February Consumer Price Index (CPI) Brings Clarity to March Federal Reserve Open Market Committee (FOMC)

March 15, 2022

Executive Summary

- February’s Consumer Price Index (CPI) print removes any urgency for the Federal Reserve Open Market Committee (FOMC) to hike 50 basis points at their March meeting.

- However, the data confirms that the Fed will embark on a series of rate hikes in 2022 to stave off the risk that higher inflation shortens the economic expansion.

- Beyond the unfolding humanitarian crisis, Russia’s invasion of Ukraine has sparked fears of commodity shortages leading to dramatic price increases. Making an already difficult outlook for the FOMC more complicated.

- We continue to expect financial conditions to tighten and view late cycle or defensive positions in equities as being compelling, while fixed income returns remain low.

Few Surprises in February CPI Lead to Our Belief of a 25 Basis Point Hike in Upcoming March FOMC Meeting

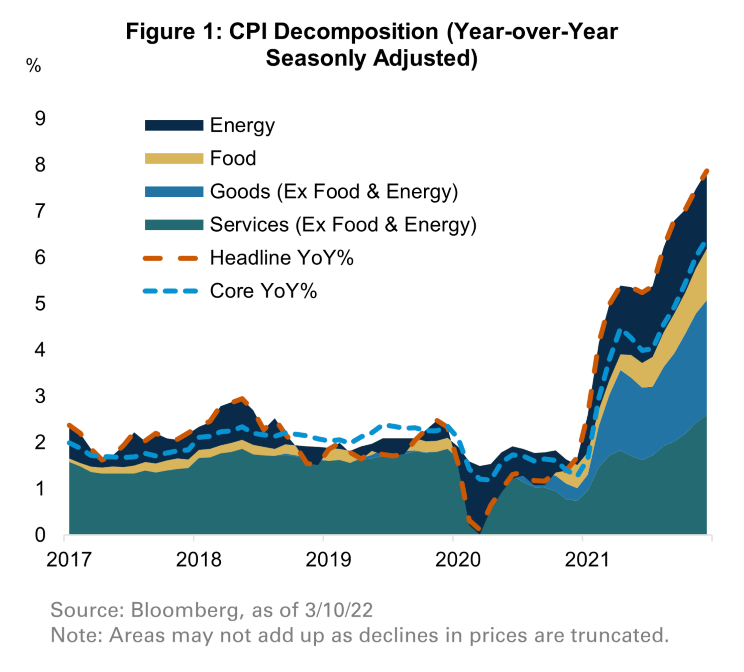

As expected, U.S. CPI continued to climb in February reaching 7.9%, in line with consensus expectations. Rent of shelter, the largest component of CPI, accelerated to 0.5% month‐over‐month as rents ticked higher and hotel prices bounced back from Omicron‐induced weakness in January; however, owner’s equivalent rent, which accounts for 24% of the index, held steady. Car prices, which have become the poster child for pandemic‐related supply chain issues, fell sharply offering hope that the global economy is moving beyond some of the COVID‐induced distortions of the past two years. In sum, the report confirms that inflation remains uncomfortably high for the FOMC, while leaving room for optimism that core inflation will slow over the second half of 2022. Furthermore, the absence of an upside surprise locks in a 25 basis points hike at next week’s FOMC meeting.

