Small Cap Growth Got You Down?

March 22, 2022

Executive Summary:

- Fed Chair Jerome Powell’s comments before Congress in late November regarding “retiring transitory inflation” proved pivotal for equity markets and prompted investor rotation away from high growth/high valuation companies, and more towards securities with lower volatility profiles.

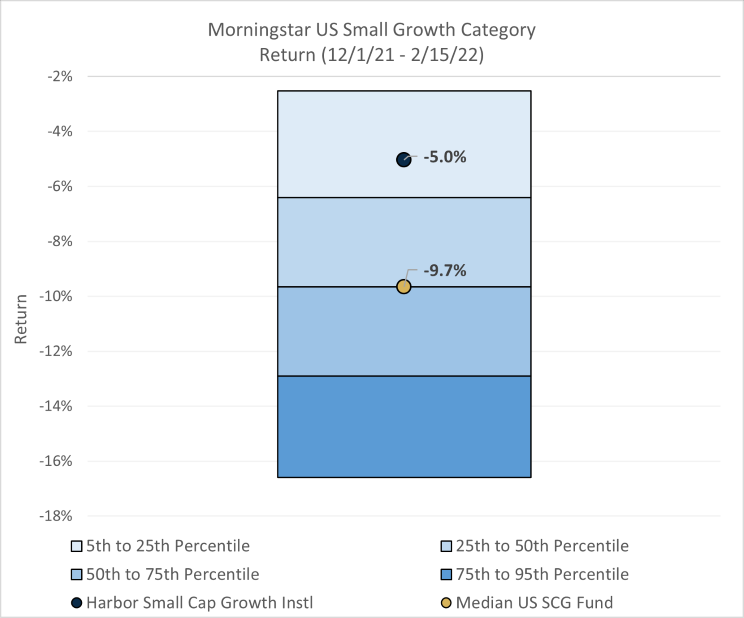

- This notably posed performance pressures for active managers across Morningstar’s U.S. Small Growth category. In fact, its median manager (institutional shares) has returned -9.7% since 11/30/2021.

- The Harbor Small Cap Growth Fund may serve as a compelling strategy in the current environment.

Below, Joe Duffy, Investment Specialist Director at Harbor Capital Advisors, Inc., outlines some of the multiple challenges that small cap growth funds face in the current environment and how investors may be better served by taking a differentiated and more disciplined active approach to investing within the small cap growth space.

Challenges Faced…

- Biotechnology and software, the two largest Global Industry Classification Standard (GICS) industries within the Russell 2000 Growth Index, declined by -21% and -15%, respectively since 11/30/2021.

- Of the 233 biotechnology companies within the Russell 2000 Growth Index, 201 posted negative absolute returns during this period (86%). Of the 78 software companies within the Index, 61 posted negative returns over the same time frame (78%).

- The bottom two Return on Equity (ROE) quintiles and the top price/earnings fy1 quintile within the Russell 2000 Growth Index declined by more than -15% during the period. This reflects decreased investor appetite for companies with the lowest profitability and highest valuations.

- Overall, stock selection and positioning within large index industries such as biotech and software, as well as exposure to less profitable companies with richer valuations have recently posed headwinds for active managers within the small cap growth space.

Differentiated Approach and results…

Harbor Small Cap Growth Fund (HASGX):

- The Fund’s investment team employs a growth at a reasonable price (GARP) approach and sets rigorous price targets to ensure adherence to valuation discipline. In addition, risk is monitored and managed throughout all steps of the investment lifecycle and from multiple perspectives.

- Since 11/30/2021, the Fund has outperformed within biotech and software, while the team’s disciplined focus on valuation, fundamentals and risk management has aided relative returns.

- Of late, HASGX has performed well versus peers, returning -5.0% since 11/30/2021 (Exhibit 1). The Fund also possesses either 1st or 2nd quartile rankings over the longer-term 1YR, 3YR, 5YR and 10YR annualized periods. See Exhibit 2 for standardized performance as of 12/31/2021. HASGX has a Morningstar rating of 4-stars and a silver Morningstar analyst rating.

Exhibit 1

Source: FactSet Research Systems

Exhibit 2

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050.

Expense ratio information is as of the Fund's current prospectus, as supplemented. Gross expenses are the Fund's total annual operating expense.

For more information regarding the Harbor Small Cap Growth Fund you can click here, access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Legal Notices & Disclosures

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. These views are subject to change at any time based upon market or other conditions, and the author/s disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results.

Investors should carefully consider the investment objectives, risks, charges, and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Stocks of small cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

The Morningstar Small Cap Growth Universe represents all funds categorized as such by Morningstar. The Morningstar Small Cap Growth Universe (MF+ETF) represents all funds and ETFs categorized as such by Morningstar. The Morningstar Small Cap High Growth Institutional Universe represents all funds categorized as such by Morningstar.

Morningstar rates funds from one to five stars based on how well they’ve performed (after adjusting for risk) in comparison to similar funds. Within each Morningstar Category, the top 10% of funds receive five stars, the next 22.5% four stars, the middle 35% three stars, the next 22.5% two stars, and the bottom 10% receive one star.

Funds are rated for up to three time periods—three-, five-, and 10 years—and these ratings are combined to produce an overall rating. Funds with less than three years of history are not rated. Ratings are objective, based entirely on a mathematical evaluation of past performance. They’re a useful tool for identifying funds worthy of further research but shouldn’t be considered buy or sell recommendations.

The Russell 2000® Growth Index is an unmanaged index representing the smallest 2000 stocks with the highest price-to-book ratio and future earnings. This unmanaged index does not reflect fees and expenses and is not available for direct investment. The Russell 2000® Growth Index and Russell® are trademarks of Frank Russell Company.

Westfield Management Company, L.P. is an independent subadviser to the Harbor Small Cap Growth Fund. Distributed by Harbor Funds Distributors, Inc.