Quantix Q1 2024 Newsletter

May 09, 2024

The bull is awakening in commodity markets. One driver has been a resilient global economy. The reality of surprisingly robust US consumer spending and signs of improved manufacturing activity in Europe have some market observers now putting a higher probability on a “no landing” scenario. As a result, US equities continued to make new highs even as US Federal Reserve (“Fed”) rate cuts perpetually stayed 2 months away.

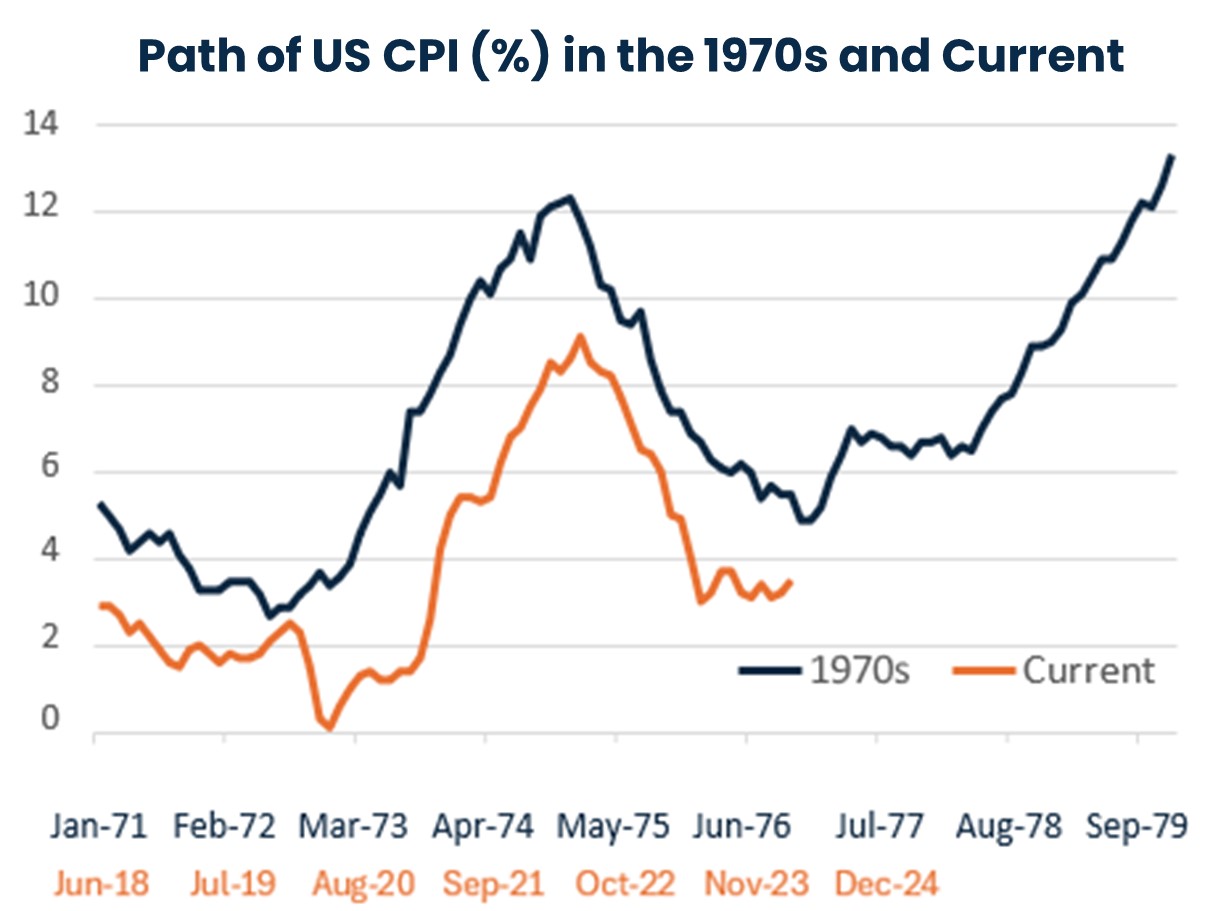

The stronger than expected economy has also been accompanied by stubbornly high Consumer Price Index (CPI) prints that have not only put the Fed on hold but are even raising the threat of another bout of higher inflation.

I recently spoke at an investor conference that featured a chart similar to this one, showing the similarities between the path of CPI in the inflationary period of the 1970s to the path that CPI is taking today. The speaker used this data to support a cautionary portfolio construction that included an allocation to commodities for an inflation hedge.

Source: Bloomberg

Source: Goldman Sachs Global Investment Research “Tracking Tightness; Still Selectively Constructive” 28-Mar-24, Wind, SMM, Bloomberg

We agree with this sage advice, and the sentiment is clearly resonating with other investors, given the renewed interest we are seeing from allocators in the asset class.