The Invasion of Ukraine Exacerbates Inflation Concerns

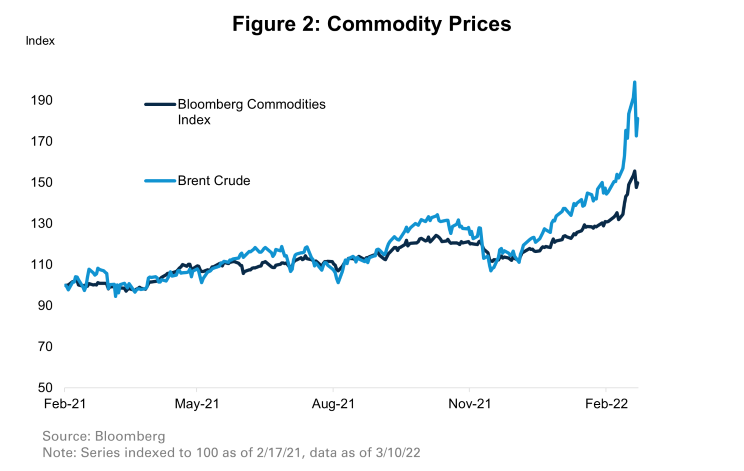

Looking beyond the March FOMC meeting, the inflation outlook is far more complicated because of the war in Ukraine. The first‐order effects of the conflict are apparent in commodities where dramatic price volatility has been the norm and major commodity prices have increased substantially given Russia and Ukraine’s central roles in primary products. The Bloomberg Commodity Index, a proxy for tradeable commodities, reached a record high this week and is up nearly 13% since the start of the war. Higher commodity prices, both directly and indirectly, increase near‐term inflation expectations at a time when the U.S. is already contending with its highest inflation rate since the 1980s. While the U.S. is relatively insulated from commodity price increases given substantial domestic production and higher services consumption, the FOMC will be concerned that higher headline inflation will propagate into the wider economy through consumers’ medium‐term inflation expectations. At the same time, further out on the forecast horizon, the invasion of Ukraine is increasing the downside risk for the global economy as financial conditions have tightened.

Despite these conflicting forces, the consensus view from policymakers appears to be that the inflationary effects of the war are more consequential for the policy outlook in the near‐term. The FOMC will now embark on a hiking cycle at a time when growth is slowing more than they anticipated as recently as a month ago. Given how far they are from their inflation target and the fact that risks are skewed to the upside, the FOMC needs to hike interest rates several times this year and begin reducing its balance sheet to ensure that inflation expectations remain anchored. The risk of a policy error, or, said differently, the risk that the FOMC will need to dampen inflation at the expense of a significant slowdown in growth, is rising and we can see evidence of that in the flattening yield curve. We now expect the FOMC to hike interest rates at 6 of their 7 meetings in 2022, a hike below market pricing, as we hold out some hope that inflation will slow enough in the second half to allow for a one meeting pause to assess their progress; however, the risks are clearly to the upside. We anticipate that the Committee will unveil the specifics of their balance sheet plan at the May meeting and then eventually start reducing the balance sheet in July following the June meeting.

More Defensive Positioning as Growth Slows and the Fed Tightens

In the near‐term, assuming the war concludes, we anticipate credit spreads to tighten, liquidity conditions to improve, and the curve to steepen leading Treasuries to underperform materially. Similarly, we anticipate value, and cyclical equity exposures, as well as Ukraine‐sensitive assets, to benefit in that scenario. Whether or not the war concludes soon, Treasury yields, particularly real yields, should increase as the FOMC seeks to tighten financial conditions and reduce inflation. Given negative expected returns in Treasuries, we believe Gold or commodities can help to diversify while also offsetting the underperformance of equities, should the war continue.

While the war widens the distribution of potential outcomes, our medium‐term view remains the same. We anticipate slowing growth, and tighter financial conditions. We favor higher quality, lower volatility exposures in developed market equities. Regionally, that leads us to prefer the U.S. to other developed markets. Emerging market exposures look attractive given elevated risk premia stemming from spillovers from the war in Ukraine and as low inflation in China, the largest component of the index, should allow authorities to continue with incremental stimulus. With yields moving higher we still prefer allocating our risk taking to equities and we remain short duration relative to our benchmark. Within fixed income we prefer high quality and positively convex exposures like treasuries and investment grade relative to agency mortgage‐backed securities or lower‐ rated credit.

For more information, please access our website at www.harborcapital.com or contact us at 1‐866‐313‐5549.

Legal Notices & Disclosures

For Institutional Use Only. Not for Distribution to the Public.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

The information provided in this article should not be considered as a recommendation to purchase or sell a particular security.

The Bloomberg Commodity Index is an unmanaged broadly diversified commodity price index distributed by Bloomberg Index Services Limited. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Harbor Capital Advisors, Inc.