February FOMC: Letting Optimism In

February 03, 2023Executive Summary:

- Financial markets responded positively to the Federal Open Market Committee’s (FOMC) decision to slow the pace of hikes to 25 basis points as Chair Powell struck an optimistic tone to start the year.

- Chair Powell acknowledged the tentative signs of disinflation as prices and wages have slowed in recent months while passing up several opportunities to push back against the easing in financial conditions to start the year.

- Neither the market nor the Committee has much confidence in the path forward, so the Committee is eschewing guidance until the data proves more definitive. We expect this uncertainty to keep a high floor under volatility as the data will be crucial in determining the FOMC’s next steps.

- The odds of a soft landing have increased in January, and market prices have responded in kind. That leaves us in a defensive position as we expect the costs of the hiking cycle to eventually surface in companies’ profits and the labor market.

New Year, New Hope

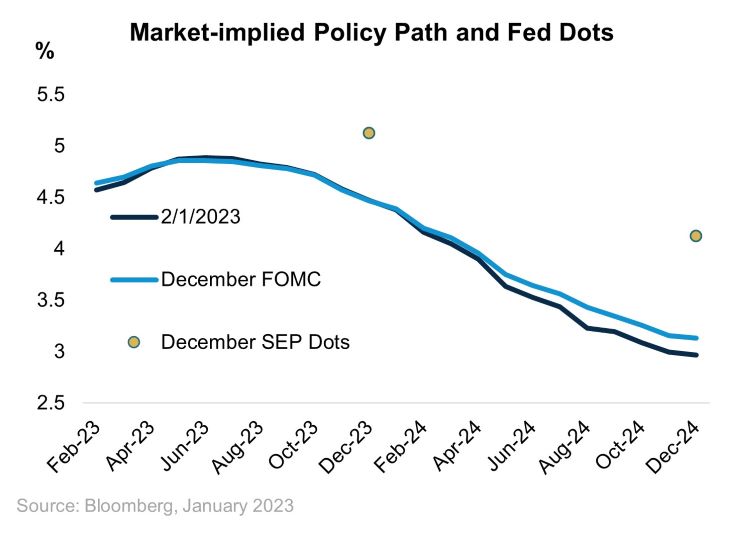

The FOMC increased interest rates by 25 basis points at their February meeting with the end of the tightening cycle fast approaching. The Committee made few changes to their policy statement, notably keeping in language that “ongoing increases” in the target range will be appropriate. During the press conference, Powell stuck to the interest rate path spelled out at their December meeting noting that he expects “a couple more rate hikes” in line with the 2 further rate increases and long pause outlined in the last Summary of Economic Projections. However, his optimistic tone and allowance that the world is highly uncertain amount to Powell ceding that the Committee is open to one further rate increase after which cuts in 2023 become a real possibility.

Beyond loosening their grip on the path of interest rates in 2023, Powell offered limited pushback to the easing in financial conditions and acknowledged that the markets’ perceptions of faster disinflation may prove correct. The implication is that each incremental data point on inflation, the labor market, and wages has the potential to shift the needle. If wages continue to decelerate and pass-through to core services prices, the Committee’s path will move towards the market. If the data reverses or deceleration slows, the Committee will move closer to the prescribed path in the December FOMC. They do not know. The Committee is still embracing “humble and nimble” stance that led them to rapidly shift course at the start of 2022 as inflation proved persistent. Only now, the optionality runs in both directions.

A lingering question from the press conference and the FOMC’s communications is whether they have already tightened policy too much and why they insist on going farther despite their acknowledgement of the positive developments. The answer goes to the core of how the FOMC thinks about policy and their risk management posture. The Committee views the positive signs seen in the data as an outgrowth of the tightening in financial conditions and further progress is predicated on them delivering that path. Furthermore, the risks of doing too little still outweigh the costs of doing too much given elevated inflation, but the gap is narrowing.

So far, disinflation is occurring without increased labor market slack. A positive spin is that a return to 2 percent inflation is possible without the Committee’s forecasted 1 percentage point increase in unemployment. As to how this is happening, potential explanations could be that higher inflation makes it easier for real labor costs to adjust in response to shifts in demand or that the difficulty finding workers following the pandemic has made companies less willing to reduce their workforces. A negative spin is that the inflation and wage growth we observed coming out of the pandemic were, dare I say, more transitory than demand-driven and the observed disinflation is more mean reversion than a response to the Federal Reserve (Fed) policy. If this mean reversion accounts for a larger share of falling inflation, our worry is that the slowdown in growth has much further to go as the lagged effects of policy come to pass.

Safety on Sale

The increase in risk assets and easing in financial conditions year-to-date has not been kind to our portfolios. Despite the incremental positives, we are sticking to our defensive positioning and quality orientation. We agree that the floor for asset prices is higher today than year-end, but the gap between current prices and the floor, if anything, is wider now. We expect the slowdown in growth to magnify before the FOMC has sufficient evidence to shift towards easing. As a result, we remain underweight risk assets relative to fixed income. Our equity risk is biased towards profitable firms and our fixed income positioning is concentrated in investment grade spread products and Treasury securities.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2736889