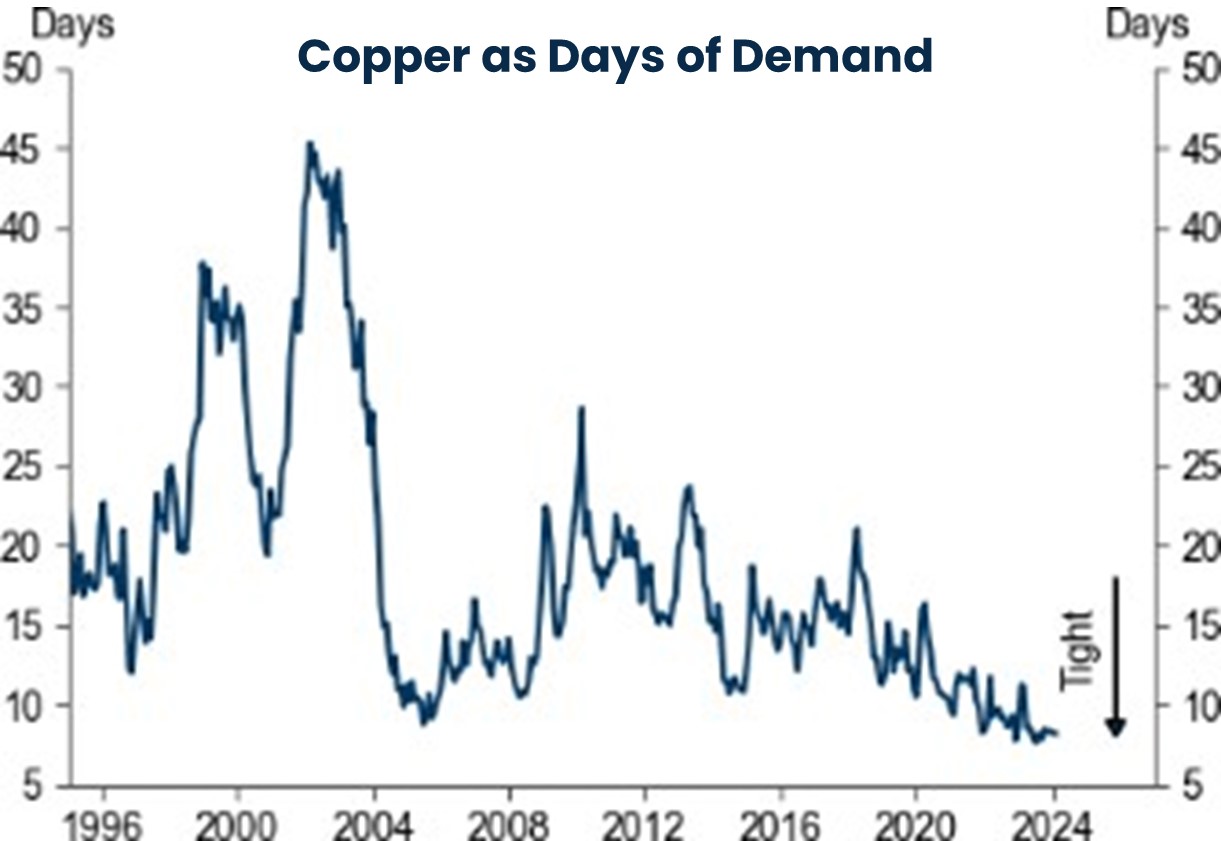

The current market environment has significantly bullish implications for commodity markets as inventories in many sectors are still historically low – including record tight Copper stocks according to Goldman Sachs – and investor interest (until very recently) is relatively light.

The Impact of Government Policy in Commodity Markets

Across all of our strategies, one thing that has become increasingly evident throughout the recent years is the increasing effect of government policy in commodity markets. In most cases, that policy effect has been bullish for these markets, and we believe is likely to remain so for the foreseeable future.

Commodity market prices are a function of both fundamental and technical factors. When discussing fundamentals, most observers tend to focus on supply and demand factors. While central bank policy has always had direct implications for fixed income markets, it has also become a major driver of equity markets since 2008. The effect of policy decision on commodity markets has also grown in recent years and should not be overlooked.

Petroleum

For institutional and governmental policy, the Organization of Petroleum Exporting Countries (OPEC) is the 800lb gorilla in petroleum markets. While the cartel officially professes to target inventories, their decisions to restrict or loosen supply have a notable impact on price. For the past 18 months, the organization has restricted supply to global markets which has likely provided a bullish tailwind for prices. As I wrote last year, the addition of Russian collaboration and compliance through OPEC+ has increased the effectiveness of this policy.

