January CPI: Finding the Right Amount of Patience

February 15, 2024

Executive Summary:

- Disinflation stalled as the January Consumer Price Index (CPI) data surprisingly accelerated month-over-month. It was even worse beneath the headline numbers as shelter and core services prices increased at the fastest pace in a year.

- The data supports the concern expressed by most Federal Reserve (Fed) officials since their meeting two weeks ago. Progress on disinflation is not broadening out to the services sector yet.

- Elevated services inflation adds some weight to concerns that volatile wage data of late is more signal than noise that the labor market remains too tight.

- Chair Powell’s forceful dismissal of a March rate cut proved prescient as employment and inflation data for January surprised to the upside. The first cut is now priced in June, which we agree with. The market is doing the Fed’s job for them and tightening financial conditions, so we do not expect a material change in tone from the Committee.

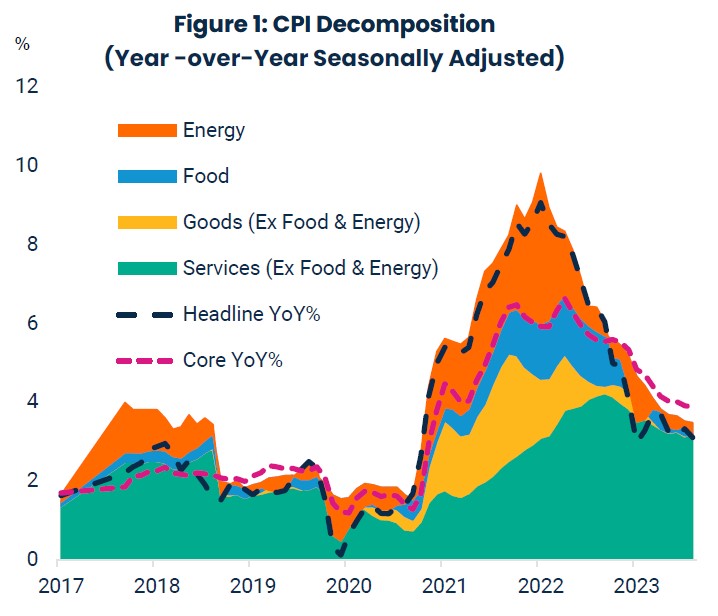

Source: Bloomberg, February 2024. Note: Areas in chart may not add up as price declines are truncated.

Headline and core CPI for January increased by 0.3 and 0.4 percent bringing their yearly rates to 3.1 and 3.9 percent, respectively. Both headline and core inflation handily beat consensus forecasts. Starting with the positive, core goods prices fell 0.3 percent month-over-month, a steady source of disinflation since the middle of 2023. The list of positives ends there given the substantial breadth of upside surprises at the sector level. Food away from home, an infrequent topic that may now be more relevant, increased 0.5 percent month-over-month. So why is it more relevant? Given that it captures restaurant prices, it is a useful proxy for discretionary demand for services and labor accounts for much of the variability in prices. The sequential pace fell over the second half of 2023, but now we are back to spring levels.

Services inflation tells a similar story this month. Core services, excluding housing, increased 0.85 percent, the fastest pace since April 2022. The acceleration was broad-based fueling concerns that the level of wage inflation may be producing second round effects for inflation rather than reflecting catch up or non-inflationary reasons like reallocation. Airfares and hotel inflation point to the same discretionary tailwinds supporting food away from home. Finally, shelter added to the concerning trends in labor-intensive sectors as it accelerated to 0.6 percent. Everybody “knows” shelter inflation will decelerate, but it would be helpful if that starts soon.

As to the concerns about second round effects, all the primary measures we look at for wages remain above 4 percent and the rate of deceleration has slowed. There is no precise estimate of wage inflation that equates to 2 percent inflation over time as productivity and the composition of the labor market shift. However, 4 percent is likely near the top of the range and may be inconsistent with meeting the inflation target. Considering the data, the Fed’s caution at the January meeting was correct. Policymakers have harped on the need for disinflation to broaden, i.e., services inflation needs to decline, before cutting interest rates. The employment and CPI reports for January were two steps backwards on that front.

However, the gap between the Fed’s view on the appropriate path of policy and the market’s is narrowing as a result. The first full cut is now priced in June up from a full rate cut by March as of the start of the year. Stronger growth and lower recession risk account for some of the change, but we attribute most of it to the market moving towards the Fed’s view on policy. We are moving along the risk spectrum away from policy easing too quickly towards overtightening. With 3 cuts still priced it is not yet time to lean against Fed hawkishness. Although that opportunity could present itself soon if markets extrapolate too much from January. We remain in a late-cycle environment for now, waiting to see whether inflation concerns persist.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

This material contains forward-looking information that is not purely historical in nature. Such information may include projections and forecasts and there is no guarantee that forward-looking information will come to pass.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Copyright ©2024 Harbor Capital Advisors, Inc. All rights reserved.

3395800