Gazing Into the Mirrors of Time

Harbor Capital Appreciation Fund

June 23, 2023A sharp rotation occurred in the first half of 2022 as investor worries pertaining to more persistent elevated inflation, aggressive Federal Reserve policy and a backdrop of higher interest rates generally prompted investor migration away from durable growth companies towards names with greater visibility of near-term profitability. During this period, the Harbor Capital Appreciation Fund’s disciplined focus on companies with multi-year structural growth opportunities faced meaningful headwinds on an absolute and benchmark-relative basis.

Within this more challenging environment, concerns surrounding the future performance potential for companies with long-term growth opportunities increased causing many investors to question their growth equity allocations. Consistent with its history, the Fund’s investment team at Jennison Associates maintained conviction in their time-tested approach and emphasis on companies with sustainable competitive advantages and long-term earnings expansion potential.

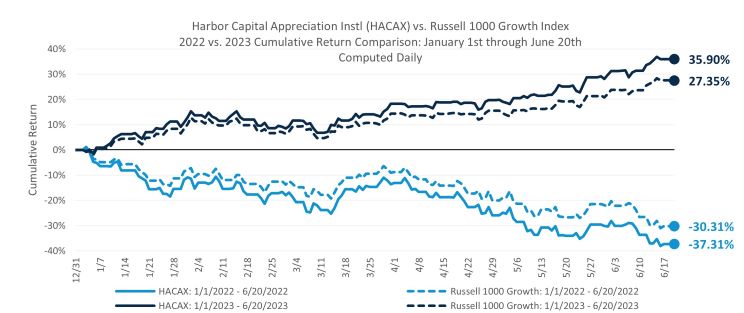

Patient Harbor Capital Appreciation Fund investors have been rewarded thus far in 2023 given the tailwinds of moderating inflation, a general level setting of interest rate expectations, and the Fund’s ability to source durable growth amidst a general scarcity of earnings expansion across the broader market. Per the chart below, Harbor Capital Appreciation’s year-to-date cumulative return and excess return (versus the Russell 1000 Growth Index) through June 20th have proven almost mirror opposite relative to 2022 results through the same day last year.

Source: Morningstar Direct, June 2023

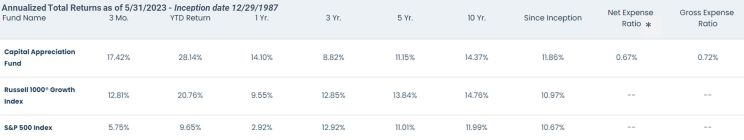

Source: Morningstar Direct, June 2023Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborfunds.com or by calling 800-422-1050. For Funds most current performance [Harbor Capital | Mutual Fund | Harbor Capital Appreciation Fund | HACAX]

*The net expense ratios for this Fund are subject to a contractual management fee waiver and/or expense limitation agreement, excluding interest expense (if any), through 02/29/2024.

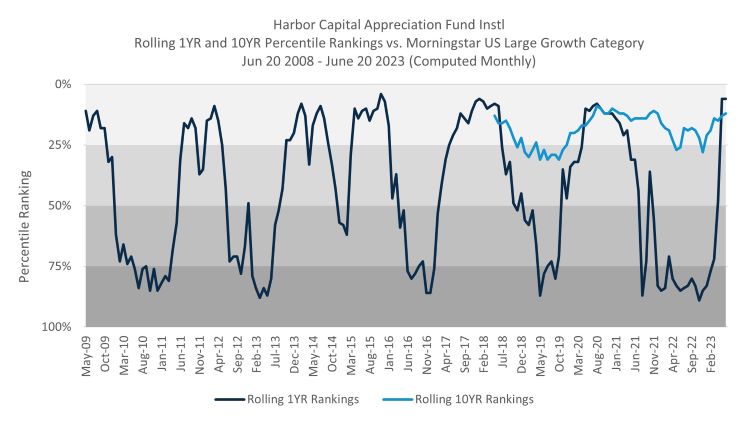

*The net expense ratios for this Fund are subject to a contractual management fee waiver and/or expense limitation agreement, excluding interest expense (if any), through 02/29/2024.The Fund’s investment team does not attempt to time markets based on short-term shifts and believes that strong growth of earnings should ultimately drive performance over long-term horizons. This longterm approach has resulted in general fluctuation of the Fund’s rolling 1-year peer rankings between Morningstar’s Large Growth category’s top and bottom quartiles as its investment style has come in and out of favor with prevailing market conditions (please refer to the chart below).

Source: Morningstar Direct, June 2023. Past rankings are no guarantee of future rankings.

Source: Morningstar Direct, June 2023. Past rankings are no guarantee of future rankings.Importantly, given Jennison’s proficiency in identifying companies with potential long-term growth, the Fund’s rolling 10YR rankings have consistently placed within the top third of its large growth peer group over the period.

Overall, we believe that investors consider the mirrors of time looking ahead. History has shown that looking through shorter-term periods marked by uncertainty has led to longer-term more favorable results for the Harbor Capital Appreciation Fund.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborfunds.com or call 800-422-1050. Read it carefully before investing.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. At times, a growth investing style may be out of favor with investors which could cause growth securities to underperform value or other equity securities. Since the Fund may hold foreign securities, it may be subject to greater risks than funds invested only in the U.S. These risks are more severe for securities of issuers in emerging market regions.

© 2023 Morningstar, Inc. All rights reserved. The information contained herein:(1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Past rankings are no guarantee of future rankings. Morningstar Ranking for the fund’s respective category monthly as of 03/31/2023 for the Institutional Class Shares; other classes may have different performance characteristics. The Morningstar Rankings are based on total returns, with distributions reinvested and operating expenses deducted. Morningstar does not take into account sales charges. Harbor Capital Appreciation Institutional was ranked against Morningstar’s US Large Growth category, quarterly, over the following time periods: 894 out of 1,250 investments in the category for the 1-year period, 650 out of 1,139 investments in the category for the 3-year period, 453 out of 1,053 investments in the category for the 5-year period, 97 out of 809 investments in the category for the 10-year period as of 03/31/2023.

The Russell 1000® Growth Index is an unmanaged index generally representative of the U.S. market for larger capitalization growth stocks. The Standard & Poor's 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. These unmanaged indices do not reflect fees and expenses and are not available for direct investment. The Russell 1000® Growth Index and Russell® are trademarks of Frank Russell Company.

Jennison Associates LLC is a third-party subadvisor to the Harbor Capital Appreciation Fund

Distributed by Harbor Funds Distributors, Inc.

2969580