Other examples of government policy within the petroleum space that have been bullish for prices include the use of sanctions against producing nations. US sanctions against Russia, Venezuela, and Iran have not only increased current prices but have also discouraged future investment in these geographically oil-rich locations.

With the advent of Shale Oil and greater US energy independence, even the US Strategic Petroleum Reserve (SPR) has been deployed more as a price control tool than for energy security. While SPR releases were effective in softening oil prices after the 2022 Russian invasion of Ukraine, inventories have never been refilled in any meaningful way, reducing the potential for similar relief if another bout of geopolitical unrest is ahead of us. While some of these forces (such as OPEC supply cuts) can be viewed as temporary and may even be reversed, others are longer lasting in nature and may continue to provide a bullish tailwind.

Natural Gas

While a similar cartel does not exist for Natural Gas markets, government policy can also have a major influence in this sector of commodity markets, primarily in the form of restricting production. The bulk of recent Natural Gas supply growth has come from fracking, but the drilling technique has become a contentious environmental and health issue. Several countries, as well as several US states, have banned the practice, putting serious limits to potential supply growth.

Even this year, the Biden Administration announced delays in approval for additional LNG (liquified natural gas) processing facilities. LNG exports are a critical element for future European gas supply and energy security, which is already stressed by a policy move away from Russian supply.

Agricultural Markets

The explosive move in Cocoa prices was largely driven by very poor weather conditions in West Africa. Cocoa production is more geographically concentrated than any other commodity, with 70% of global supply coming from just four countries in that region: the Ivory Coast, Ghana, Nigeria and Cameroon. As such, the crop may be highly susceptible to a single regional climate anomaly, as has been the case so far in 2024.

In most cases in commodities, as the popular saying goes, the cure for high prices is high prices. In the case of Cocoa, farmers should be incentivized to maximize future supply. Policy, however, is severely interfering with this dynamic. The governments in Ivory Coast and Ghana have capped farm gate prices (keeping the excess for their own coffers) which effectively shields the price signal to increase production. There is also regulation out of Europe (EUDR) which will prohibit Cocoa imports without proof that the beans were not grown in areas that led to deforestation, putting additional regulatory burden on the already stressed market.

Industrial Metals

One notable exception to the resilient global growth story has been China. While Chinese GDP growth is still above the global average, it has fallen well short of expectations in recent periods. As a result, there is tremendous pressure on Chinese officials to take measures to stimulate growth.

As the world’s largest consumer of copper1, nearly twice as much as the US, any stimulus steps would only put additional pressure on an already very tight market. Despite the recent lackluster Chinese economy, copper prices have held up remarkably well due to strong green energy and growing data center demand.

Furthermore, notable mine supply disruptions in Chile and Panama since late 2023 point to a 4.5 million ton deficit by 2025, in a market that Goldman Sachs2 expected at the start of 2024 to have a global output of 23 million tons this year.

