Winter Is Coming… Right?

September 26, 2022

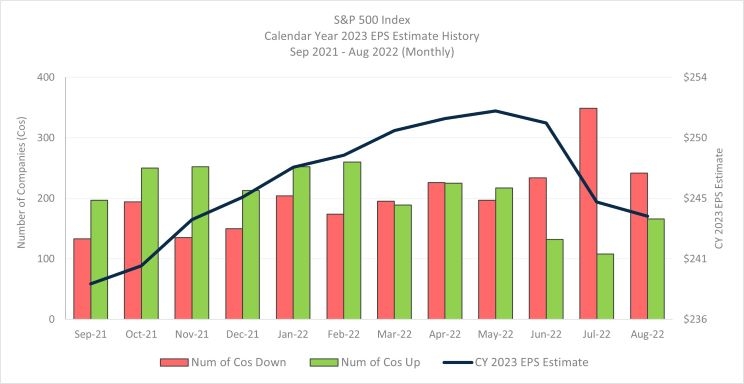

The world economy has been shaken by shockwaves in the form of elevated inflation, tighter financial conditions, a worse-than-expected slowdown in China, and formidable supply disruptions attributed to the Russia/Ukraine conflict. Within this backdrop, the International Monetary Fund (IMF) communicated in July that it now expects the world economy to grow 3.2% in 2022 before decelerating to a 2.9% Gross Domestic Product (GDP) rate in 2023, which reflects a downgrade of -0.4% and -0.7%, respectively, from their April forecast. In addition, equity analysts have recently reduced calendar year 2023 earnings per share (EPS) estimates as companies across sectors and industries grapple with input cost pressures, a more challenging consumer environment, currency translation effects and other macro headwinds (please refer to the chart below).

Source: FactSet Research Systems, August 2022

With year-to-date returns across major asset classes mostly in negative territory and macro headline risks still ever present, many investors may likely be worrying that “Winter is coming” as we round into the back end of the year. Amidst what seems a sea of bearish sentiment, we believe it is likely more prudent to question this mindset as opposed to simply accepting its implications from an investment perspective. As such, below are some questions to help spark differentiated and opportunistic thinking as we move towards the conclusion of 2022:

- U.S. Inflation/Federal Reserve (Fed) Policy: What if U.S. inflation surprises to the downside while the labor market experiences moderate increase in unemployment? Could this prompt the Fed to modify tone regarding future policy decisions? How would this impact fixed income and equity markets?

- European Energy Crisis: The E.U. appears on track to surpass targets for filling gas storage facilities; what if Europe experiences milder-than-anticipated winter weather patterns? Have long-term benefits been created given declining dependences on Russian energy imports?

- China Slowdown: Will accelerated government stimulus efforts prove successful in stabilizing conditions and reigniting demand across the world’s second largest economy?

- Long-Term Investment Consideration: As of 8/31/2022, the S&P 500’s price/earnings (P/E) ratio from the current fiscal year of 17.5x was only 4.8% higher relative to its valuation at the height of the pandemic (16.7x as of 3/31/2020). How much expected negative news is already priced into equities today based on this comparison? Will conditions likely be brighter for equities looking out over longer-term horizons?

It is likely that investors will produce varying responses to these questions, exhibiting favorability towards more cautious or opportunistic portfolio positioning. For investors that believe “Winter is coming”, the growing dividend streams and enhanced downside support provided by the Harbor Dividend Growth Leaders ETF (ticker: GDIV) could potentially serve as a mindset match opportunity. For those that feel differently, added emphasis on companies with multi-year structural growth opportunities via the Harbor Long-Term Growers ETF (ticker: WINN) may enable further investment alignment with their views. Overall, both ETFs leverage the manager research expertise of Harbor to meet dynamic needs, providing strong long-term investment prospects for the road ahead – whichever way it may lead.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to buy a particular security.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Harbor Dividend Growth Leaders ETF (GDIV): Investments involve risk including the possible loss of principal. There is no guarantee the investment objective of the Fund will be achieved. The Fund's emphasis on dividend paying stocks involves the risk that such stocks may fall out of favor with investors and under-perform the market. There is no guarantee that a company will pay or continually increase its dividend. The Fund may invest in a limited number of companies or at times may be more heavily invested in particular sectors. As a result, the Fund's performance may be more volatile, and the value of its shares may be especially sensitive to factors that specifically effect those sectors. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuation, political instability, government sanctions, social and economic risks. Foreign currencies can decline in value and can adversely affect the dollar value of the fund.

Harbor Long-Term Growers ETF (WINN): All investments involve risk including the possible loss of principal. There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. At times, a growth investing style may be out of favor with investors which could cause growth securities to underperform value or other equity securities. Since the Fund may hold foreign securities, it may be subject to greater risks than funds invested only in the U.S. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The price/earnings (P/E) ratio is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS). P/E ratios are used by investors and analysts to determine the relative value of a company's shares in an apples-to-apples comparison. It can also be used to compare a company against its own historical record or to compare aggregate markets against one another or over time. A company's P/E can also be benchmarked against other stocks in the same industry or against the broader market, such as the S&P 500 Index.

Westfield Capital Management is a third-party subadvisor to the Harbor Dividend Growth Leaders ETF.

Jennison Associates LLC is a third-party subadvisor to the Harbor Long-Term Growers ETF.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

2449142