February CPI: CPI Strength Not Enough to Distract from Bank Failures

March 16, 2023

Executive Summary:

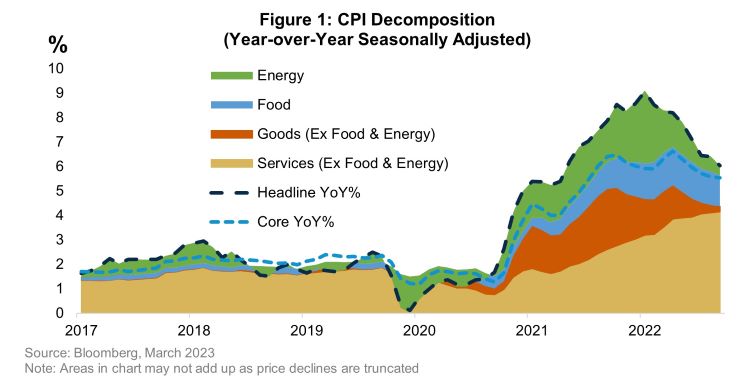

- Headline and core inflation for February printed at 6 and 5.5 percent, respectively, on a year-over-year basis with the core figure surpassing expectations somewhat on a month-over-month basis.

- Despite the modest upside surprise to core inflation, markets remained focused on the fallout of the three bank failures over the last week.

- No news is good news on that front for now with equity indices climbing sharply, Treasury yields reversing some of their declines, and bank stocks recovering.

- Inflation is set to fall meaningfully on a year-over-year basis next month as the initial effects of Russia’s invasion of Ukraine begin to fall out of the index.

- We expect the Federal Open Market Committee (FOMC) to hike 25 basis points next week absent further contagion in the banking system. Beyond that, our interest rate crystal ball is murky with little clarity around deposit flows in the banking system and how banks are likely to behave following the recent failures to inform our view on the path forward.

Shelter Strength Remains Sticky and Ongoing Labor Imbalance Supports Core Services

While the topline numbers were close to expectations, the acceleration in shelter inflation to 0.8 percent month-over-month was an unwelcome surprise. Markets and policymakers remain confident that shelter prices are set to decline in the months to come given trends in rental markets, but there is uncertainty about how soon and how fast the largest contributor to overall inflation will fall. A slower decline will support year-over-year figures and complicate the Federal Reserve’s (Fed) messaging around inflation as the optics of above-target inflation will contrast with their confidence that the underlying trend has slowed. Beyond the strength in shelter, airfare and hotel prices jumped, a read-through to the strength of the consumer and their willingness to spend on discretionary items.

The focus for the FOMC lately is on the services sector excluding as this carve out is viewed as better proxy for underlying wage dynamics. These sectors increased 0.5 percent month-over-month, corroborating the strength of the labor market seen in other recent data releases. In sum, the inflation data reflects incremental progress for the FOMC towards their inflation target, without room for increased optimism.

25 Basis Points in March and No One Knows What’s Next

A week ago, with this data in hand and Chair Powell’s Congressional remarks opening the door to 50 basis points, the market prices the FOMC to hike 50 basis points at their meeting next week. A lot has happened since then and there’s little transparency on the full extent of the damage done by the failures of Silvergate, Silicon Valley Bank, and Signature Bank. We think the FOMC hikes 25 basis points next week as 50 basis points seems like too large of a departure from market pricing given the vulnerabilities in bank balance sheets. Counterintuitively, If the Fed doesn’t hike, the market might react negatively as it could be a sign that the FOMC is more worried about fragilities in the banking sector than previously thought.

We do not know much about the official sector’s interventions to improve banks liquidity, but we should have some incremental information before next week’s meeting. The Federal Home Loan Banks (FHLBs), who provide financing to banks collateralized by real estate loans, raised a significant amount of debt on Monday indicating that banks are or are expected to make material use of this financing. We will be monitoring short-term interest rates for signs about whether this lending is going out to banks or is more precautionary liquidity for the FHLBs. Meanwhile, the creation of the BTFP requires that the Federal Reserve Board report on the program to Congress within 7 days and any take-up will be evident on the Fed’s weekly balance sheet report by Thursday. If take-up is material, the program should offset the effects of quantitative tightening in the short run. Otherwise, there continues to be uncertainty about whether the FDIC, Treasury, and Fed are willing to use the systemic risk exception if additional banks fail, a tail risk if certain banks continue to see large deposit outflows. All of this is to say that while the Fed has more clarity around bank specific risks than the market, neither appears to have any confidence around the appropriate interest rate path going forward.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2797709