U.S. Growth Equities: 2023’s Must Take or Head Fake?

March 29, 2023A Tug of War Between Duration Growth and Nearer-Term Profitability:

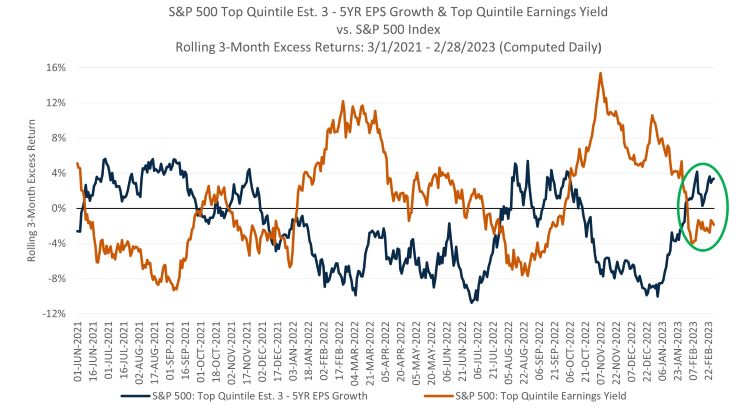

Over the past two years, U.S. equity markets have been influenced by an economic reopening induced surge in consumer demand and subsequent persistent elevated inflation, tighter monetary policy, and higher interest rates. Within this backdrop, investor preference has fluctuated between companies with the strongest estimated earnings growth profiles and companies with the highest earnings yields (please refer to the chart below).

Source: FactSet Research Systems, March 2023.

Source: FactSet Research Systems, March 2023.Performance data shown represents past performance and is no guarantee of future results.

While exhibiting rotational aspects over this 2-year period, investors generally favored companies with the strongest visibility of nearer-term profitability (high earnings yields) for much of 2022 given increased concerns pertaining to the challenges posed by higher interest rates on companies with long duration growth profiles. Now given inflation moderation and aggressive Fed tightening potentially nearing its conclusion, growth equities have outperformed thus far in 2023. This environment has raised questions as to whether U.S. growth equities are positioned to outperform for the road ahead or if 2023 year-to-date results may end up being a head fake as experienced in the third quarter of 2022.

U.S. Growth Equities for a Scarcity of Growth Environment:

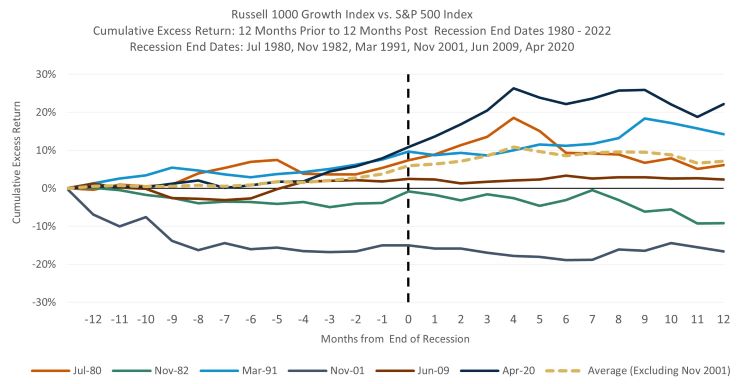

While market turbulence may continue, U.S. growth equities could likely remain in favor given a backdrop of muted U.S. economic expansion and broad market earnings per share growth. Per FactSet, the median U.S. GDP growth estimate for 2023 now rests at only 0.7%, while the mean S&P 500 EPS Growth estimate sits at only 1.7% for the year as of March 2023. Looking ahead, companies with sustainable growth prospects have the potential to be rewarded within this scarcity of growth environment. Additionally, as recession risk has increased, U.S. growth equities have been successful in navigating previous periods of economic weakness.

Source: Morningstar Direct, March 2023

Source: Morningstar Direct, March 2023

This chart shows that the Russell 1000 Growth Index has outperformed broad market equities in the 12-month prior through 12-month post-recession end date periods in four of the last six U.S. recessions since 1980. When excluding 2001’s dot-com bubble that roiled growth markets, the Russell 1000 Growth Index has averaged a 7.2% cumulative excess return versus the broad market during these recessionary periods.

Tactical Tailwinds and Anchor Allocation:

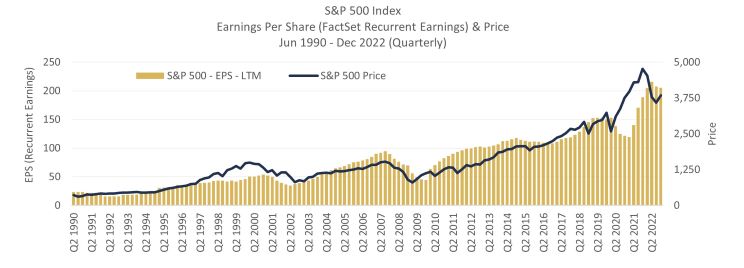

Other potential tailwinds for U.S. growth equities may likely occur with falling inflation, a level-setting of interest rate expectations, potential dollar weakness and secular themes such as fintech, electric vehicles and luxury. Most critically, short-term market shifts can become disconnected from company fundamentals. However, the chart on the following page shows that over the long term, stock prices have followed growth in earnings per share.

Source: FactSet Research Systems, March 2023. LTM: Last Twelve Months.

Source: FactSet Research Systems, March 2023. LTM: Last Twelve Months.Performance data shown represents past performance and is no guarantee of future results.

Companies that create economic value through long-duration competitive advantages possess potential to generate strong growth in earnings and cash flows and deliver excess returns over the long term. As such, investors may want to consider U.S. growth equities as both a timely opportunity, as well as a longterm anchor position within diversified portfolios for 2023 and beyond.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-3135549.

Important Information

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Past performance is no guarantee of future results.

All investments involve risk including the possible loss of principal. Stock prices can fall because of weakness in the broad market, a particular industry, or specific holdings. At times, a growth investing style may be out of favor with investors which could cause growth securities to underperform value or other equity securities. Foreign securities may be subject to greater risks than investments only in the U.S. These risks are more severe for securities issuers in emerging market regions.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. The Russell 1000® Growth Index is an unmanaged index generally representative of the U.S. market for larger capitalization growth stocks. The Russell 1000® Growth Index and Russell® are trademarks of Frank Russell Company. Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

In relation to any data attributed to Morningstar, please note the following: © Morningstar 2023. All rights reserved. Use of this content requires expert knowledge. It is to be used by specialist institutions only. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

Certain forecasts, estimates and returns are based on hypothetical assumptions. It is for informational and illustrative purposes only. This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy. The forecasts, estimates and return presented do not represent the results that any particular investor may actually attain. Actual performance results will differ, and may differ substantially, from the hypothetical information provided.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Diversification does not assure a profit or protect against loss in a declining market.

Harbor Capital Advisors, Inc.

2834170