Finding Diversification with All Else Equal

January 31, 2024

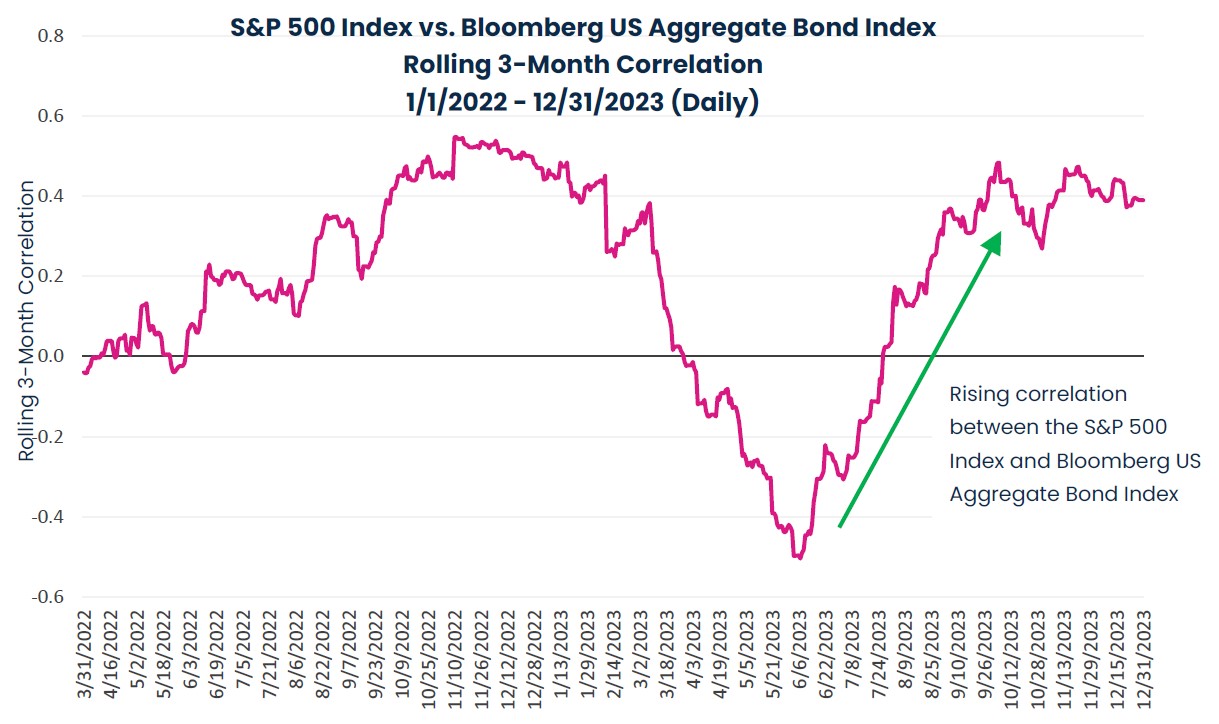

As we enter 2024, we believe the need for portfolio diversification remains elevated alongside heightened stock and bond correlations.

Source: Morningstar Direct, December 2023.

Equity and fixed income correlations trended higher throughout 2022 alongside historic inflationary pressures and rapid Fed tightening. Reprieve appeared to set in as correlations then quickly descended into negative territory in the first half of 2023 amidst a backdrop of U.S. Consumer Price Index (CPI) moderation and heightened interest rate volatility. However, equity and fixed income correlations have returned to the elevated levels experienced in 2022 over more recent periods. Within this backdrop, alternative asset classes such as commodities appear well positioned, in our view, likely enabling enhanced diversification benefits when investors potentially need them the most.

A Potential Solution

We think the Harbor Commodity All-Weather Strategy ETF (HGER) represents a compelling long-term opportunity that may help to reduce the aggregate volatility of 60/40 portfolios and add a potential source of differentiated returns looking ahead. HGER dynamically allocates to commodities with considerations pertaining to relative inflation sensitivities, roll yield dynamics, as well as different market and inflationary regimes. HGER rethinks commodities investing in an ETF wrapper, providing a strategic cornerstone and cost-effective alternative for the everyday portfolio. To learn more, please visit our website.

Important Information

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

Commodity Risk: The Fund has exposure to commodities through its and/or the Subsidiary’s investments in commodity-linked derivative instruments. Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Commodity-Linked Derivatives Risk: The Fund’s investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities.

Diversification does not assure a profit or protect against loss in a declining market.

Correlation is a statistic that measures the degree to which two variables move in relation to each other. A 60/40 portfolio is generally one that has a 60% allocation to stocks and a 40% allocation to bonds. Roll yield is the return from adjusting a futures position from one futures contract to a longer-dated contract.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. The Bloomberg Aggregate Bond Index broadly tracks the performance of the U.S. investment-grade bond market. Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

Quantix Commodities LP (“Quantix”) is a third-party subadvisor to the Harbor Commodity All-Weather Strategy ETF (HGER).

3354452