Bringing the Human Capital Factor® (HCF®) to Life

February 14, 2024

Although human capital is often thought of as an asset critical to any company’s success, it is accounted for as an expense. Given this dynamic, we find that human capital is often systematically overlooked, mispriced, and ignored, in large part because it is difficult to quantify. However, the distinct and proprietary data ecosystem developed Irrational Capital aims to quantify levels of motivation and engagement in a company’s workforce in a new investment factor – the Human Capital Factor (HCF®).

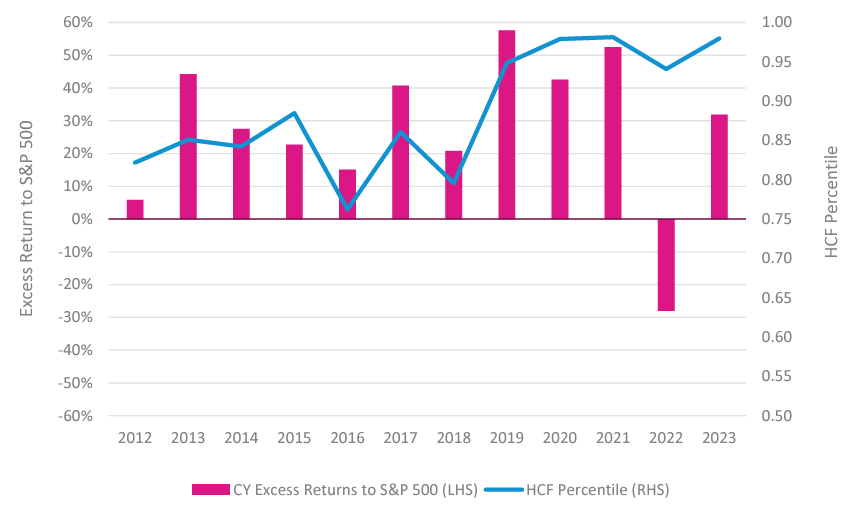

Case Study of Improving Human Capital

The example that follows highlights a large hardware and software company that previously had a since described “know it all” culture. Recognizing the need for a culture change, the company replaced the existing CEO with a new CEO in 2014 who was focused specifically on changing the culture. It embraced an open-minded, “learn it all” culture emphasizing innovation which has produced an exceptional culture. As a result, this company was at the forefront of technology trends such as Cloud and artificial intelligence (AI), where the prior culture had driven the company to miss out on the opportunity they had in mobile years prior. As the HCF® scores improved at this company, the business has performed well, and its stock has gone on to outperform the broad market by a wide margin.

1/1/2012 -12/31/2023

Source: Morningstar Direct & Irrational Capital, December 2023. For illustrative purposes only. Security performance is for illustrative purposes only and does not represent actual performance of a security held by Harbor Capital. The Highest (most favorable) is 1, the lowest (least favorable) is 0.

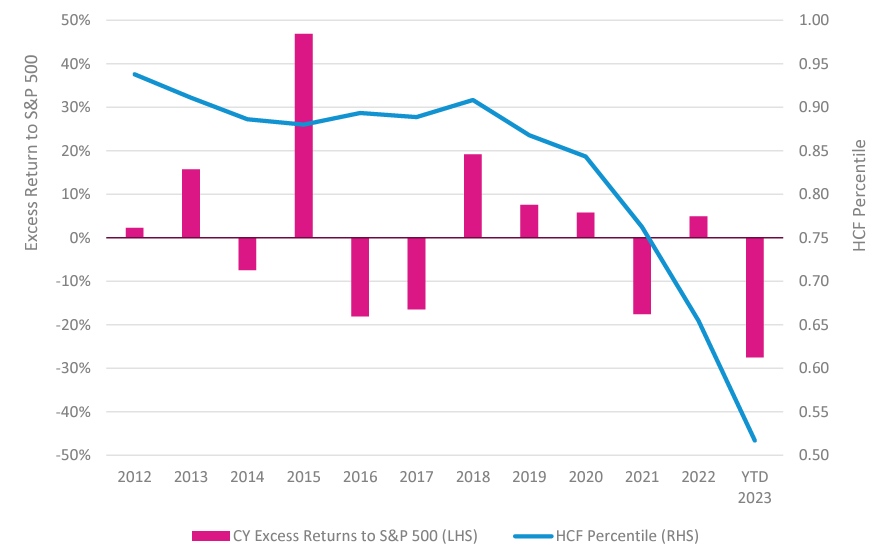

Case Study of Declining Human Capital

On the other hand, at a food and beverage retailer with a founder-centric culture, the founder served multiple terms as an on-and-off CEO of the business. Over time, what had been a strong HCF® score degraded meaningfully. Particularly during the COVID-19 period, a management vs. worker culture emerged. This produced a lack of emotional connection from front-line employees and ultimately less organizational alignment and effectiveness. As a result, per store revenue has suffered and the company has underperformed the broad market (S&P 500) in recent years following the declining HCF® score.

1/1/2012 -12/31/2023

Source: Morningstar Direct & Irrational Capital, December 2023.For illustrative purposes only. Security performance is for illustrative purposes only and does not represent actual performance of a security held by Harbor Capital. The Highest(most favorable) is 1, the lowest (least favorable) is 0.

For more information on the HCF® and ways to invest, please visit our website.

Important Information

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to purchase or sell a particular security.

Past performance is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions.

HCF Scoring: Each company in the universe is scored on each of the seven dimensions (organizational effectiveness, innovation, direct management, organizational alignment, engagement, emotional connection, and extrinsic rewards). In the examples provided above, eligible constituents are chosen from Solactive GBS United States 500 Index (the “index universe”) at the time of Index reconstitution. The Solactive GBS United States 500 Index intends to track the performance of the largest 500 companies from the US stock market. The index listed is unmanaged and does not reflect fees and expenses and is not available for direct investment. HCF scores across all seven dimensions are aggregated for each company. The raw score reflects aggregate scores across the seven dimensions for every company in the universe. The Z-score then serves to normalize the distribution of raw scores across the universe. A Z-score is a statistical measurement that tells you how far away from the mean (or average) your datum lies in a normally distributed sample. The Highest (most favorable) raw HCF® value is 3, the lowest (least favorable) raw HCF® value is -3.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. Index listed is unmanaged and does not reflect fees and expenses and is not available for direct investment.

Copyright © 2024 Harbor Capital Advisors, Inc. All rights reserved.

3392904