The Case for The Harbor Scientific Alpha High-Yield ETF (Ticker: SIHY)

February 21, 2023The Case for a Strategic Allocation to High Yield Bonds

High yield bonds are typically issued by companies with below investment grade credit ratings. In exchange for higher risks of default across the space, investors generally receive outsized yields relative to investment grade corporate bonds providing healthier streams of income for investors.

Strong Risk/Reward Profile:

High yield bonds tend to exhibit characteristics of both equities and fixed income, which can make them useful portfolio diversifiers. They have a history of offering annualized returns closer to that of equities with lower risk (standard deviation), thus making them potential equity replacements for risk-averse investors. They have also been less correlated with investment grade corporate bonds, while generating higher average yields and annualized returns for fixed income investors (please refer to the table below).

Last 20 Years as of 12/31/2022

| Name | Annualized Return | Annualized Standard Deviation | Average Yield | Sharpe Ratio | Correlation to ICE BofA US High Yield Index |

|---|---|---|---|---|---|

| ICE BofA US High Yield TR USD | 7.12% | 9.14% | 7.62% | 0.66 | |

| S&P 500 TR USD | 9.80% | 14.76% | 1.64% | 0.62 | 0.73 |

| ICE BofA US Corporate TR USD | 4.14% | 6.12% | 4.07% | 0.48 | 0.66 |

| ICE BofA US Treasury TR USD | 2.67% | 4.62% | 2.32% | 0.32 | -0.08 |

| Source: FactSet Research Systems & Morningstar Direct, February 2023 *Average Dividend Yield Applied for S&P 500 Performance data shown represents past performance and is no guarantee of future results. Index performance does not represent actual fund performance. SIHY is actively managed and does not seek to replicate the performance of a specified index. Visit www.harborcapital.com for SIHY's performance. |

|||||

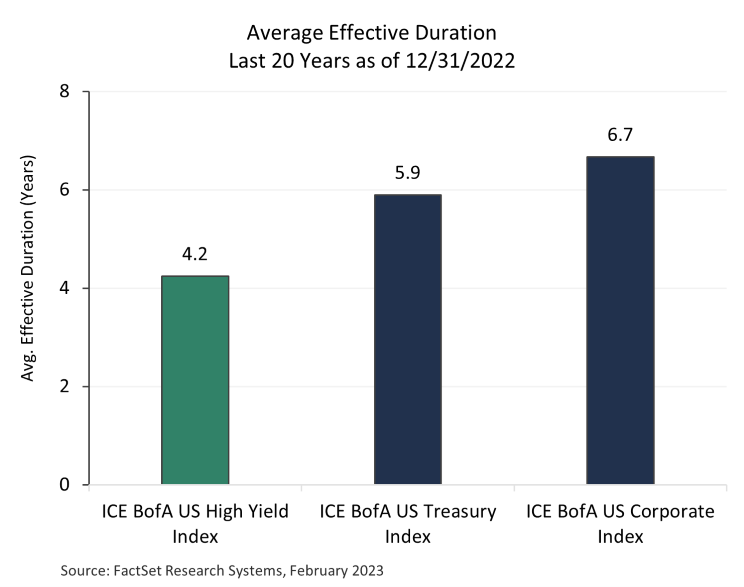

Lower Duration Profile:

As seen on the chart to the right, high yield bonds typically have relatively low duration compared to other fixed income asset classes; therefore, their returns tend to be less sensitive to changes in interest rates and more correlated to corporate earnings and business conditions. As such, high yield may outpace many fixed income asset classes within backdrops of rising interest rates or economic recovery. Amidst today’s elevated uncertainty pertaining to the future direction of interest rates or US economic growth, high yield bonds could likely serve an important role in investor portfolios as both a diversifier and a potential source of return.

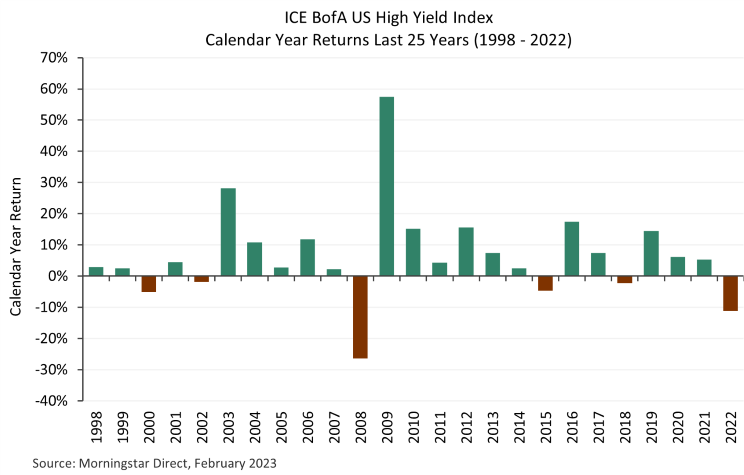

Calendar Year Return Considerations:

Per the chart below, high yield bonds have only generated negative returns in 6 of the last 25 calendar years. In addition, negative return years have been followed by solidly positive performance years over the represented 25-year timeframe. If history were to repeat itself following 2022’s challenging performance environment, patient high yield bond investors could potentially be rewarded.

The Potential Benefits of Active versus Passive Management

High yield bonds have their advantages, but they do court more credit risk than other segments of the bond market. We believe that actively managed strategies manage those risks more effectively than index funds.

- We believe active managers tend to have the skills and flexibility to select issuers with better credit profiles and construct portfolios that allocate the most to bonds with the most appealing risk/reward characteristics. In contrast, many passive strategies are weighted by market capitalization, meaning they place the greatest weight on those issuers with the most debt. Consequently, passive strategies can be more vulnerable to periods of economic stress.

