The Future of Fixed Income: Quantitative Disruption

March 29, 2023

Quantitative strategies have long been prevalent in the equity space but are few and far between in fixed income. However, that's begun to change as both academic and industry researchers increasingly turn their attention to the bond market.

Potential Advantages of Quantitative Fixed Income Investing

- The process is objective, disciplined, and repeatable.

- Quant strategies are less vulnerable to key-person risk.

- By limiting human judgment, quantitative processes are less susceptible to behavioral biases, which may increase the chance of repeatable outcomes.

- Systematic strategies have the capacity to harness large and growing data sets, which can be challenging for discretionary managers to digest.

- Quantitative core fixed income strategies may arguably be more effective diversifiers than many discretionary portfolios.

Why Now?

![]()

Depth & Breadth

Research advancements have been made possible by the tripling of the global liquid credit market over the past two decades.

![]()

Tech & Data

Advancements in data collection and storage have produced significantly more robust datasets, providing the raw material for empirical research, which has accelerated thanks to advances in computer processing power.

![]()

Trading & Transparency

The shift to electronic trading improves price data, which helps systematic fixed income managers identify mispricings and improves estimates of liquidity conditions and transactions costs.

Runway for Growth

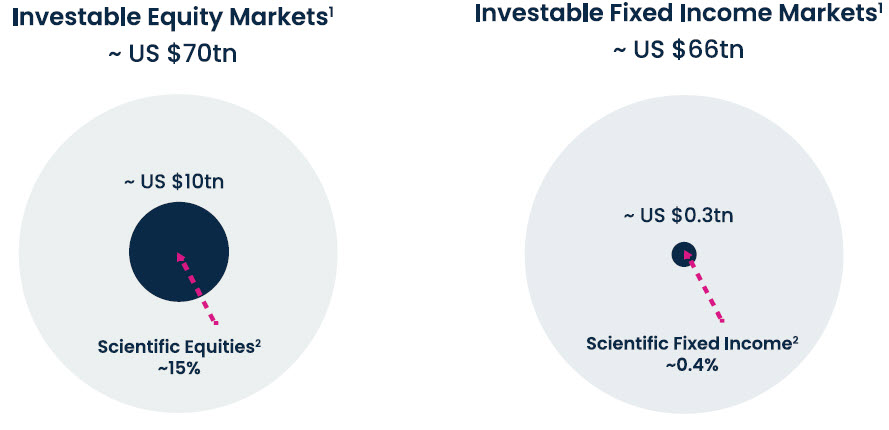

Quantitative fixed income managers have plenty of runway for growth. Equity quant strategies have about $10 trillion in AUM (about 15% of the market), while bond quant strategies represent just over $300 billion (approximately 0.4% of the market). With a robust technological foundation now in place, we expect skilled quantitative fixed income managers to earn a significant portion of market share.

Want to learn more about quantitative fixed income investing? Explore The Case for SIHY or contact info@harborcapital.com.

About Harbor Capital Advisors

Harbor Capital Advisors is an asset manager known for curating an intentionally select suite of active ETFs from boutique managers. Advisors looking for distinct and differentiated investment options for their clients’ portfolios often connect with our passionate obsession to find what we believe to be the best – bold solutions that have the potential to produce compelling, risk-adjusted returns.

Important Information

1. Source: Investable Equity Markets = MSCI ACWI IMI Index (MXWDIM). Investable Fixed Income Markets = Bloomberg Barclays Global Aggregate Bond Index (LEGATRUU), as of 31 March 2021.

2. Source: Morgan Stanley Research, “Navigating the New Normal”, 8 September 2020, “The World’s 500 Largest Asset Managers”, joint study with Pension & Investments and Willis Towers Watson, Thinking Ahead Institute, October 2020, BarclayHedge Bloomberg, Morningstar Direct, and BlueCove estimates as of March 2021

All investments involve risk including the possible loss of principal. Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the value of your investment in the Fund may go down. There is a greater risk that the Funds will lose money because they invest in below- investment grade fixed income securities and unrated securities of similar credit quality (commonly referred to as “high-yield securities” or “junk bonds”). These securities are considered speculative because they have a higher risk of issuer default, are subject to greater price volatility and may be illiquid. Because the Funds may invest in securities of foreign issuers, an investment in the Funds is subject to special risks in addition to those of U.S. securities. These risks include heightened political and economic risks, greater volatility, currency fluctuations, higher transaction costs, delayed settlement, possible foreign controls on investment, possible sanctions by government bodies of other countries and less stringent investor protection and disclosure standards of foreign markets.

Diversification does not assure a profit or protect against loss in a declining market.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Foreside Fund Services, LLC. is the Distributor of the Harbor ETFs.

2836886