Small Caps – Is it time to be greedy?

May 18, 2023

Equity markets recently have been grappling with a host of uncertainties – persistent inflation, the Federal Reserve’s continued hiking cycle, a banking crisis and heightened recession risk. Small cap stocks have been particularly hard hit in this environment, but that’s not unusual in periods like these. Small caps have tended to be more cyclical than large caps and often underperform when economic worries take center stage.

The Case for A Contrarian Stance

However, if history is any guide, the tide could soon be turning for small caps. First, a look at past cycles shows that U.S. small caps have often led in recovery rallies, and second, U.S. small caps valuations are at levels that have previously preceded strong total returns and relative returns to large caps. For these reasons, we believe that long-term investors could potentially benefit by taking a contrarian stance toward small caps.

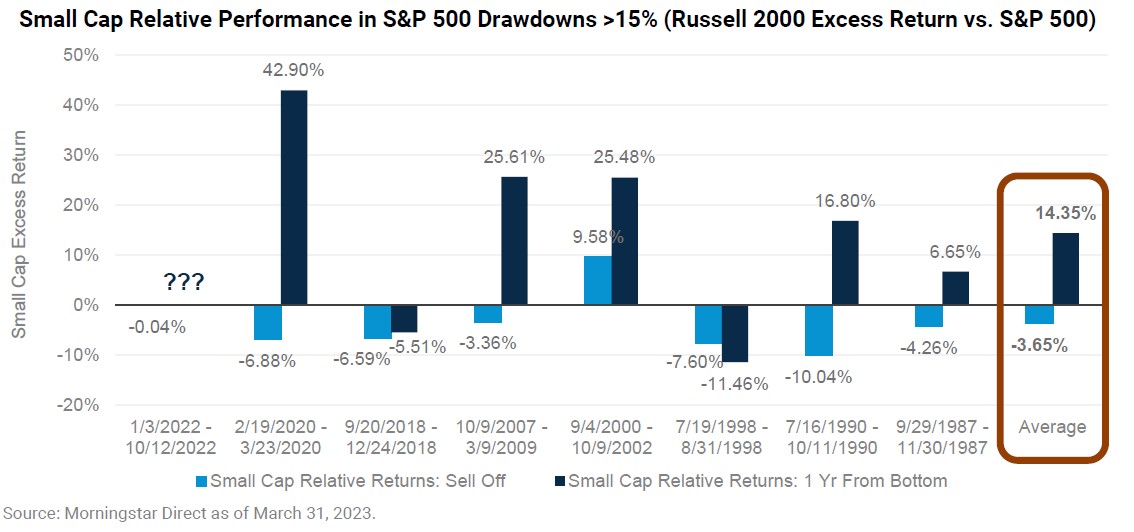

Data shows that small caps have often outperformed in recovery rallies after deep selloffs. The S&P 500 has experienced drawdowns of greater than 15% eight times since the inception of the Russell 2000 Index in 1984. The chart below shows the relative performance of the Russell 2000 during the sell-off and in the subsequent 1-year from the date of an S&P 500 bottom. While the Russell 2000 tends to lag in sell off, small caps have outperformed in the 1-year from bottom in five of seven instances for an average excess return of 14.35%.

