July CPI: Progress Where Progress is Due

August 14, 2023

Executive Summary:

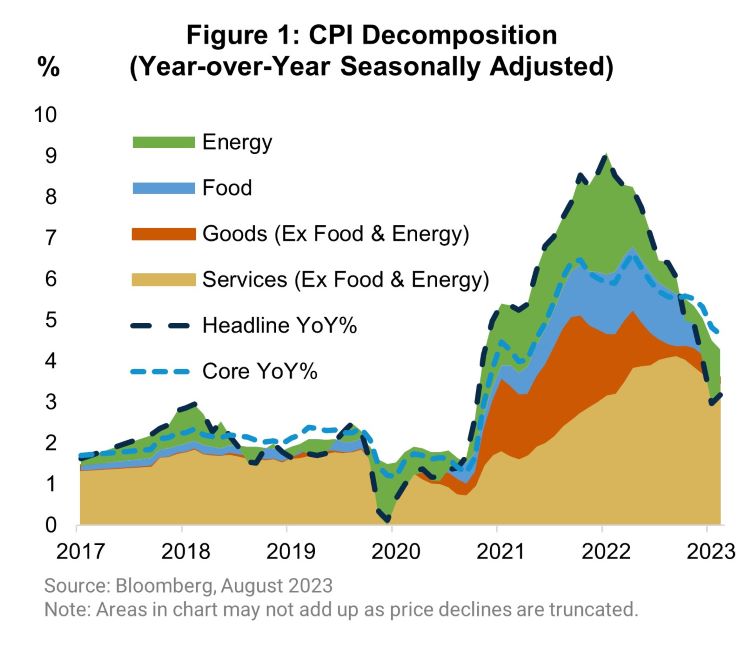

- As expected, the pace of annual headline and core inflation declined again in July leaving each rate at 3.2 and 4.7 percent, respectively.

- It was more of the same with core goods deflation paired with above target services inflation. The data is further confirmation that the days of 4 percent inflation are likely numbered; however, the question remains whether we are on track to return close enough to 2 percent for the Federal Reserve (Fed).

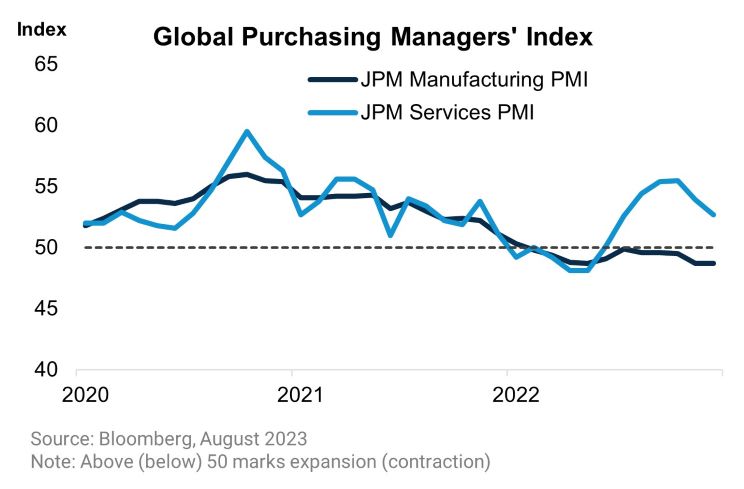

- The dichotomy in prices mirrors the continued weakness in the global manufacturing sector as the services sector supports the global expansion. The idea that the economy will be subject to rolling sectoral recessions rather than a simultaneous contraction is gaining traction as housing regains its footing after experiencing a mild recession as interest rates ratcheted up.

- This theory suggests that services is the next sector to falter, which, given its larger share of economic output, risks an increase in unemployment and falling into a full recession.

The Consumer Price Index (CPI) for July was printed in line with market expectations on a rounded basis with both headline and core inflation increasing 0.2 percent month-over-month. The minimal surprises in the data were the magnitudes of both core goods disinflation and services inflation. Shelter inflation increased marginally from the prior month, but we should not mistake this for a turn in trend as forward-looking indicators of shelter costs imply further deceleration. On the goods side, there were larger price declines than expected within several categories. Much like services, the trend for core goods prices is lower, although we have less visibility into the duration of the decline and weakness in the manufacturing sector could extend goods deflation for a while longer. The most we believe we can take away from the CPI data in isolation is that the disinflation that appears certain has the potential to continue. However, there is no definitive evidence that the necessary disinflation stemming from lower wages and slowing aggregate demand is occurring.

Rolling Recessions or Rolling Into a Recession

The weakness in goods prices, products like cars, furniture, and apparel stems from three factors. The first two factors, which are fading in importance, include the normalization of supply chains and the past strength of the dollar. However, the third factor, which is the combination of waning consumer demand for goods after demand exploded during the pandemic and the consequent impact on the goods sector, dominates. The global manufacturing sector, measured by PMIs (Purchasing Managers’ Index), has been running below potential since August of last year. Weakness in the manufacturing sector is not surprising as it was forced to contend with excess demand during the pandemic amid strained supply chains making an inventory overhang a likely consequence as the other side of the bullwhip effect surfaced. Furthermore, the capital intensity of this sector is often more susceptible to rising interest rates and tighter monetary policy than the more labor-intensive services sector.

The plight of the manufacturing sector resembles that of another large, interest rate sensitive sector in 2022, housing. Robust demand during and after the pandemic met with a dramatic increase in the cost of capital and subsequent slowdown. Therefore, the recovery in housing, largely confined to the primary market of homebuilding rather than the secondary market of existing homes, and continued resilience of global consumers could mean an imminent turnaround for the manufacturing sector. Pulling further on this idea, the much-feared recession may be evolving into a succession of recessions across different sectors of the economy.

Services, the next in line in this succession, can be the most perilous given it amounts to more than 60 percent of consumption and an even larger share of employment in the U.S. The services sector has slowed meaningfully from its post-pandemic highs but is still in expansionary territory. High household net worth is supporting both U.S. consumers’ willingness to save less than the pre-pandemic norm and the services sector at large. A lower savings rate should be sustainable as long as the labor market remains robust and consumers are willing to forgo higher interest rates. Some normalization in the savings rate is our expectation, which we think will be a result of the composition of income shifting back towards the higher end as the labor market weakens. Low consumer debt outstanding relative to incomes should enable lower income workers, who have benefitted from the tight labor market, to increase borrowing to offset any real income weakness associated with a looser labor market.

We believe this benign transition to a higher reliance on credit is possible and would likely achieve the necessary labor market adjustment without an economy-wide recession. However, it is a tightrope to walk. To be successful, it requires companies reducing hiring without laying off workers, workers lowering wage demands, and the Fed easing rates proactively before an increase in unemployment gains momentum. We remain skeptical that this is the most likely scenario but recognize that rolling recessions would be just another remarkable part of the post-pandemic story.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

The J.P. Morgan Global Manufacturing PMI™ is a composite index produced by J.P. Morgan and S&P Global in association with ISM and IFPSM.

The JP Morgan Global Services PMI™ is based on data compiled from questionnaires sent to purchasing executives in around 350 private service sector companies. The index tracks variables such as sales, employment, inventories, and prices.

Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

3061429