Renewables as Hope: Creating the Road Ahead in the Great Energy Transition

August 10, 2022

Harbor Capital Energy Transition Strategy ETF (RENW)

Few, if any, long-term investment themes have ever had the world’s attention like the race to transition to cleaner, renewable sources of energy. Perhaps this is because climate change is an existential crisis and solving its challenges will require us to create the road, all together, as we go. Policymakers in governments around the world are grappling with ways to best enable this rapid shift to renewables, and while they do, investors in the capital markets are already making it happen.

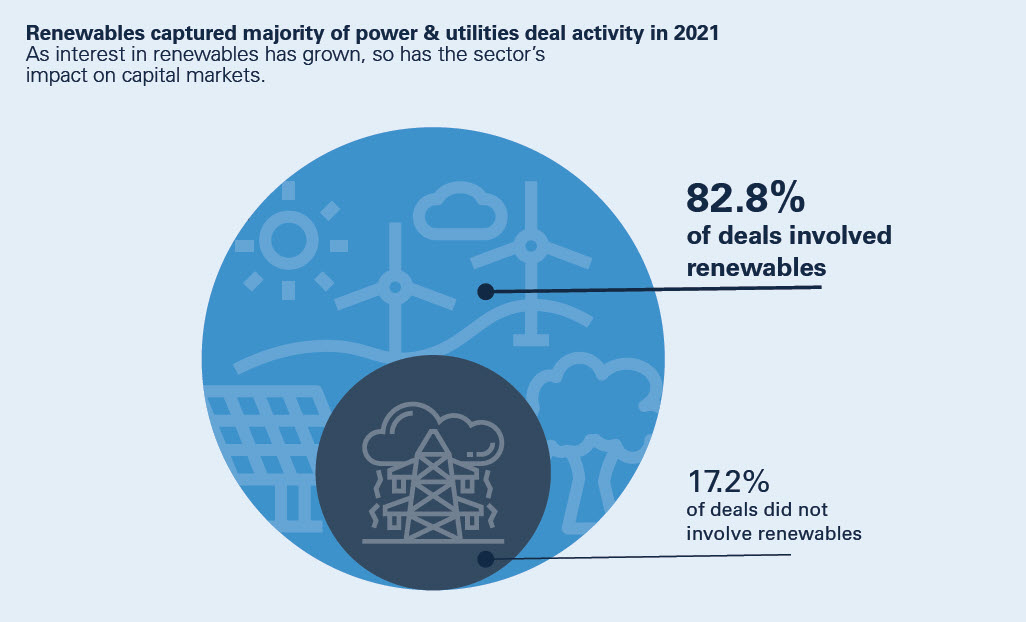

Source of data: Deloitte, 2022 Renewable Energy Outlook. U.S. announced M&A deals in Power and Utilities, 2021.

The International Energy Agency’s landmark “Net Zero by 2050” report outlined the “narrow but achievable” pathway to hitting net zero carbon emissions by 2050. It flagged a “key priority action item” for the world that is stark: Drive a historic surge in clean energy investment.

Although technology to achieve net zero exists and continues to rapidly develop, the clock is ticking and the amount of needed infrastructure to bring it within reach is staggering. It is exactly this gap which may provide unprecedented, long-term growth opportunities in high demand commodities needed to facilitate this generational energy regime shift.

Growing demand for energy transition commodities

- The infrastructure to face this challenge with a shift to renewable sources of energy must be built.

- The need, after the pandemic, to ensure greater economic and social resilience will work in favor of clean energy and distributed power sources, including solar and wind, and the many use cases for battery storage.

- Large companies are going to considerable lengths to demonstrate they are responsible corporate citizens. They’re looking for ways to sustainably source clean energy.

Investors exploring energy transition commodities have standards

- High conviction is king: Investors seeking to access this compelling theme via “environmentally-conscious” commodities often want alignment with their values. They want options that not only exclude “dirty” commodities but also target those commodities that are expected to benefit from and help facilitate the global transformation to renewable energy.

