June CPI: Easy Come, Easy Go

July 13, 2023

Executive Summary:

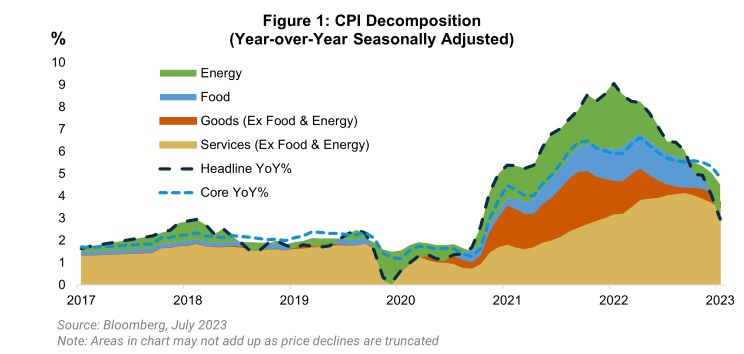

- U.S. Consumer Price Index (CPI) for June printed below expectations at 0.2% month-over-month (m-o-m) for both headline and core stoking expectations that the July rate increase will be the Federal Reserve’s (Fed) last. Headline inflation is now at 3% year-over-year well off its 9% peak.

- Pencil in a July hike. However, despite Fed guidance to the contrary, take the under on further increases.

- The resilience of the U.S. economy questions the assumption that interest rates are heading meaningfully lower after inflation returns to 2 percent.

- Despite the incremental positives, we do not think that it is time to declare victory on a soft landing.

The report marked continued progress on the three main areas of focus for markets. Goods prices flipped back to deflation m-o-m as used car prices declined after two consecutive months of surprising increases given wholesale car price data. Shelter costs continued to decelerate, falling 0.1 percentage points to 0.4 percent. Shelter, the largest contributor to the index, is now within the range that prevailed prior to the pandemic with a further slowdown expected as the official index catches up to private rent indices. Core services, excluding housing, the Fed’s preferred gauge of the cyclical forces acting on inflation was flat, an encouraging sign that cost-push inflation from wages is abating. While there were positives across the report, the size of the index miss was flattered by a large decline in airline fares, which is unlikely to persist.

Despite the incremental improvement in the inflation outlook, markets still assign a high probability of a July rate increase. Federal Open Market Committee (FOMC) participants have offered a consistent message since the June meeting that two additional interest rate increases are the most likely outcome for the rest of the year. The June CPI lowers the probability of that second hike, but the data up to and since the June meeting makes a July rate increase a near certainty. The market-implied odds for an additional rate increase following July are around 25% down from around 45% prior to the inflation data.

Looking beyond the next couple of FOMC meetings, steady disinflation and a resilient economy are increasing the odds that the U.S. avoids a recession. Alongside these lower odds, the probability of Fed cuts in 2024 and 2025 should decline as well. Those cuts are predicated on the idea that Fed policy is in restrictive territory, which will be unwound soon after inflation is sustainably lower. However, the normalization in inflation and the recent upturn in the housing market are calling into question the market’s assumption that medium-term interest rates are nearer to their ceiling than their floor. The past year’s focus on how many interest rate increases is beginning to shift to how much higher should the ten-year go if a 5 percent federal funds rate proves sustainable.

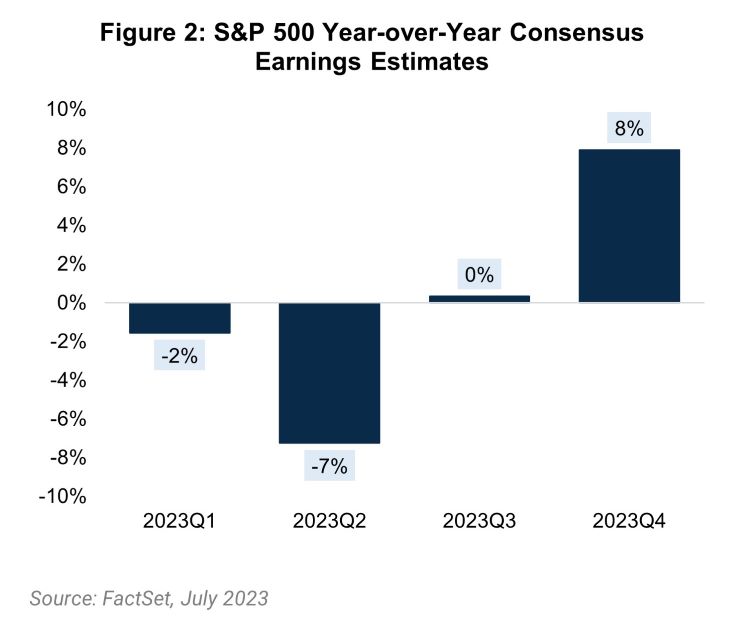

Lower Inflation Means Lower Operating Leverage

While lower inflation is a positive for the Fed’s goals, we are also learning how much companies benefited from high inflation and operating leverage. As U.S. earnings season looms with S&P 500 earnings estimates calling for a 7% decline year-over-year, how much of the sharp increase in inflation since the pandemic stems from idiosyncratic factors rather than excess aggregate demand remains to be seen. Companies clearly benefited as high nominal growth and inflation boosted revenues while wages declined in real terms supporting profit margins. Now as inflation declines and aggregate demand slows, both top-line and bottom-line growth are suffering. The question is whether companies will continue to retain workers as this real adjustment takes place as workers catch up in real terms through higher wages. Our best guess is that this real adjustment leads to a recession, whether it’s from workers’ wages outstripping their real losses or companies responding too forcefully to the slowdown, there are few historical examples where the U.S. economy underwent such large nominal adjustments successfully.

Cautiously Pessimistic

So far, the U.S. economy has weathered the storm. Interest rates are above 5 percent and job growth continues apace at 200 thousand jobs per month. Combine that with the enthusiasm around artificial intelligence, it is not that surprising that equity prices and sentiment are well off their lows from last year. However, we do not think a low personal savings rate, rising delinquencies, and student loan repayment restarting again in the fall point to sustainable consumption. Add to it another quarter of declining profits and we think the outlook remains just as uncertain as it has been for the past year. We remain cautious, underweight risk, and up in quality across equities and fixed income.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

3001183