Short-Term Pains + Potential Long-Term Gains = Harbor ETF Opportunity

August 29, 2022

Executive Summary:

- Over the past decade, equity mutual fund investors have generally grown accustomed to positive investment returns and the corresponding tax consequences via annual capital gains.

- Given performance challenges starting in late 2021, recent mutual fund investors are likely facing losses combined with potential capital gains exposures on their funds’ long-term assets. This is most noteworthy within Morningstar’s U.S. large cap growth category.

- Within this backdrop, an opportunity has now likely risen for investors to vehicle shift through tax-loss harvesting from mutual funds into more tax-efficient ETF offerings.

- As investors weigh tax implications, particularly within U.S. large cap growth, we believe the Harbor Long-Term Growers ETF (ticker: WINN) represents a compelling investment opportunity.

Examining Past & Present Conditions:

Broad market equities, as measured by the Russell 3000 Index, generated positive performance returns in nine out of the last ten full calendar years (2012 – 2021). Performance throughout this time was primarily led by the strong returns of bellwether growth companies such as Apple, Microsoft, Amazon, Alphabet and Meta Platforms. Given the strong performance of these names, as well as other impacts, U.S. large cap growth equities, as measured by the Russell 3000 Index, outperformed most other major asset categories from 2012 to 2021. Throughout this decade, equity mutual fund investors generally grew accustomed to strong return realization and the corresponding tax consequences via annual capital gains distributions.

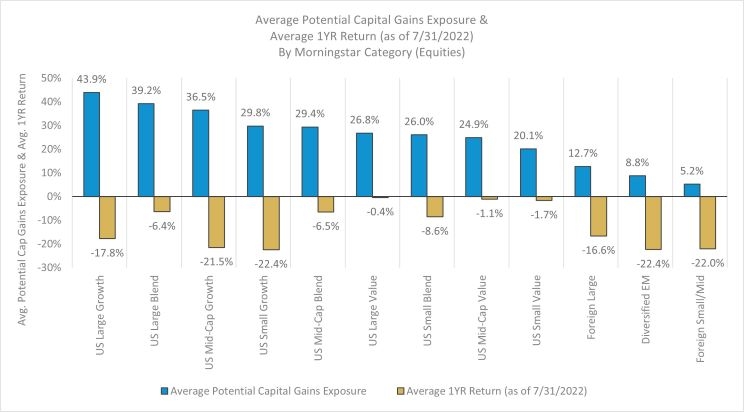

Starting in late 2021, equity markets have experienced more challenging returns across asset categories amidst a backdrop of elevated inflation, monetary policy tightening, increased geopolitical tensions and slowing global growth. Despite recent performance headwinds, many actively managed mutual funds remain longer-term focused and maintain multi-year positions in securities with unrealized gains. This means investors that have made recent mutual fund purchases have likely realized losses in 2022, however, are still susceptible to possible capital gains on the longer-term assets held by their mutual fund investments. Per the chart on the following page, this is most notably the case within Morningstar’s U.S. large cap growth category, which averages the largest potential capital gains exposure1 (43.9%) of the represented asset classes yet possesses an average 1-year return of -17.8% as of 7/31/2022.

Source: Morningstar Direct, July 2022

A Vehicle Shift Opportunity Has Risen in 2022:

Within this backdrop, an opportunity has now likely risen for investors to vehicle shift through tax-loss harvesting from mutual funds into ETFs. This shift means investors selling more recent mutual fund investments at losses and purchasing ETFs that are similar but not “substantially identical” to what was previously held to avoid the “wash-sale” rule2. This enables investors to potentially realize losses and offset future gains in their portfolios, as well as gain access to similar strategies & exposures in ETF format.

Due to the in-kind exchange of shares, ETFs generally allow for greater tax efficiency, transparency, liquidity and reduced costs versus mutual funds. Unlike a mutual fund, only authorized participants (APs) may transact directly with an ETF. APs are ordinarily large investment firms that have authorization to deal directly with the fund through a participant agreement with the fund sponsor. APs will generally create and redeem shares "in-kind" with the fund, meaning that they exchange shares, not cash with the ETF. These cashless transactions are typically not taxable events and help make ETFs relatively tax efficient.

The Harbor Long-Term Growers ETF (Ticker: WINN):

As investors weigh tax implications, particularly within U.S. large cap growth, we believe the Harbor Long-Term Growers ETF (ticker: WINN) represents a compelling investment opportunity. WINN is managed by Jennison Associates LLC (“Jennison”), an active manager with five decades of experience identifying companies with sustainable competitive advantages and significant long-term growth potential. WINN’s investment strategy seeks to exploit market inefficiencies by investing in companies with underappreciated multi-year structural growth opportunities. The Harbor Long-Term Growers ETF (ticker: WINN) ultimately enables investor access to Jennison’s seasoned Large Cap Growth team and their time-tested philosophy and approach, all within a fully transparent ETF offering enhanced liquidity and tax-efficiency.

Conclusion:

Over the past decade, equity mutual fund investors have generally grown accustomed to positive investment returns and the corresponding tax consequences via annual capital gains. However, late 2021 has ushered in performance challenges across asset classes given investor concerns pertaining to elevated inflation and decelerating global growth. This has resulted in a scenario where more recent mutual fund investors are likely facing losses combined with potential capital gains exposures on their funds’ long-term assets. This is most noteworthy within Morningstar’s U.S. large cap growth category given its average potential capital gains exposure of 43.9% and 1-year return of -17.8%.

Within this backdrop, an opportunity has now likely risen for investors to vehicle shift through tax-loss harvesting from mutual funds into more tax-efficient ETF offerings. As investors weigh tax implications, particularly within U.S. large cap growth, we believe the Harbor Long-Term Growers ETF (ticker: WINN) represents a compelling investment opportunity. WINN ultimately enables investor access to Jennison’s seasoned Large Cap Growth team and their time-tested philosophy and approach, all within a fully transparent ETF offering enhanced liquidity and tax-efficiency.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

1Morningstar’s Potential Capital Gains Exposure estimates how much the fund’s assets have appreciated, and it measures the gains that have not yet been distributed to shareholders or taxed. It is especially relevant for investors who are considering a new purchase of a fund. If there are a lot of gains embedded in the fund, the investor may potentially receive capital gains distributions for gains that happened before they purchased the fund.

2The wash-sale rule prohibits selling an investment for a loss and replacing it with the same or a "substantially identical" investment 30 days before or after the sale.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice or a current or past recommendation or solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

The Russell 3000® Growth Index measures the performance of the broad growth segment of the US equity universe. It includes Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. It is market-capitalization weighted. This unmanaged index does not reflect fees and expenses and is not available for direct investment. The Russell 3000® Growth Index and Russell® are trademarks of Frank Russell Company.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge.

Shares are bought and sold at market price not net asset value (NAV). A fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

All investments involve risk including the possible loss of principal. There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. At times, a growth investing style may be out of favor with investors which could cause growth securities to underperform value or other equity securities. Since the Fund may hold foreign securities, it may be subject to greater risks than funds invested only in the U.S. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political, or regulatory occurrence than a more diversified portfolio.

Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund.

Note about tax-efficiency: ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy. Harbor Capital and its associates do not provide legal or tax advice. Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

Harbor Long-Term Growers ETF Top Ten Holdings can be found here.

2401663