The Fed Means Business: Time For Dividend Growers, Not High Dividend Yielders

September 29, 2022

Executive Summary:

- Dividend paying stocks have outperformed the broad market this year as investors have sought a stable source of income amidst (until recently) low and volatile fixed income yields.

- While dividends will likely continue to represent a meaningful part of investor total returns going forward as the economy decelerates and stock multiples remain under pressure, we believe that dividend growers are poised to outperform high dividend yielders going forward.

- High dividend yielders, or bond proxies, have historically demonstrated negative correlation to rising treasury yields, which we believe will result in their underperforming dividend growers and non-bond proxies as the U.S. Federal Reserve (Fed) remains vigilant in hiking interest rates.

- Conversely, the lower dividend payout ratios and more reliable growth profile of dividend growers will likely serve as a source of resiliency and inflation protection for investors going forward.

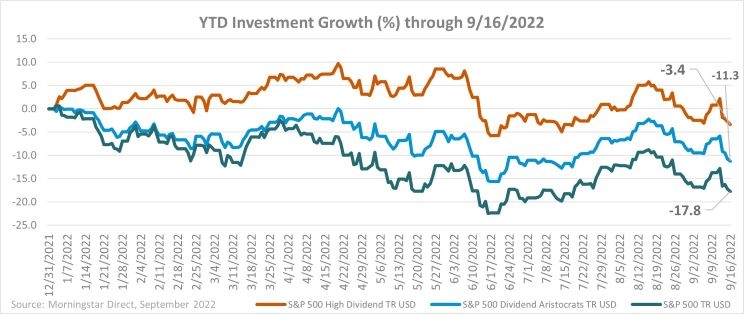

In a year where both stocks and bonds have experienced significant volatility and negative absolute returns, U.S. dividend stocks have served as a useful refuge for investors, outpacing the broad market. For example, the chart below shows the YTD performance of the S&P 500 High Dividend Index, which tracks companies with above average dividend yields, as well as the S&P 500 Dividend Aristocrats Index, which tracks companies that have regularly increased their dividend payouts over time. Both of these dividend focused indexes have handily outpaced the broad market YTD as investors have sought income potential from equities amidst (until recently) relatively low bond yields. Investors have also been drawn towards the lower valuation profile, or perceived margin of safety of dividend paying stocks vs higher duration growth stocks that have seen their high valuations compress significantly over the last year as the U.S. Federal Reserve has acted swiftly to stamp out inflation.

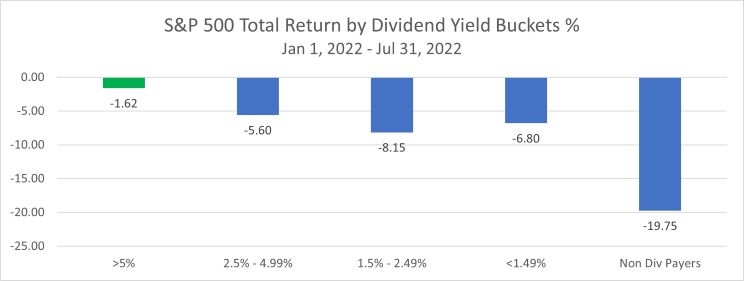

In particular, stocks with high dividend yields (often referred to as bond proxies given that investors gravitate between asset classes in search of the most attractive yields) performed very well on a relative basis for the first 7 months of the year, through 7/31/2022, as seen in the chart below.

Source: FactSet, July 2022

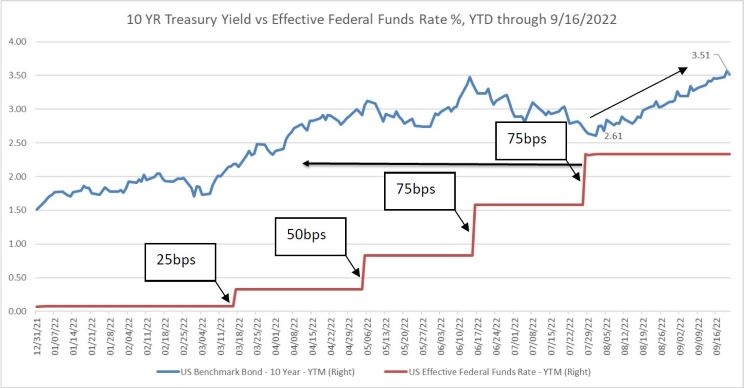

During this part of the year, interest rates (as seen by the 10 YR Treasury yield in the chart below) were rising, but were still at relatively low levels based on history and had largely flatlined between late March and the end of July as the Fed began hiking the federal funds rate. During this environment, high yielding equities (The Aug 31 weighted average dividend yield of the S&P 500 High Dividend Index was 4.84%) remained attractive relative to the 10 YR treasury yield, which averaged 2.5% between Jan 1 – July 31st.