- Furthermore, index funds’ rules-based approach may not allow for the flexibility required to optimally manage risk. For example, index funds may have to hold deteriorating credits as long as they remain in the index. Similarly, when a bond falls out of the index, index funds may be forced to sell at an inopportune time when liquidity is most challenged. In contrast, active managers can try to avoid troublesome creditors in the first place, and by closely monitoring portfolio holdings, active managers can strive to eliminate weakening issuers long before they are dropped from the index. Active managers also have the ability to time their purchases and sales to take advantage of forced sellers like index funds.

- Lastly, passive investing in the high yield bond space is meaningfully different versus passive investing within equities. This is mainly attributed to the lower liquidity and/or availability of issues for passive products to employ in their attempt to replicate broad US high yield Bond benchmarks.

Why Harbor Scientific High Yield (SIHY)

We believe that SIHY offers investors a distinctive solution for adding high yield to a portfolio.

Its systematic approach offers several potential advantages over traditional active management.

- Systematic investing potentially increases the probability of repeatable outcomes by minimizing cognitive and behavioral biases.

- It may minimize key person risk and improve knowledge management.

- Fixed income market conditions now allow for stronger systematic alpha opportunities given increased data sources, electronic trading advancements, enhanced issuer breadth, and a more mature market structure.

- BlueCove’s quantitative models have the capacity to harness large data sets, and the ETF enables multifactor exposure across sentiment, fundamental, and valuation signals. This substantially increases the breadth of the opportunity set, allowing for more potential alpha opportunities as well as solid diversification.

SIHY is managed by cadre of seasoned investors at BlueCove, a specialist boutique, solely focused on systematic fixed income investing.

- The quantitative models behind the strategy are created and overseen by seasoned professionals with decades of experience in high yield markets.

- Their experience allows them to construct models grounded on long-term enduring investment principles and economically intuitive factors rather than spurious non-financial signals. BlueCove’s models use many of the same inputs that traditional discretionary bond managers apply but in a systematic fashion.

- Unlike some quantitative strategies, BlueCove’s strategy is not a black box. The process is fully transparent, enabling close performance attribution, which in turn produces a virtuous feedback loop that contributes to ongoing model enhancements.

- Continuous improvement is further enhanced by BlueCove’s meticulous and robust research process, which is grounded on the principles of the scientific method. This enables the models to remain fresh and potentially resist alpha decay. We believe BlueCove has put the conditions in place to encourage the ongoing innovation necessary to maintain their investment edge.

- BlueCove’s dynamic approach is mindful of credit risk. The portfolio downplays the lowest quality segment of the universe. The strategy’s models lean into mid-quality bonds when signals show that risk is more likely to be rewarded, and vice versa.

- SIHY is one of the few active high yield bond ETFs available, providing a distinctive strategy to ETF investors at a competitive fee.

Explore SIHY

Harbor Scientific Alpha High-Yield ETF (SIHY)

(866) 313-5549 (Institutional Service Desk) | HarborCapital.com | info@HarborCapital.com | Find your Sales Rep

Annualized standard deviation is a statistical measurement of dispersion about an average, which depicts how widely returns have varied over a certain period of time. Investors use the standard deviation of historical performance to try to predict the range of returns that are most likely for a given offering. When standard deviation is high, the predicted range of performance is wide, implying greater volatility.

Average yield is the 20-year historical average effective yield for represented fixed income indices and 20-year historical average dividend yield for represented equity Index, computed monthly. Effective yield is the yield for securities with redemption options, representing the total yield an investor receives. Dividend Yield is the annual percentage of return earned by an investor dividing dividends per share by market price.

The Sharpe Ratio is a risk-adjusted measure of return which uses standard deviation to represent risk.

Correlation is a statistic that measures the degree to which two variables move in relation to each other.

ICE BofA US Corporate Index tracks the performance of US dollar denominated investment grade rated corporate debt publicly issued in the US domestic market. Index is unmanaged and does not reflect fees and expenses and are not available for direct investment.

The ICE BofA 3-6 Month U.S. Treasury Index measures the performance of U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity greater than or equal to 3 months and less than 6 months.

The ICE BofAML US High Yield Index (H0A0) is an unmanaged index that tracks the performance of below investment grade U.S. Dollar-denominated corporate bonds publicly issued in the U.S. domestic market. All bonds are U.S. Dollar-denominated and rated Split BBB and below. These unmanaged indices do not reflect fees and expenses and are not available for direct investment.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Average Effective Duration: 20-year historical average effective duration for represented fixed income indices, computed monthly. Effective duration conveys the relative price sensitivity (percentage change in price) of a security to change in interest rates.

Alpha is a measure of risk (beta)-adjusted return.

Important Information

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

All investments involve risk including the possible loss of principal. Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the value of your investment in the Fund may go down. As interest rates rise, the values of fixed income securities held by the Fund are likely to decrease and reduce the value of the Fund’s portfolio. There is a greater risk that the Funds will lose money because they invest in below-investment grade fixed income securities and unrated securities of similar credit quality (commonly referred to as “high-yield securities” or “junk bonds”). These securities are considered speculative because they have a higher risk of issuer default, are subject to greater price volatility and may be illiquid. Because the Funds may invest in securities of foreign issuers, an investment in the Funds is subject to special risks in addition to those of U.S. securities. These risks include heightened political and economic risks, greater volatility, currency fluctuations, higher transaction costs, delayed settlement, possible foreign controls on investment, possible sanctions by government bodies of other countries and less stringent investor protection and disclosure standards of foreign markets.

Diversification does not assure a profit or protect against loss in a declining market.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals. They may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

BlueCove is a third-party subadvisor to the Harbor Scientific Alpha High-Yield ETF and the Harbor Scientific Alpha Income ETF.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

2751204