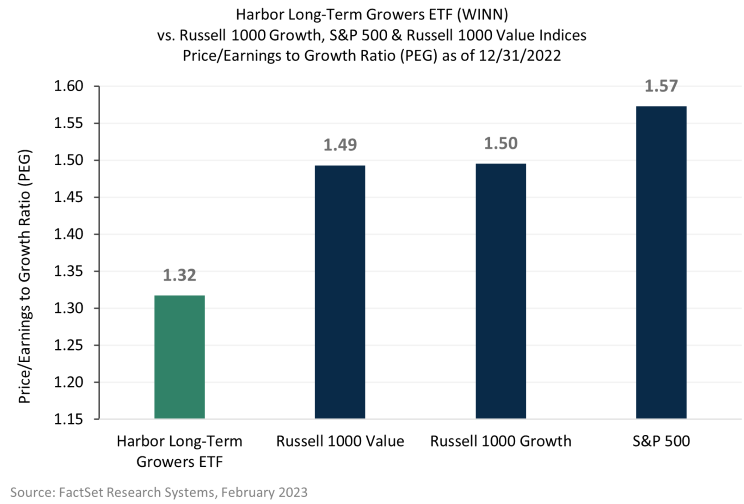

Recent performance pressures have resulted in meaningful valuation compression for growth stocks. As price-to-earnings multiples have declined across the space, WINN has maintained investment in companies with stronger earnings growth profiles. This means that despite sourcing companies with stronger levels of earnings per share expansion, the Fund is now paying less per unit of growth in terms of price/earnings-to-growth ratio (PEG) versus the Russell 1000 Growth, S&P 500, and Russell 1000 Value Indices.

As economic growth decelerates, markets are widely anticipating that calendar year 2023 S&P 500 earnings per share (EPS) growth will decline to below trend levels. We believe periods of scarce S&P earnings growth may have historically favored WINN’s investment style, as well as growth equities.

Taking an Active Approach

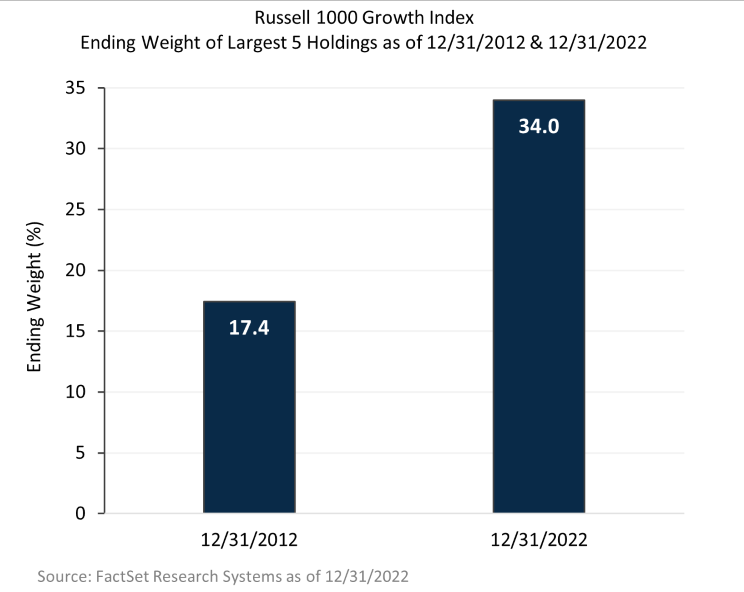

The Russell 1000 Growth Index concentration has expanded meaningfully over the last decade. The benchmark’s largest five holdings now command a collective weighting of 34.0%. This has almost doubled from 10 years prior as companies such as Apple and Microsoft have exhibited significant outperformance over this period.

Given the increased concentration risk of passive solutions coupled with a backdrop of elevated volatility, bottom-up fundamental research and active security selection appear increasingly important. WINN enables investor access to Jennison’s seasoned Large Cap Growth team and their time-tested philosophy and approach all within a fully transparent ETF offering enhanced liquidity and tax-efficiency.

Portfolio Implementation

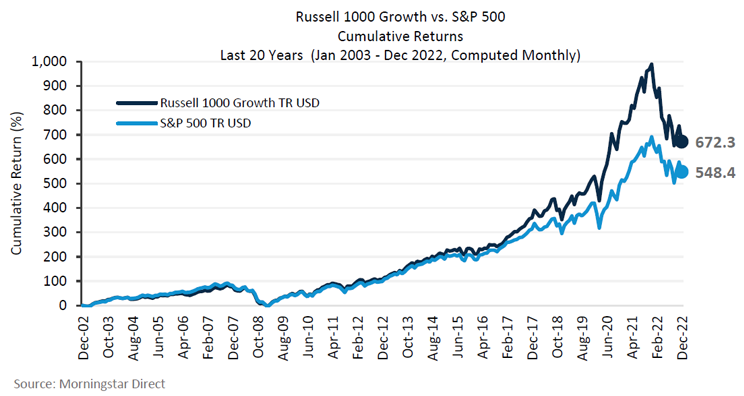

We believe the Harbor Long-Term Growers ETF (WINN) has the potential to serve as a strong anchor position in portfolios as markets have generally rewarded companies driving superior levels of growth over longer time horizons. As seen below, the Russell 1000 Growth Index has cumulatively outperformed broader market equities (S&P 500 Index) by nearly 124% over the past twenty years.

Explore WINN

Harbor Long-Term Growers ETF

(866) 313-5549 (Institutional Service Desk) | HarborCapital.com | info@HarborCapital.com | Find your Sales Rep

Important Information

Alpha is a measure of risk (beta)-adjusted return.

Price/Earnings to Growth Ratio (PEG) is derived by dividing Price/Earnings by Estimated 3 to 5 Year EPS Growth as of 12/31/2022.

Earnings per share (EPS) is the portion of a company's profit allocated to each outstanding share. EPS growth illustrates the growth of earnings per share over time.

The Russell 1000® Value Index is an unmanaged index generally representative of the U.S. market for larger capitalization value stocks. This unmanaged index does not reflect fees and expenses and is not available for direct investment. The Russell 1000® Value Index and Russell® are trademarks of Frank Russell Company.

The Russell 1000® Growth Index is an unmanaged index generally representative of the U.S. market for larger capitalization growth stocks. This unmanaged index does not reflect fees and expenses and is not available for direct investment. The Russell 1000® Growth Index and Russell® are trademarks of Frank Russell Company.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

All investments involve risk including the possible loss of principal. There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response adverse issuer, political, regulatory, market and economic conditions. At times, a growth investing style may be out of favor with investors which could cause growth securities to underperform value or other equity securities. Since the Fund may hold foreign securities, it may be subject to greater risks than funds invested only in the U.S. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

Diversification does not assure a profit or protect against loss in a declining market.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETFs are new and have limited operating history to judge.

ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals. They may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to purchase or sell a particular security.

Jennison Associates is a third-party subadvisor to the Harbor Long-Term Growers ETF.

Foreside Fund Services, LLC is the Distributor of the Harbor Long-Term Growers ETF.

3105621