September FOMC: Playing the Same Tune

September 26, 2022

Executive Summary:

- The Federal Open Market Committee (FOMC) met market expectations with another 75 basis points hike at their September meeting alongside a forecast for a more aggressive path through 2023.

- As Chair Powell plainly stated, the message has not changed since his speech at Jackson Hole in late August: The Committee will follow-through on delivering below-trend growth to achieve their 2 percent inflation goal.

- The median outcomes in the FOMC’s Summary of Economic Projections (SEP) are plausible, but unlikely as a recession in 2023 is the most likely outcome for the U.S. economy.

- With growth slowing we anticipate a further tightening in financial conditions led by tighter credit conditions, lower earnings, and higher risk premia instead of a continuation of higher rates and only de-rating.

- We maintain our defensive posture in equities and are considering extending duration given the substantial repricing in interest rates and high-quality credit spreads.

Higher for Longer, Whatever the Cost

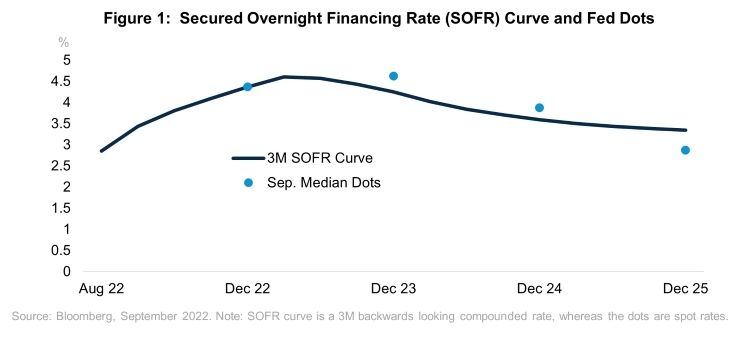

The biggest surprise following the September FOMC was the significant revisions to Committee members’ interest rate paths, the so called ‘dot plot.’ The median path implied an additional 1.25 percent in hikes in 2022, a further hike in 2023, and a gradual decline through 2025. The median path implies that the FOMC intends to keep policy tight for a prolonged period, which should continue to exert downward pressure on growth. Monetary policy orthodoxy argues that it’s the policy setting in real terms relative to a ‘neutral’ rate that effects real outcomes. The SEP’s economic forecasts show the Committee increasing real interest rates to near 2 percent, depending on realized inflation, which is significantly higher than their estimate of the long-run, real neutral rate of 0.5 percent. This restrictive policy will slow growth even when the FOMC eventually pauses.

Despite the significant revision to the median rate path, the Committee’s forecasts for growth and unemployment remain optimistic. The peak in the unemployment rate is 4.4 percent in 2023 and 2024, 0.7 percentage points higher than today, with the highest individual forecast pegging it at 5.1 percent. This outcome is plausible and relies on an argument that the uniqueness of the post-pandemic labor market may result in fewer job losses to achieve lower inflation than in prior policy tightening regimes. The counterargument is that the strength of the labor market is the result of above-trend demand, which is seen clearly in rapid wage growth and broad-based inflation. The latter seems more likely to us and renders the Committee’s modal outlook as a low probability outcome as they will need to slow growth substantially to reduce inflation. We think the Committee agrees with us on the latter point and Powell said as much during the press conference. Call it optimism maybe, but the historical record is quite clear that the FOMC rarely forecasts a recession unless the economy is already in a recession.