Source: FactSet, September 2022

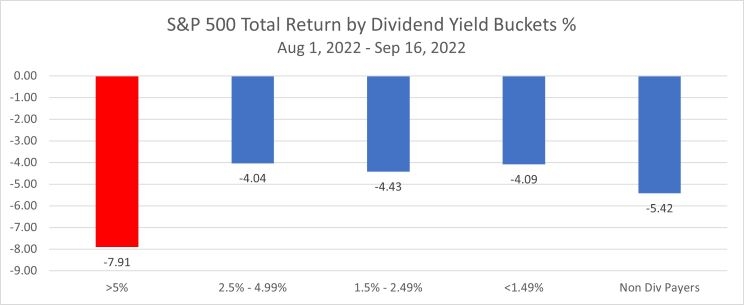

Many believed that the 10YR yield’s failure to keep pace with Fed funds increases was based on the hope that the Fed would pivot towards a more dovish monetary stance as inflation declined from peak headline levels reached in June (9.1% Year-over-Year). However, hopes of a Fed pivot have increasingly abated since early August as measures of core inflation have remained elevated and the Fed has indicated that it would remain diligent with its Fed Funds Rate increases with another 75bps increase at the September meeting. Over this more recent period (8/1-9/16), the 10YR yield has rapidly responded to the failure of this Fed pivot to materialize, rising 85bps in less than two months to the current level of nearly 3.5%. This has also coincided with a much more difficult period for the highest yielding equities, whose yields have now become less attractive relative to longer dated Treasuries.

Source: FactSet, September 2022

So where do we go from here? We believe that the Fed will continue to remain vigilant in fighting inflation, which is likely to keep interest rates high and rising for a significant period of time. It also raises the prospect of the economy entering a recession in 2023 as increasingly tightened financial conditions have an impact on labor markets and consumer spending. In these challenging environments, dividends can represent a meaningful part of total returns as earnings growth and multiple expansion potential becomes scarce. However, we believe that investors should focus on dividend growers rather than high dividend yielders going forward.

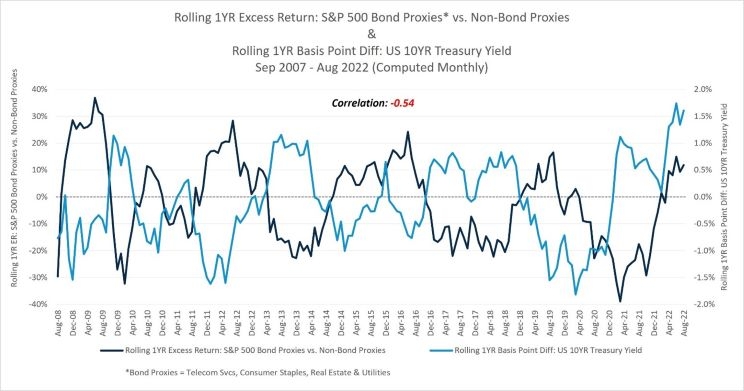

One reason is that high dividend yielders, again often referred to as bond proxies, have historically demonstrated a negative correlation to rising interest rates. Put another way, high yielding bond proxy equities (defined in the chart below as Telecom Svcs, Consumer Staples, Real Estate and Utilities companies within the S&P 500) have historically tended to underperform lower yielding equities when interest rates are rising.

Source: FactSet, August 2022

Another reason we favor dividend growers going forward is that economic growth is clearly decelerating, making it more difficult for all companies to maintain, let alone grow their dividends. We believe that companies with lower dividend payout ratios as well as track record of increasing their dividends over time will prove more resilient than companies with high current dividend payout ratios that may be difficult to maintain as the economy cools. Lastly, another benefit of focusing on dividend growers is that rising dividends can represent a useful way for investors to preserve their purchasing power amidst still high levels of inflation.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to buy a particular security.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

2451128