- Structure matters: Investors seeking portfolio diversification are finding few suitable ETF options. They want all the benefits ETFs confer along with the focus on energy transition with commodities.

- Experience inspires confidence: Investors rightly require a seasoned management team with the experience and skills to navigate the conditions in today’s market.

About Harbor Energy Transition Strategy ETF (RENW)

RENW is a fully transparent ETF that seeks to track the performance of the Quantix Energy Transition Index (QET). The index is comprised of commodity futures that serve one of three purposes related to the transition to clean energy:

- They are used to construct the new energy infrastructure (for example, copper, aluminum, and silver)

- They are “bridge fuels” that are less carbon-intensive and will provide energy between now and the net-zero state (for example, natural gas); or

- They incentivize investment in the new energy infrastructure (for example, carbon credits).

Use RENW to kick off compelling conversations in your next client-advisor meeting:

- Talk about values: An investment in the great energy transition may be in good alignment with an investor’s personal values system. Explore what it would mean to use deployable capital or re-allocating with an aim of investing in commodities necessary to help build the infrastructure for a more environmentally sustainable future.

- Get clear on strategy: Many portfolios would benefit from another layer of portfolio diversification, or a potential hedge to help mitigate against a protracted inflationary environment. If an allocation to traditional commodities exposure already exists, it may be appropriate to diversify that slice to include an investment in decarbonization.

- Revisit risk tolerance and goals: A broad conversation about what’s driving inflation and why it’s unlikely to end anytime soon, or any other risks of concern, can make it easier to express fears about not meeting cherished goals, or make space to explore new or changing goals that deserve a game plan.

Important Information

"Net zero emissions" refers to achieving an overall balance between greenhouse gas emissions produced and greenhouse gas emissions taken out of the atmosphere.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge. Shares are bought and sold at market price not net asset value (NAV). Market price returns are based upon the closing composite market price and do not represent the returns you would receive if you traded shares at other times.

Commodity and Commodity Linked Derivative Risk: The Fund has exposure to commodities through its and/or the Subsidiary’s investments in commodity- linked derivative instruments. The Fund’s investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities.

The Fund is non-diversified and may invest a greater concentrate of its assets in a particular sector of the commodities market (such as metal, gas or emissions products). As a result, the Fund may be more susceptible to risks associated with those sectors.

Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund.

Energy Transition Risk: The commodities included in the Index may become less representative of energy transition trends over time and the Fund’s investments may be significantly impacted by government and corporate policies.

Foreign Currency Risk: Because the Index may include futures contracts denominated in foreign currencies, the Fund could be subject to currency risk.

The Quantix Energy Transition Index (QET) was developed by Quantix with the objective of providing diversified exposure to the building blocks of the accelerating transition from carbon-intensive energy sources to less carbon intensive sources of energy using commodity futures. Commodity futures that provide exposure to the energy transition theme are considered component candidates for inclusion in the Index. Examples of component commodity candidates include copper, aluminum, nickel, zinc, lead, natural gas, silver, palladium, platinum, soybean oil, ethanol, emissions – European Union Allowances (EUA), and emissions – California Carbon Allowances (CCA). The selection of commodities is subject to periodic review by Quantix Commodities Indices (QCI). Under normal conditions, the Index maintains exposure to at least 10 commodities from its eligible universe in the United States (U.S.), Canada, United Kingdom (U.K.) and other European exchanges. Commodity futures from the component candidates are selected for the Index and weighted based on QCI’s quantitative methodology. Under normal circumstances, the Index is rebalanced on a monthly basis.

The index listed is unmanaged and does not reflect fees and expenses and is not available for direct investment.

ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold. The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Foreside Fund Services, LLC is the Distributor of the Harbor Energy Transition Strategy ETF. Quantix Commodities LP (“Quantix”) is a third-party subadvisor to the Harbor Energy Transition Strategy ETF.

2334340