September CPI: Home Is Where the Inflation Is

October 19, 2022

Executive Summary:

- Once again, U.S. Consumer Price Index (CPI) data surprised to the upside as inflation in the services sector made new cyclical highs leaving the Federal Reserve (Fed) with no choice but to carry on with substantial further rate increases.

- We are running out of reasons to be optimistic about a soft landing given the muted effects of the Fed’s interest rate hikes on inflation. As the September Federal Open Market Committee (FOMC) meeting minutes said, the cost of doing too little to bring down inflation outweighs the cost of doing too much.

- We expect the Fed to deliver a fourth consecutive 75 basis points hike at their November meeting and, at least, another 50 basis points in December.

- On the precipice of Q3 earnings, we expect an earnings downgrade cycle to unfold, which, coupled with robust inflation, makes for a poor landscape for risk assets.

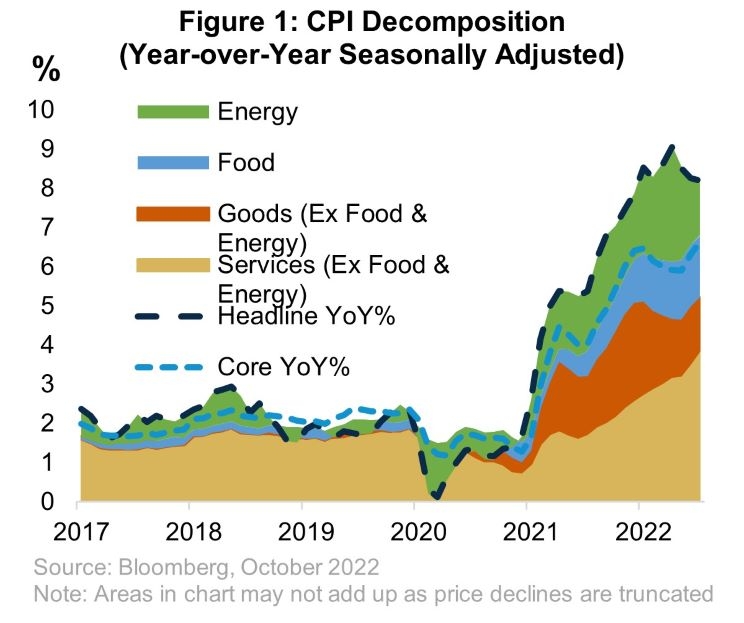

Persistently Disappointing

September headline and core inflation printed 0.1 percentage points above consensus estimates at 8.2 and 6.6 percent year-over-year, respectively. Among the various sectors we have been monitoring for signs of waning inflation, there were positive signs in energy and goods prices; however, the upside surprise in services outweighed them. Energy prices declined for the third consecutive month amid falling commodity prices and narrower refining margins. However, early indicators point to rising energy prices for next month’s CPI print, an unwelcome development for the FOMC. Goods inflation, which was the largest contributor to core inflation for much of 2021 and early 2022, decelerated with used car prices declining notably. Material deflation in goods prices is necessary for the Fed to get anywhere close to their 2 percent target by year-end 2023 given the underlying trend in services.

Whatever optimism you might take from energy and goods prices, the strength in services inflation is distressing. Leaving aside shelter, there was a broad-based acceleration in other sectors in a clear sign that the strength of the labor market and wages is supporting robust underlying inflation. The only cure is more labor market slack, meaning higher unemployment, lower wage growth, and less aggregate demand. Compounding the bad news, shelter costs continued to increase above 8 percent on an annualized basis with the two most important subcategories: owner’s equivalent rent and primary rent accelerating month-over-month. While robust shelter inflation was expected given how the construction of CPI incorporates realized housing costs on a lagged basis, further acceleration was not anticipated. So, by construction, each additional month of unexpected strength lengthens the period over which shelter will continue to run well above target.

Given its importance, it’s worth explaining what we do and do not know about shelter inflation. We know how it’s constructed. In short, shelter inflation accounts for the share of owner occupied and rented housing units across the U.S. changes in prices are observed for the latter, which are then used to calculate the change in costs for the former. As rental prices are sticky month-to-month given standard lease periods of 1 year, the month-to-month change in shelter is based on a rotating sample of rental units. In practice, what this means is that the responsiveness of shelter inflation to market rents and, indirectly, housing prices is variable based on rental turnover. The post-pandemic period shows just how difficult it is to estimate the lagged effect of rising rents on shelter inflation and will likely remain a major source of uncertainty. What we are confident in is that shelter inflation will eventually fall as market rents have slowed in 2022 relative to 2021, but not in a timely manner.

Nowhere to Go But Up

If there is a bright spot to the September CPI print, there is less suspense surrounding the November FOMC meeting. We believe the Committee will hike another 75 basis points and signal that the floor for the December meeting is 50 basis points, with a lean towards a further 75 basis points. More importantly, we expect Chair Powell to reinforce the Committee’s intention to hold rates at a high level in 2023, something we have heard consistently from policymakers lately. At the same time, we are becoming more confident that growth is slowing while the Committee, by virtue of their distance from the inflation target, is no longer relying on forecasts. Unfortunately, this sets us up for another bad policy outcome. First came high inflation, next we expect a recession.

If High Interest Rates Weren’t Enough, Now Comes Earnings

The September CPI print gives us no reason to change our underweight to risk assets. However, the third-quarter earnings season, which kicks off this week, will be critical to our assessment of how much of a slowdown is discounted in markets. We expect a deepening earnings downgrade cycle as we progress over the coming quarters. Earnings expectations have already come down meaningfully, with the third quarter estimate dropping 7% from the end of the second quarter. If the projections play out as expected, it will be the first sequential earnings decline since the pandemic began. However, the earnings bar may be set low enough that we could see earnings upside this quarter. An earnings surprise, equivalent to last quarter, would imply flat earnings quarter on quarter. As companies begin to report, we are most interested in hearing how companies are managing P&L, and balancing pricing power vs. rising input costs, most notably labor.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2523809