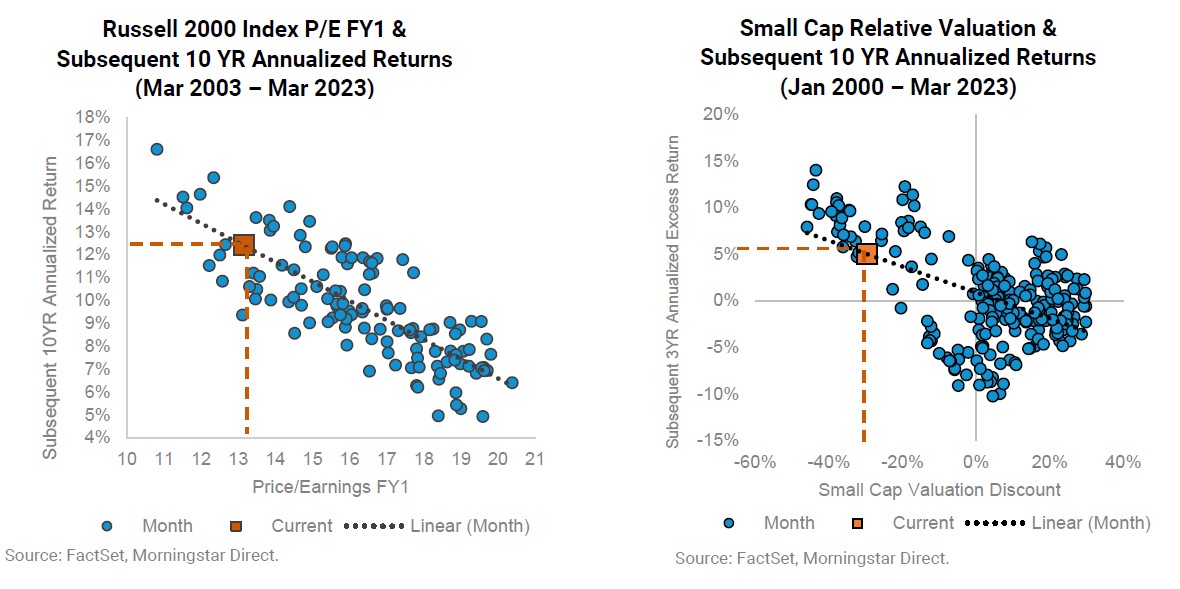

Attractive valuations also support the case for small caps. As of March 31, 2023, the Russell 2000 trades at a forward P/E of 13.2x, a -22% discount to its 20-year average of 16.8x. Meanwhile the S&P 500 trades at 18.7x forward P/E, a premium to its 20-year average. As small caps are discounting the uncertain economic outlook and large caps continue to trade at a premium, there is a wide small cap discount at -30%, levels not seen since 2001. Historically these valuation levels have led to both strong long-term total returns and strong relative returns to large caps.

Look Overseas Too

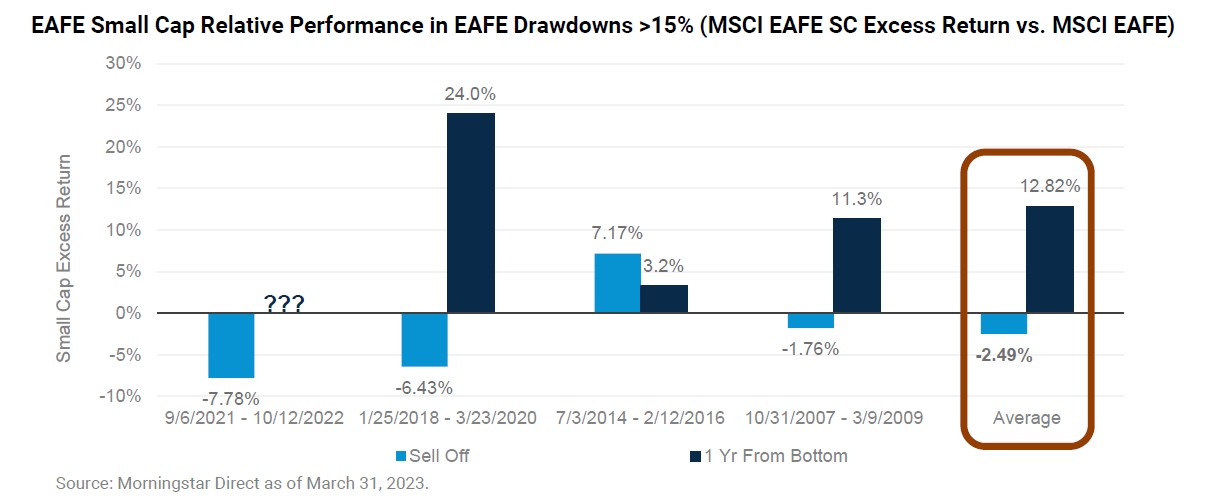

The story is similar for non-U.S. stocks. International small cap stocks have also struggled in the current challenging environment. Like their U.S. brethren, foreign small caps have typically outperformed large caps in market recoveries. The MSCI EAFE index has experienced declines of more than 15% four times since the inception of the MSCI EAFE Small Cap. The chart below shows the relative performance of the MSCI EAFE Small Cap during the sell off and in the subsequent 1-year from the date of MSCI EAFE bottom. Non-U.S. small caps have outperformed in the 1-year from bottom in all four instances for an average excess return of 12.82%.

