Accessing Alpha Potential with Active Growth

January 25, 2024

We recognize that much of 2023 was defined by a significant rebound and outperformance of growth stocks vs. the broad market amidst the backdrop of inflationary uncertainty and the continued tightening of financial conditions driven by the Federal Reserve. That said, we believe a variety of factors suggest that the backdrop for U.S. growth stocks can continue to be favorable.

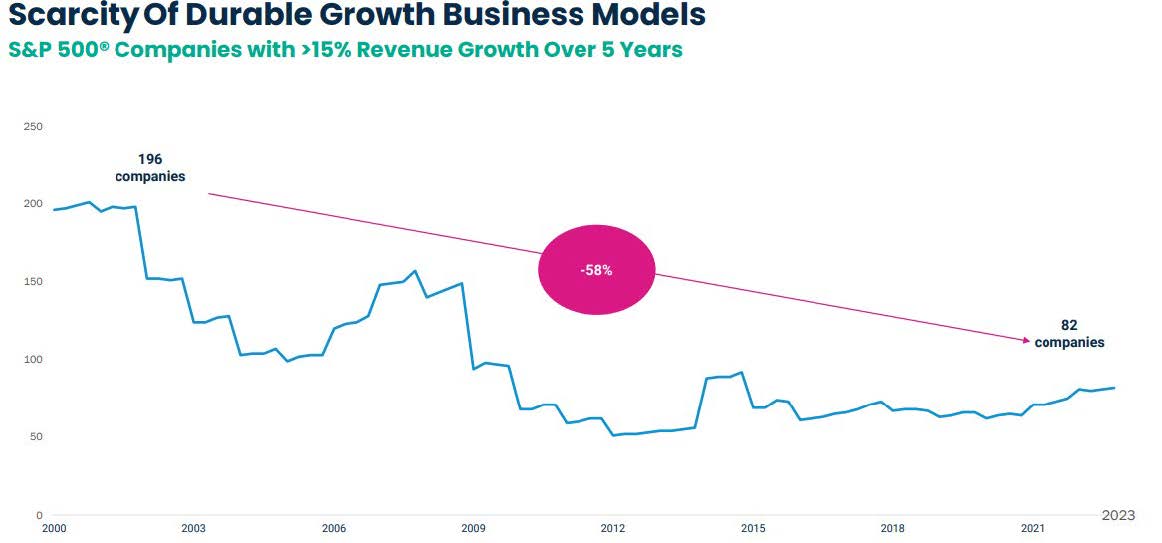

Real Growth Has Slowed

In our view, real growth has slowed with secular growth becoming increasingly scarce. Thus, we believe this scarcity effect will drive demand for proven secular winners with long-term profiles and the ability to grow faster than the average stock. Said differently, we think the market will be drawn to these companies that can grow no matter the backdrop.

Quarterly data from 12/31/00 to 9/30/23. Source: FactSet.

Secular Drivers Remain in Place

We believe drivers of secular revenue remain in place today. Importantly, we find that earnings results are showing that income statements remain in good shape with strong free cash flow fueling solid business models.

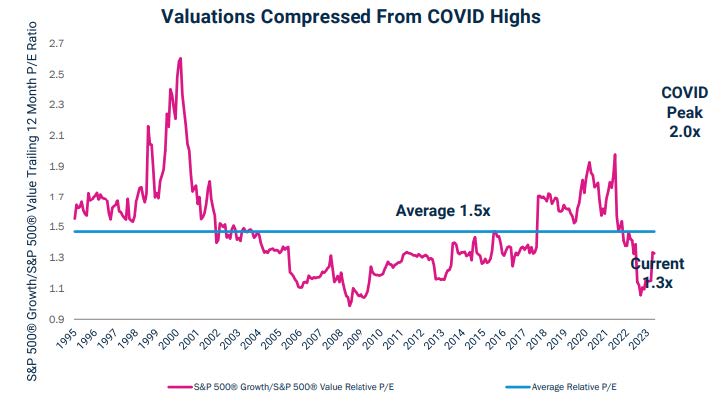

Attractive Entry Point

Even following the growth rally in 2023, Jennison Associates believes that valuations for growth stocks are attractive, particularly relative to expected earnings growth projections in 2024. Even though valuations rose in 2023, they did so from a starting point following meaningful valuation compression in 2022. Subsequently, valuations in the latter half of 2023 looked more normalized after an overshooting to the downside in 2022 when the market became too pessimistic towards growth stocks.

As of 9/30/23. Source: Jennison and FactSet. Growth is represented by the S&P 500® Growth Index and Value is represented by the S&P 500® Value Index. See Important Information for term and index definitions. Past performance does not guarantee future results.

Potential Investment Solutions

For investors looking to add to their growth exposure in 2024, we point to the Harbor Long-Term Growers ETF (WINN) as an attractive option. Subadvised by Jennison Associates, the ETF boasts an experienced management team with a decades-long investment process that includes a proprietary combination of rigorous bottom-up, fundamental research and systematic portfolio construction to derive a portfolio of growth stocks that reflects a compelling combination of opportunity, valuation and risk. Moreover, we believe WINN delivers on what ETF investors want, including consideration for liquidity, transparency and tax efficiency. Ready for a WINN investment? Learn more here.

Important Information

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

Diversification does not assure a profit or protect against loss in a declining market.

Alpha refers to excess returns earned on an investment above the benchmark return when adjusted for risk.

Free Cash Flow is the money a company has left over after paying its operating expenses and capital expenditures.

The price-to-earnings (P/E) ratio relates a company's share price to its earnings per share.

The S&P 500 Growth Index is a stock index that represents the fastest-growing companies in the S&P 500.

The S&P 500 Pure Value Index is an index comprised of the strongest value stocks on the S&P 500.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Jennison Associates is a third-party subadvisor to the Harbor Long-Term Growers ETF.

3339905