Facing the Inevitable? A Commodity Squeeze in Oil

April 11, 2022

Executive Summary

- Energy prices and inflation have risen dramatically of late with multiple key drivers. We see challenges to normalizing energy prices over the near-term.

- Even with the recent SPR oil release, supply side challenges limit the amount of additional oil production that can be expected relative to the imbalance of outsized demand.

- Demand destruction appears to be the only path forward for true price normalization which may be difficult to achieve, especially as we enter peak demand season.

- Given both supply and demand side impediments to price normalization, we expect significant price spikes in energy over the near-term.

Recent events have dramatically shifted the balance of supply and demand within the commodities and particularly, the oil market. The impact of COVID-19 and subsequent post-lockdown recovery, supply chain disruptions, years of accommodative monetary policy, and the Russia/Ukraine conflict have resulted in a significant re-pricing of the energy sector.

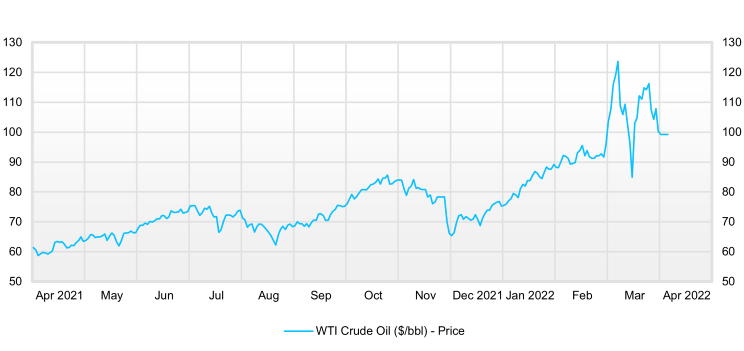

Crude Oil Spot Prices

Source: Factset

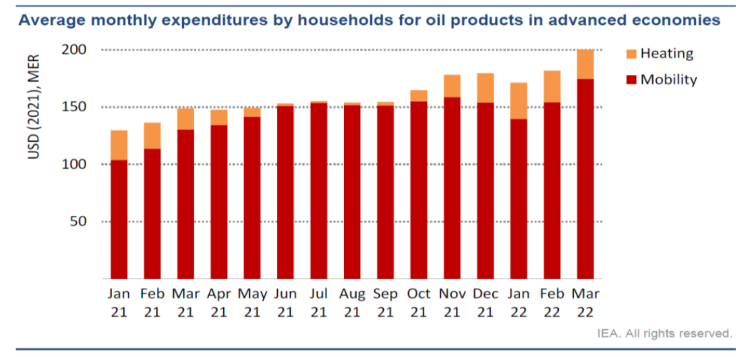

Inflated oil prices have put a marked strain on consumers far beyond what is paid at the gas pump. Increased oil prices can be felt in virtually all the goods and services we use. Everything from home heating costs, to shipping costs on consumer goods, to oil-based materials like plastics and many more items are impacted by rising energy prices.

What will it take to reduce energy prices? Simply put, oil markets would need to either increase supply or decrease demand (or some combination of both). The reality is that the current dynamic of the energy markets makes the execution of either of these measures challenging.

Supply

With such high oil prices, one could question why oil producers wouldn’t respond to higher prices by simply producing or selling more oil? We believe that future production increases should be expected. However, we also believe that production increases will most likely be insufficient to meet demand. The challenges that oil producers are facing are significant.

- Environmental pressures have made new permits more difficult to obtain in the U.S.

- Current backwardation in oil futures market makes hedging/investment less attractive for producers

- Shortages in materials and labor have impacted production

Overall, the U.S. oil industry has seen a significant reduction in production investment in recent years, impacting the global markets. Increasing oil production often involves large amounts of financing, organizing capital expenditure, and the enablement of large supply chains to increase production. The amount of piping and manpower needed is material. Each of these represent challenges to increasing production of oil in the near- term.

Even with the Biden administration’s recent announcement of a Strategic Petroleum Reserve (SPR) release of 1 million barrels per day (on average), with a target of 180m barrels in total; while sizable, we believe is more of an attempt to treat a problem rather than provide a cure. Whatever production that can be brought online will most likely be overburdened by demand given the continued need for oil, high supply constraints and tightness in the market. The environment that we are entering into, which we expect to last over the next several years, is one of demand destruction.