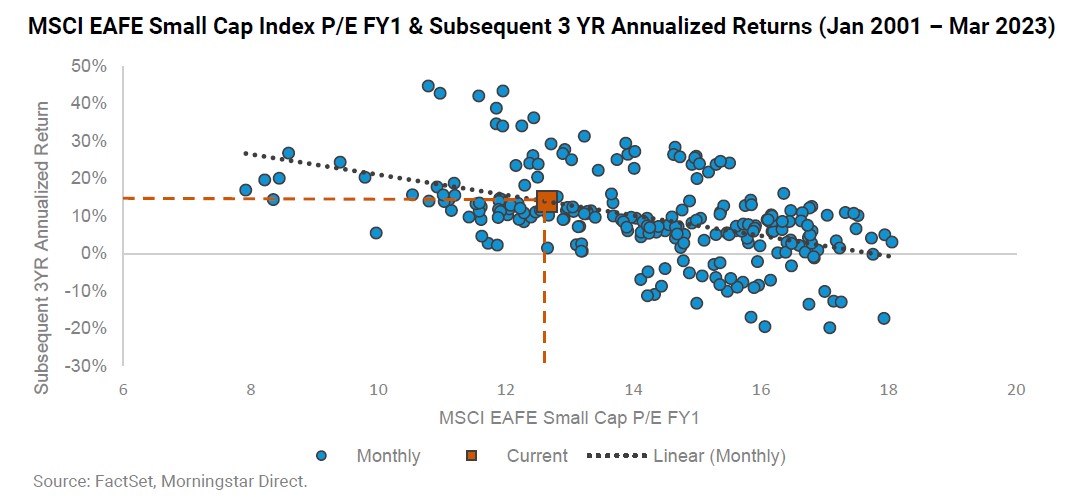

Small cap valuations also look compelling internationally. The forward P/E for the MSCI EAFE Small Cap stood at 12.6x as of 3/31/2023, which is a -12% discount to its since inception average (2001) and at levels not seen since 2012. History has shown that investing in the MSCI EAFE Small Cap Index at these valuation levels has led to attractive levels of annualized total returns over the subsequent 3 years.

Fruitful Source for Manager Selection

Because the small cap universe contains more companies with serious fundamental flaws, we believe there are more opportunities for costly mistakes. Consequently, compared to large caps, there is more dispersion between the top performing small cap managers and the bottom performing small cap managers. This may indicate manager selection is even more critical for small cap funds.

Harbor has spent decades curating best-in-class asset managers for its clients, and our experienced manager research team has found the small cap space to be a fertile hunting ground for our selection efforts. We believe our detailed bottom-up research process has led us to a handful of managers in whom we have a high degree of conviction, both now and over the long term.

Harbor’s Small Cap Lineup

When it comes to small cap strategies, Harbor has something for every investor:

Domestic Small Caps

- Single-Manager Small Cap Funds:

- Harbor Small Cap Growth Fund: Subadvisor Westfield Capital brings deep industry expertise and experience to this growth-at-a-reasonable-price strategy.

- Harbor Small Cap Value Fund: A traditional value strategy run by long-timesubadvisor EARNEST Partners, a firm known for detailed research carried outby a diverse team of senior investors.

- Thematic Index Small Cap ETF:

- Harbor Corporate Culture Small Cap ETF (HAPS): An ETF that capitalizes on research from experts at Irrational Capital, led by renowned behavioral economist Dan Ariely. Tracks an index that provides an objective and systematic way to invest in smaller companies with strong corporate cultures.

- Multimanager Small Caps:

- Harbor Multi-Manager Small Cap Explorer ETF (QWST): A collection of small cap managers that Harbor’s manager research team deems best in class with Harbor’s Multi-Asset Solutions team performing portfolio construction. The ETF provides broad exposure to small caps, making it well suited for a one-stop small cap holding.

International Small Caps

- Harbor International Small Cap: A mutual fund run by international small cap specialists at Cedar Street Asset Management. Offers value-oriented exposure to non-U.S. small cap stocks.

Important Information

Performance data shown represents past performance and is no guarantee of future results.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge. Diversification does not assure a profit or protect against loss in a declining market.

Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Risks: Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge. Diversification does not assure a profit or protect against loss in a declining market. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

Harbor Small Cap Growth Fund and Harbor Small Cap Value Fund Risks: Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Harbor International Small Cap Fund Risks: Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in

emerging market regions. Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Harbor Corporate Culture Small Cap ETF Risks: There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. The Fund may not exactly track the performance of the Index with perfect accuracy at all times. Tracking error may occur because of pricing differences, timing and costs incurred by the fund or during times of heightened market volatility. The Fund relies on the Index provider's methodology in assessing whether a company may be considered a corporate culture leader. There is no guarantee that the construction methodology will accurately assess a company to include or exclude it from the index which could have an adverse effect on the Fund's returns. The Fund's assets may be concentrated in a particular sector or industries to the extent the Index is concentrated and is subject to the risk that economic, political, or other market conditions that have a negative effect on that sector or industry will negatively impact the value of the Fund. The Fund’s assets may be concentrated in a particular sector, industry or group of industries to the extent the Index is so concentrated and could subject the Fund to the risk that economic, political or other conditions that have a negative effect on the Fund. There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Board of Trustees may determine to liquidate the Fund.

Harbor Small Cap Explorer ETF Risks: There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. The Fund’s performance may be more volatile because it may invest in issuers that are smaller companies. Because the Fund is managed pursuant to model portfolios provided by nondiscretionary Subadvisors that construct the model portfolios but have no authority to effect trades for the Fund’s portfolio, it is expected that the Advisor will effect trades on a periodic basis as the Advisor receives the model portfolios, and therefore less frequently than would typically be the case if the Fund employed discretionary subadvisors that effected trades for the Fund’s portfolio directly, which could affect the performance of the Fund. The Subadvisors’ investment styles and security recommendations may not always be complementary, and the Subadvisors' judgment about the attractiveness, value and growth potential of a particular security may be incorrect, which could affect the performance of the Fund. Since the Fund may hold foreign securities, it may be subject to greater risks than funds invested only in the U.S. These risks are more severe for securities of issuers in emerging market regions. There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case the Board of Trustees may determine to liquidate the Fund. REITs may decline in value as a result of factors affecting the real estate sector including the risk that REITs are unable to generate cash flow to make distributions to unitholders and fail to qualify for favorable tax treatment.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals. They may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

The CIBC Human Capital Index consists of a modified market-weighted portfolio of the equity securities of U.S. companies identified by Irrational Capital LLC (“Irrational Capital”) as those it believes to possess strong corporate culture based on its proprietary scoring methodology. The Index is developed by CIBC World Markets, Inc. (the “Index Provider”), Irrational Capital evaluates companies based on a proprietary, rules-based scoring methodology it developed by leveraging its research in behavioral science, data science and human capital. Constituents of the Solactive GBS United States 500 Index (the “index universe”) at the time of Index reconstitution are eligible for inclusion in the Index. Each company in the index universe that is also identified by Irrational Capital on its list of high-scoring companies (based on the most current scores as of each reconstitution) will be included in the Index. Index constituents in the same sector are weighted based on their float-adjusted market capitalizations. On reconstitution dates, the Index will target the same sector weights as the index universe. If after the Index’s weighting and capping rules are applied, a sector’s weight in the Index would be less than its weight in the index universe, the Index will hold exchange-traded funds that invest specifically in the stocks and securities of the corresponding sector (known as sector ETFs), or such other sector proxy as the Index Provider may determine, to fill the remaining weight and ensure sector neutrality as compared with the index universe. The index listed is unmanaged and does not reflect fees and expenses and is not available for direct investment.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index and Russell® are trademarks of Frank Russell Company. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The MSCI EAFE (ND) Index is an unmanaged index generally representative of major overseas stock markets. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The MSCI EAFE Small Cap (ND) Index is an equity index which captures small cap representation across developed market countries around the world, excluding the U.S. and Canada. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Dispersion refers to a statistical measure of the range of potential outcomes for an investment based on its historical volatility or returns.

Westfield Management Company, L.P. is an independent subadvisor to the Harbor Small Cap Growth Fund.

EARNEST Partners LLC is an independent subadvisor to the Harbor Small Cap Value Fund.

Cedar Street Asset Management, LLC is a third party subadvisor to the Harbor International Small Cap Fund.

Irrational Capital is a third-party index provider to the Harbor Corporate Culture Leaders ETF.

2914967