June FOMC: Uninformative Priors

June 15, 2023

Executive Summary:

- The Federal Open Market Committee (FOMC) left interest rates on hold while retaining a bias for further rate hikes.

- While the forecasts implied two further rate increases this year, the message from the Chair is that the Committee’s forecasts have limited utility in the current environment.

- We still lean towards no additional rate increases this year, a view we think is closer to the Chair’s own view than two further hikes.

- We remain cautious as the market’s exuberance outpaces our confidence in the likelihood of a soft landing.

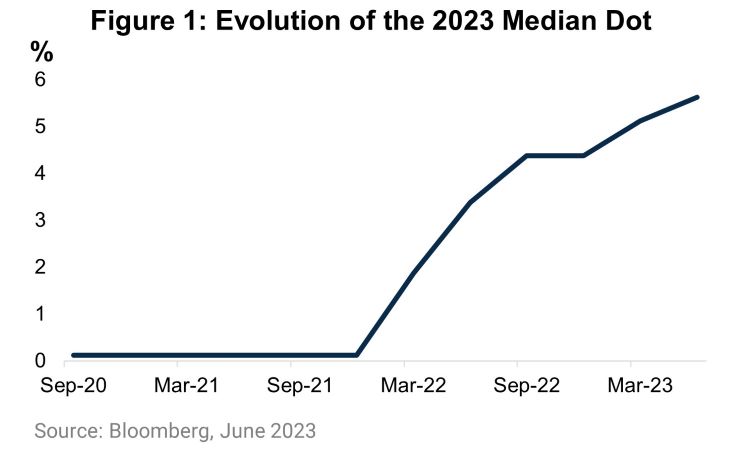

The FOMC decided to skip a rate hike at their June meeting, despite the accumulation of evidence since their last meeting and their own forecasts suggesting otherwise. There were slight changes to the statement. The most notable was a tweak to their forward guidance that changed from “in determining the extent to which additional policy firming may be appropriate” to “the extent of additional policy firming that may be appropriate,” which tilted it closer to their forecast changes. Those forecast changes in the Summary of Economic Projections (SEP) marked a significant shift from their March meeting. The median dot for 2023 implies two additional hikes from here, 25 basis points more than markets expected. Alongside the 2023 revision, the 2024 and 2025 median dots increased as well. The changes to the economic forecasts dovetailed with the higher rates path as the projections for unemployment declined, meanwhile those for both core inflation and growth increased. So, adding it all together, the economy is stronger, inflation is more persistent, and more hikes are necessary. The obvious question throughout the press conference then was why not hike in June.

Hear What We Are Saying, But Don’t Listen Too Closely

The repeated answer was that a skip made sense within the context of this hiking cycle where the rate of change has slowed as we get closer to the destination for interest rates. Ex-post, sure they can apply this logic for the skip, but we still believe that they, particularly Chair Powell, made this decision in May despite their professed data dependence. We titled this piece ‘Uninformative Priors’ because we think it summarizes Powell’s core message from the press conference and goes some way in explaining the dissonance between recent data and their decision not to hike. The common refrain from the Chair was to discount their forecasts, whether it’s for inflation or rate hikes by the end of 2023. The Committee is going to take it meeting by meeting rather than repeat the mistake they made ahead of this meeting in pre-signaling no rate change.

Besides further guidance to downplay the SEP, the speeches, and the minutes, we think the press conference revealed that Chair Powell is on the dovish end of the Committee. The goal for the Chair is to speak for the Committee rather than their own views during the press conference, but they are human. What tipped his hand for us was his response to a question on the conditions required for disinflation where, after listing them, he said “I would almost say that the conditions that we need to see in place to get inflation down are coming into place.” In the world of hedged central bank speak, we would call that optimism. The choice not to hike against the plurality of FOMC participants’ forecasts signaling two further hikes also demonstrates the Chair’s preference to be more cautious going forward relative to the rest of the Committee.

A July Hike is a Placeholder

We are taking the Chair Powell at his word and largely disregarding the forecasts. Our assumption is that the Committee’s default for the July meeting is to hike. However, we still lean towards a permanent pause. Inflation is trending lower with markets expecting headline inflation to fall to 3% year-over-year next month. We are seeing softening in the labor market at the margin, despite the overall picture showing excess demand for labor remains. Our optimism pales in comparison to the market, however, leaving us defensively positioned in our portfolios.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2957404