Demand

Absent a significant increase in oil supply, the only other solution for the normalization of energy prices is through a reduction in demand. While the idea of demand destruction is easily understood in theory, it is not easily applied in practice. In other words, energy prices would need to become severe enough that consumers will be forced to make necessary lifestyle adjustments to decrease their overall consumption of, and dependency on, oil and oil-based products in the nearer-term.

A Near-Term Squeeze

The impact of the war in Ukraine helped make an already tight commodities market produce explosive price action to the upside with enhanced volatility in the oil and energy markets. Government sanctions banning Russian oil imports estimate a reduction in oil supply by ~2.5 million barrels per day. With Russia being the world’s third largest oil producer and largest exporter, impact has been, and can reasonably be expected to continue to be, dramatic and felt on a global scale.

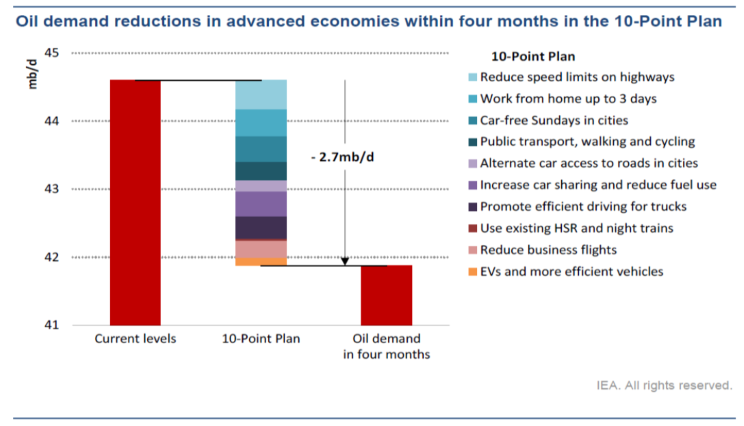

Citing a recent report by the International Energy Agency (IEA) entitled “A 10-Point Plan to Cut Oil Use”, it is reasonable to surmise that oil prices will increase significantly in the near future. “With the potential loss of large amounts of Russian supplies looming, there is a real risk that markets tighten further, and oil prices escalate significantly in the coming months as the world enters the peak demand season of July and August.”

The IEA even goes so far as to detail a 10-point plan to reduce global oil consumption, exemplifying the seriousness of the current environment. “In view of this and the potential emergency the world is facing, the IEA is proposing 10 immediate actions that can be taken in advanced economies to reduce oil demand before the peak demand season. We estimate that the full implementation of these measures in advanced economies alone can cut oil demand by 2.7 million barrels a day within the next four months, relative to current levels.”

It is our belief that it is highly unlikely that consumers would adhere to such a plan without some level of government interference. We also believe that a government mandate is unlikely. However, the fact that the IEA is making such a recommendation is important and cannot be overstated.

Conclusion

We believe that what we are currently witnessing within the commodities/oil markets is a transitioning from financial to actual physical disruption. In other words, a global transition from the “noise” of daily financial market disruption to the “signal” of actual commodity price impacts and what may be to come in the not-so- distant future. Supply and demand dynamics are becoming more real each day and the war in Ukraine is going to impact our daily lives well beyond what current headlines are reporting. Based on this, we encourage investors to take a longer-term view on the potential impact on broad commodity prices, oil, and inflation.

Legal Notices & Disclosures

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Forecast and estimates are based on assumptions and for informational purposes only. This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy. The information presented does not represent the results that any particular investor may actually attain. Actual results will differ, and may differ substantially, from the information provided.

This material may reference counties which may be generally the subject of selective sanctions programs administered. Readers of this commentary are solely responsible for ensuring that their investment activities in relation to any sanctioned country is carried out in compliance with applicable Laws, rules, or policies.

Commodities and commodity-related products carry a high level of risk and are not appropriate for all investors. Commodities and commodity-related products may be extremely volatile, illiquid and can be significantly affected by underlying commodity prices, world events, import controls, worldwide competition, government regulations, and economic conditions.

Harbor Capital Advisors, Inc.

2121428