October CPI: Back to Benign Disinflation

November 16, 2023

Executive Summary:

- The October Consumer Price Index (CPI) data was unambiguously positive for the Federal Open Market Committee (FOMC) as both headline and core inflation surprised to the downside.

- Last month’s high services inflation appears to have been an aberration as shelter and core services excluding shelter regressed to the prior trend.

- Slowing inflation validates the FOMC’s recent shift in emphasis away from a costly disinflation towards a more benign outlook as labor supply tailwinds introduce labor market slack.

- The market-implied probability of another rate increase is minimal with nearly 4 cuts priced by the end of 2024. The path reflects a bimodal set of outcomes where in the most likely path the Fed realizes one or two cuts alongside an alternative path of aggressive cuts if the U.S. experiences a recession.

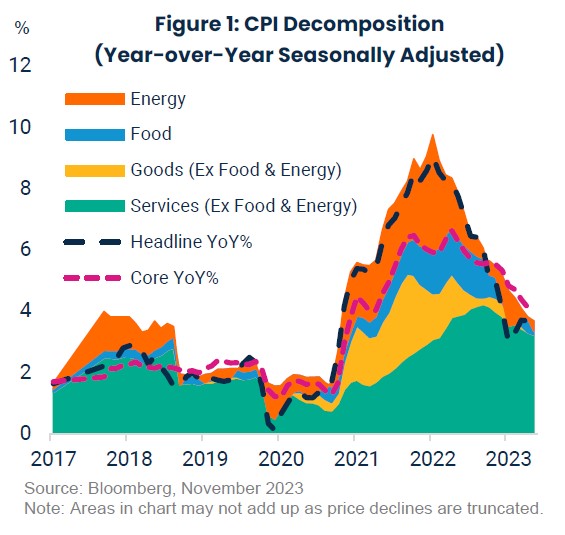

Flat headline and the 0.2 percent increase in core CPI for October printed below consensus expectations and reversed the concerning uptick seen in September. Energy prices fell 2.5 percent accounting for the deceleration in headline inflation, which we believe should continue in November given declining wholesale crude and natural gas prices. Within core inflation, goods prices declined modestly month-over-month as vehicle prices continue to be a drag on inflation as auto production recovers and demand wanes amid high financing costs. We expect core goods prices to continue to bounce around zero month-over-month as the effects of the pandemic recede from view.

The Fed’s focus is on services inflation and the October CPI data delivered on all fronts. Shelter inflation declined from 0.6% to 0.3% month-over-month. The reversal from last month is consistent with realized price changes in the rental market, but confirmation that the prior month was an aberration was necessary given the uncertain pass-through of market rents to measured shelter CPI. We believe we should see several more months of shelter inflation at or below its current level given subdued rental price changes in 2023. Services ex-shelter, the Fed’s preferred inflation metric for much of 2023, decelerated from 0.6 to 0.2% month-over-month in October. This pace is consistent with Chair Powell’s contention at the November FOMC meeting that risks to the outlook are becoming more balanced between inflation and the labor market.

Below trend to below potential

Up until the November meeting, the FOMC has emphasized that a period of below-trend growth would be necessary to achieve 2 percent inflation. However, the messaging changed at the November meeting as Chair Powell stated that a period of below-potential rather than below-trend growth was necessary. As he expanded on this point, the genesis of the change is that the Committee revised up their estimate of potential growth. The implication is that an economy growing at 2 percent may be above trend growth but below an elevated potential growth rate. They see 3 reasons as responsible for the increased estimate of potential growth: a reversal of pandemic-constrained supply, an increasing labor force, and the economy’s resilience to higher interest rates. The first answer alludes to all the frictions introduced to production and supply chains because of the pandemic. Things like shifting to remote and then hybrid work, introducing more resilience into the supply chain, or the reallocation of labor across goods and services and the requisite training. These changes temporarily constrained supply capacity after the pandemic and now may be supporting potential growth.

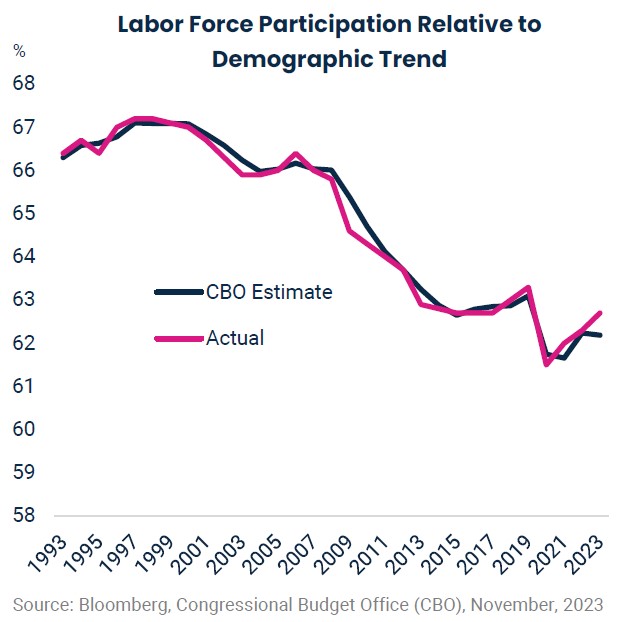

The Fed appears to be attributing the most weight to a rebound in the labor force. After the start of the pandemic in March 2020, it took two full years for the size of the labor force to return to its pre-COVID level as workers exited the labor force and immigration fell. Since the start of this year, the labor force grew by nearly 3 million workers, a larger increase than expected based on demographic trends. A normalization in immigration to pre-COVID levels accounts for some of the increase, but, ultimately, the strength of the U.S. economy is driving participation rates higher. The participation rates for people with a disability is the highest in decades, as is the prime age participation rate. A larger labor force means a larger economy today and can boost future productivity as well as workers develop skills.

A resilient economy despite high interest rates is the natural result of a larger labor force and a more efficient allocation of resources. The Fed tries to reason in both directions, but the current environment and the difficulties of the post-pandemic period mean a greater emphasis on observing how the economy responds to policy changes. So far, the evidence supports a benign disinflation, but the uncertain lags of policy linger. Typically, an increase in the unemployment rate like that of the last few months is followed by a recession, but for now the emphasis is on the growth in the labor force rather than the number of unemployed. We think the October CPI data offers both incremental support for a soft landing and that it confirms that the Fed’s hiking cycle is done. However, the Fed will continue to emphasize that cuts are a distant prospect, despite market pricing suggesting otherwise. The market-implied path of policy indicates roughly 4 rate cuts in 2024. Neither us nor the market believes that this is the most likely path as it embeds some chance of a recession and faster cuts. However, it is difficult for the Fed to push hard against market pricing at this point given the positive string of data.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

This material contains forward-looking information that is not purely historical in nature. Such information may include projections and forecasts and there is no guarantee that forward-looking information will come to pass.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

3238003