February CPI: Not Bad, Not Good

March 18, 2024

Executive Summary:

- February Consumer Price Index (CPI) printed close to expectations alleviating fears for worse if we take the bounce in the equity market at face value.

- Concerns were well-founded after services inflation unexpectedly accelerated in January.

- The upside surprise to shelter in January was perplexing, particularly after the Bureau of Labor Statistics (BLS), the agency responsible for the data, miscommunicated about the source of the surprise. February data suggests that January was an aberration and shelter cost disinflation should continue.

- Services, excluding shelter, increased at an alarming pace in January before decelerating in February as well. Despite the slowing, the pace of core services inflation remains too high.

- We expect the Federal Open Market Committee (FOMC) dot plot to show one fewer rate cut in 2024 than the December meeting because of the upside surprises to growth and inflation to start the year.

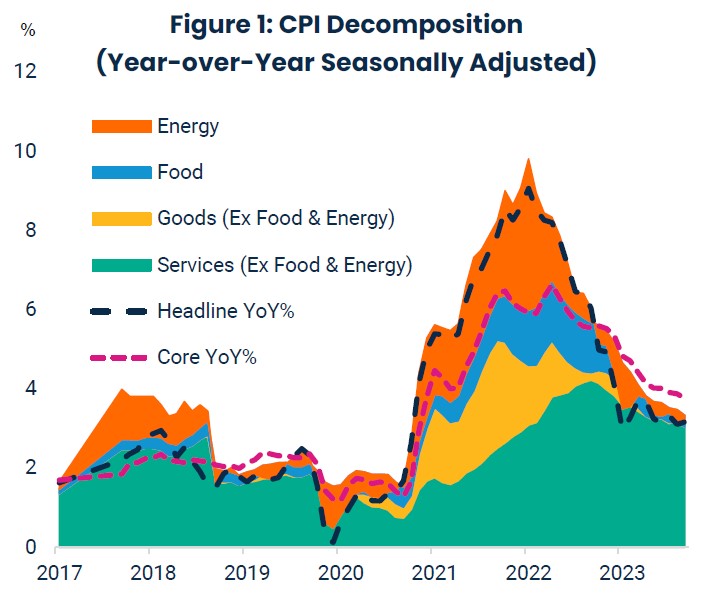

Headline and core inflation for February printed at 3.2 and 3.8 percent, respectively, 0.1 percentage points above consensus estimates. Energy added to inflation for the first time since September as wholesale energy prices recovered, while food prices stagnated. Moving through core inflation, goods prices increased by 0.1 percent month-over-month (m-o-m) as apparel, used cars, and staple goods increased. Goods prices have stagnated for 18 months as supply chain improvements met falling demand for goods. Both factors are fading, but we think goods prices will continue to be a negligible contributor to inflation unless trade frictions increase, a risk given trade’s prominence in the election debate.

Ahead of the print, focus on the services sector was even more pronounced after CPI for January saw worrying developments in both shelter costs and core services. Starting with shelter, owners’ equivalent rent (OER) i.e., the cost of owning a home, diverged materially from rent of primary residence. This was strange as the two series are derived from the same source data with differences accounted for by weighting across housing types. The BLS stoked further confusion with an email suggesting that weights were the primary reason for the divergence before retracting the email. With OER having the single-largest weight in the index, uncertainty was elevated. However, the gap between the two narrowed in February with OER and tenant’s rent coming in near 0.4 percent m-o-m.

The uncertainty for shelter was as much a story about data construction as it was the underlying trend, whereas core services inflation uncertainty centered on whether the underlying trend is settling at a level inconsistent with 2 percent inflation. Core services halved from 0.85 percent in January to 0.47 percent in February. With hindsight, the elevated January print likely reflected seasonal effects in the services sector given wages reset in many industries at the turn of the year and the several of these sectors are not seasonally adjusted within CPI. However, the underlying trend remains elevated as February demonstrated. Looking at the Atlanta Federal Reserve’s (Fed) sticky core CPI measure excluding shelter, the 3-month annualized rate increased to 4.6 percent.

Source: Bloomberg, March 2024

Note: Areas in chart may not add up as price declines are truncated.

At their meeting next week, the FOMC will likely judge that there has been little progress on inflation in 2024. Alongside growth surprising to the upside year to date, we expect positive revisions to the Committee’s forecast for growth and inflation. The shift in market pricing from 6 cuts at the start of the year to 3 cuts reflects these revisions as well. If we look at market pricing for 3 cuts and assume the distribution around that includes some weight on a recession, we think the most likely path for Fed cuts in the market is 1 or 2 cuts at this point. We expect the Fed’s median 2024 dot to show one fewer cut at 2 cuts as well with the risk to a larger shift up in the Fed’s median rate path. Moreover, the Committee will provide more information on the plan for tapering quantitative tightening whether it comes in the form of a statement of their plan or Chair Powell’s press conference. Going into the meeting the balance of risks are skewed to the hawkish side given the inflation data coming against a backdrop of easing financial conditions.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

This material contains forward-looking information that is not purely historical in nature. Such information may include projections and forecasts and there is no guarantee that forward-looking information will come to pass.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Copyright ©2024 Harbor Capital Advisors, Inc. All rights reserved.

3449464