Precious Metals

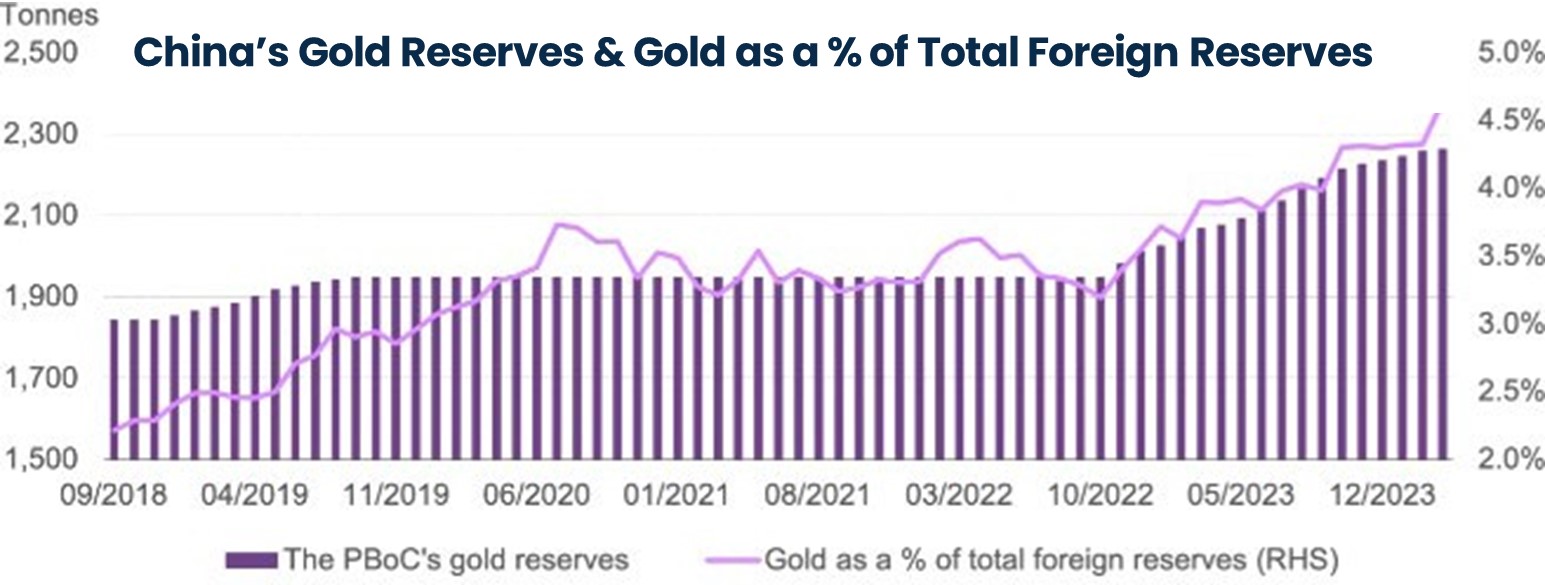

Generally, Gold behaves like a currency and is highly correlated with real (and nominal) yields. In that sense, the commodity has always been indirectly influenced by central bank rate policy.

Source: PBOC, World Gold Council

While that correlation has largely broken down recently, consistent official sector buying has helped propel Gold prices to one of its all-time highs. This is, in effect, a targeted sovereign policy to de-dollarize the reserves of central banks around the world. Since 2001, the US dollar’s share of global foreign exchange reserves held by central banks dropped from 73% to 58%, according to the International Monetary Fund (IMF).

As seen in preceding chart, China alone has net added to its official sector gold reserves for 17 consecutive months.

Source: Goldman Sachs Global Investment Research “Commodity Views: choosing wisely” 14-Jan-24, Wind, SMM, Bloomberg

Outside of the official sector, ETF & managed futures positions are still well below record levels, further suggesting that recent Gold moves may be more policy driven than retail or speculative buying. This is further supported by the fact that implied volatility remains relatively low for a market that is making all-time highs.

The potential to attract participation from these other market participants is why many analysts3 are calling for Gold to reach $2700-$3000 by year’s end.

Emissions

The global emissions markets are arguably entirely based on government policy! Indeed, the instruments of trade were created by federal agencies to achieve carbon emission reductions.

While day-to-day prices are set by trading in these markets, the overall, long-term price levels are a function of government policy. By controlling the supply of credits allocated to the market, regulators can control price levels, and in fact explicitly intend to. Recent announcements for the controlling entities in both the US and Europe indicate that these regulatory bodies will continue to support more restrictive policies with the aim of raising the prices of emission credits to achieve their policy goals.

One such example is the removal of free aviation emission credits in Europe that is setting the stage for a hefty carbon bill for that sector in 2026.

Conclusion

A combination of recent forces has resulted in commodity markets breaking out to the upside.

The resilient global economy, combined with excess liquidity, has bolstered demand for oil and metals that is well above the expectations set at the start of the year. Escalating tensions in the Middle East, coupled with continued conflict in Russia/Ukraine have embedded a deserved geopolitical risk premium in many commodity prices.

Yet beyond these more immediate and obvious factors, global government policy decisions are providing an additional bullish catalyst for commodity markets. Whether it is designed to achieve environmental goals (emission credits/production bans) or deployed through financial weaponry (sanctions/tariffs), policy is usually geared toward higher commodity price outcomes.

In this precarious environment, it is little wonder that a country-less currency (Gold) is at record highs. Given the geopolitical climate, policy impacts are unlikely to reverse any time soon. While the US election cycle can often result in meaningful policy shifts, there is little to suggest that much will change irrespective of who is in the White House.

It is a sign of the times that one of the few issues with bipartisan political support in the US is a stricter trade policy with China, including a potential carbon border fee. This provides further evidence of the deglobalization theme that I have discussed in the past that Quantix believes is ultimately very bullish for commodities.

The conclusion that many investors can draw is that, in this environment, to place a greater allocation of their portfolios to commodities.

Sincerely,

Don Casturo

CIO, Quantix Commodities LP

Important Information

1 Source: Statista, Projected copper consumption worldwide in 2023, by country

2 Source: Golman Sachs Investment Research, “Copper: Countdown to the deficit”, 23-Jan-24

3 Source: Bloomberg, “Gold Seen Hitting $3,000 at Citi as Investor Inflows Juice Rally”, 16-Apr-24

The views expressed herein are those of Quantix Commodities at the time the comments were made. These views are subject to change at any time based upon market or other conditions, and the author/s disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions.

3537396