January FOMC: How Much Data is Enough Data?

February 05, 2024

Executive Summary:

- The Federal Open Market Committee (FOMC) maintained its policy stance and leaned against the likelihood of a March rate cut.

- Unfortunately, the standard for when to cut rates is ‘more data,’ as 8 months of solid inflation data up to the March meeting is not sufficient based on Chair Powell’s guidance.

- However, the difference between a cut in March, May, or June will not determine the course of the economy. Instead, focus on the durability of the labor market, whether productivity is accelerating, and the business cycle outside of the U.S.

- Overall, the meeting and press conference were unsatisfying as they provided few answers, but it makes sense given the strength of the economy. Signaling a policy change requires a confident forecast, which the Fed lacks. We know what the optimistic and the pessimistic cases are, but we agree that it does not make sense to lean too heavily on either.

The FOMC maintained its policy rate and introduced a rate cutting bias to the statement. The change noted that “the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.” In choosing that phrasing, the Committee intended to push back against the likelihood of a cut at the March meeting. Chair Powell then spent the press conference outlining that intention, subject to the data.

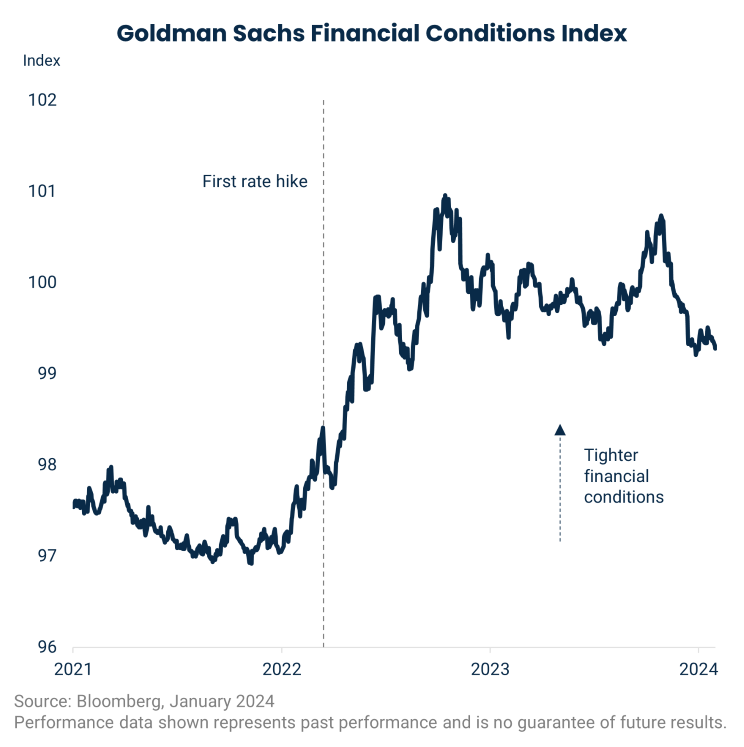

The precondition for cuts is enough data like the last 6 months of data on inflation, growth, and the labor market. Inflation data remains the emphasis where 6-month annualized core Personal Consumption Expenditures (PCE) is 1.9 percent. The Committee is not looking for better data than that, just a longer sample size. When asked explicitly if 8 months of data would prove enough, extrapolating to the March meeting, Chair Powell said no. Taking that at face value, enough data is somewhere between 8 and 12 months, after which the expectation is that core PCE will be close to 2 percent. The inference is that the Committee is reticent to pre-commit to easing in March as financial conditions have eased. Without an urgent need for change, why reduce policy flexibility? However, do not assume that a March cut is off the table, the odds are just lower now than before.

The Committee is less concerned about the difference between a March, a May, or a June cut for the economy than it is about the sustainability of a rate cut cycle. Once the direction of policy changes, the Committee expects it to continue in that direction. Whether they place the correct emphasis on it or not from the market’s perspective, inertia is a key aspect of how the Fed sets policy as they believe that it is the best approach given the inherent uncertainty of the economy. The March guidance tells us that the risks to inflation are becoming more balanced, but still skew higher for now.

The other consideration for the Committee is the sequencing of easing policy. The tapering of Quantitative Tightening (QT) is likely to start in the first half of the year and Chair Powell noted that a discussion will take place in March, which will then feature in the minutes. Using the December Summary of Economic Projections (SEP) to assume a baseline of three cuts this year combined with QT, what is a plausible path? Like most of us, the Committee likes the idea of a neat meeting by meeting by plan. Our guess is that the Committee will announce how they plan to taper QT, not the start date, following the March meeting alongside an updated SEP. At this point, we think that the March SEP will still contain 3 cuts leaving us with either a May or June start. Given the choice between a meeting with a SEP (June) vs. one without, their bias is to make policy changes at SEP meetings. This does not preclude a May start; it just leans us toward June. From there, we get a clear quarterly cadence of cuts to year end, which also conveniently leaves out a policy change immediately following the election.

A nice plan, but it depends on the data. Beyond the benign inflation data since the December meeting, labor and wage data also supported the direction of policy. The bear case argues that the breadth of labor market gains is narrowing to just the government, healthcare, and hospitality sectors and it’s easy to list all the geopolitical risks that could produce a shock. The bullish case points to company earnings improving from last year’s trough just as the impulse from the Fed’s hiking cycle is fading. We think sentiment leans towards the latter, but not so much so to create an opportunity over the short-term leaving our risk posture in a neutral setting.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

The Goldman Sachs Financial Conditions Index is a weighted average of short-term interest rates, long-term interest rates, the trade-weighted dollar, an index of credit spreads, and the ratio of equity prices to the 10-year average of earnings per share.

Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

3372850