From De-Rating to De-Risking

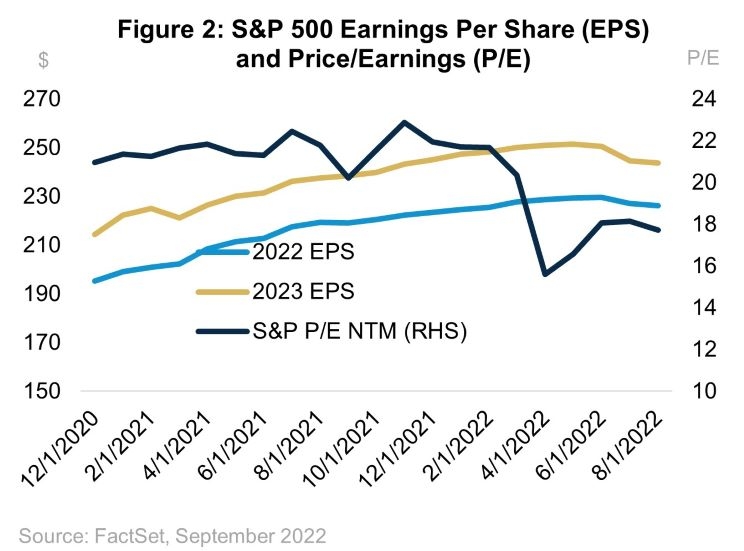

There was significant volatility following the announcement at 2 pm through the 4 pm close, but on net equites fell, credit spreads widened, the curve flattened, and the dollar strengthened in response to the hawkish rate guidance. This is more of the same for 2022 as further tightening leads to higher rates, a stronger dollar, and falling equity prices. However, year-to-date the decline in equity prices is largely a function of higher yields leading to a de-rating with the forward Price/Earnings (P/E) for the S&P falling from the low 20s to the high teens. Meanwhile earnings expectations have remained resilient. For us, the next stage is declining earnings and, with it, wider credit spreads as markets begin to price in a higher default rate for lower-rated corporates. As this transition occurs, we expect risk premia to rise across markets and fuel volatility.

There are other sources of volatility that we are focused on as well. As planned, the pace of the FOMC’s balance sheet decline doubled in September against a backdrop of lower liquidity. While balance sheet normalization is unlikely to entail active sales by the central bank, the private sector will need to absorb more duration and history shows that predicting investors’ response to balance sheet policy is difficult in the best of times. Global central banks are also becoming a meaningful source of volatility. Just this month, the Swedish central bank surprised with a 100 basis points hike that rocked their currency. The Bank of England hiked rates 50 basis points in a 5-4 vote that saw policy members vote for 3 different rate hike sizes as they confront stagflation. In Japan, the central bank’s determination to keep policy unchanged has fueled currency weakness, which prompted the Ministry of Finance to intervene to strengthen the yen for the first time since 1998. These are just a few examples of the unprecedented steps policymakers are taking globally to stem high inflation, a frequent reminder for us how unique the current environment is. And this is just the policy side of it, geopolitics continue to upend the post-crisis regime whether it is the war in Ukraine, COVID-zero in China, or other global hotspots.

The Best Course Remains the Safe Course

The first problem we face as asset allocators is the uncertain macroeconomic environment; we do not know when the FOMC will be successful nor the cost despite our confidence that they will not give up. The second, closely related problem is that volatility is high, and we expect it to remain so, which magnifies the tracking error costs associated with a given position. The combination of problems 1 and 2 are unstable relationships among assets, the most notable instance being the simultaneous underperformance of bonds and stocks year-to-date.

In this environment, we are focused on the following:

- Limiting our overall risk while positioning for some reversion in cross-asset relationships towards their long-term averages.

- Within equities, we favor profitable companies with secular growth tailwinds, the healthcare sector as an example, while also considering adding to higher beta sectors that are discounting a significant slowdown relative to overall index.

- We remain up in quality in fixed income with an overweight to investment grade credit, but increasingly skewed away from Treasuries towards corporate debt and MBS given attractive spread levels. Our medium-term view is that we will return to a lower rate environment, but elevated rate volatility makes us less willing to express this view in the short-term.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Mortgage and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and their value may fluctuate in response to the market’s perception of issuer creditworthiness; while generally supported by some form of government or private guarantee there is no assurance that private guarantors will meet their obligations.

Fixed income investments are affected by interest rate changes and the creditworthiness of the issues held. As interest rates rise, the values of fixed income securities held are likely to decrease and reduce the value of a portfolio.

Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions.

2444463