Quantix Q1 2023 Newsletter – After the Landing

May 02, 2023

Macroeconomic cross currents created a very challenging investing environment in the first quarter of 2023. Conflicting signals generated significant turbulence for the U.S. Federal Reserve (“Fed”) as it attempts to navigate a “soft landing”. Overall, investors had to “fasten their seatbelts” due to unstable economic conditions. While equity markets were relatively (and somewhat surprisingly) calm through this chaos in the first quarter of 2023, the uncertainty led to heightened volatility in commodity markets.

As I have long argued, Deglobalization, the process of diminishing interdependence and integration between certain units around the world, typically nation-state and Decarbonization, the reduction or elimination of carbon dioxide emissions from a process such as manufacturing or the production of energy are featured components of the commodity market landscape and structural drivers of commodity price inflation. These forces cannot be easily addressed with central bank policy. The Federal Reserve simply does not have the appropriate tools in their toolkit. Rate hikes are designed to relieve inflationary pressures by slowing growth through credit contraction that cools demand; they do nothing to address the commodity supply issues created by these dual forces.

This does not mean that commodity markets can only go up. Demand is not irrelevant. It is feasible that a “hard landing” could cripple demand so dramatically that even with the expected low supply, markets wind up in surplus and commodity prices decline.

This, however, is not an outcome anyone is hoping for. If the objective is sustainable Gross Domestic Product (GDP) growth, the world will need an ample supply of energy to fuel it. Whether it is from traditional carbon-based sources or new alternative sources, a greater supply of commodities than the world is currently projected to have will be required. In order to stimulate that supply growth, prices will have to rise to incentivize greater production. We believe it is just that simple.

Below, we take a more detailed look into four commodity sectors to see how the themes of Deglobalization and Decarbonization are playing out:

Petroleum

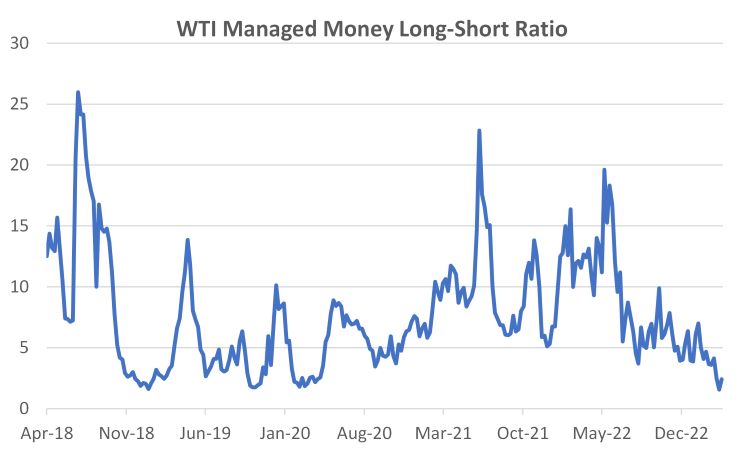

Source: Bloomberg, calculations by Quantix Commodities. Date range: Apr-18 to Mar-23

Oil market speculators were hit particularly hard by the recent macro turbulence. Consequently, pessimism reached an extreme in March, as bearish positions in response to the banking crisis reached historic proportions. In fact, the West Texas Intermediate (WTI) Managed Money Long-Short ratio, a measure commonly used in these markets to evaluate positioning, reached levels last seen at the depths of the COVID pandemic.

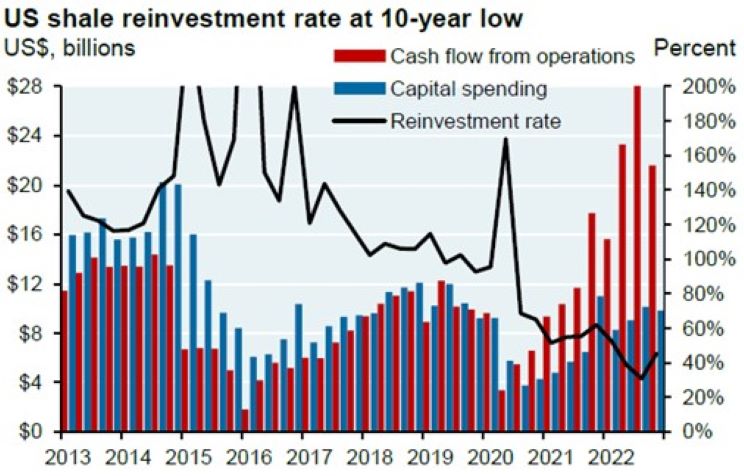

No matter how hard the landing, we believe it is difficult to justify such extreme one-sided pessimism on the same level as an environment where nearly a quarter of global demand was lost due to lockdowns. Indeed, the far more relevant, longer-term concern is about a shortage in supply. Decarbonization has led to a lack of investment in re-supply as evidenced in the dramatic decline in the reinvestment rate among shale producers, as shown in the chart from JPMorgan Asset Management below.

Source: Bloomberg. JPMAM, ‘Growing Pains: The Renewable Transition in Adolescence’, March 28, 2023

On top of this, strategic reserves have been drawn down dramatically not just in the U.S. (ostensibly to combat inflation) but more recently in France (strikes) in response to global events.

I would even argue that the recent Organization of Petroleum Exporting Countries (OPEC+) surprise production cut had more to do with deglobalization and political tensions than demand concerns. The timing of the cut – an unplanned Sunday announcement just after the U.S. Energy Secretary dismissed any imminent plans to support prices by re-filling the U.S. Strategic Petroleum Reserve – would suggest that the OPEC+ decision was at least in part politically motivated. Goldman Sachs research asserts1, and I agree, that OPEC pricing power is higher than ever and recent actions show that they recognize this.

The end result is a market that is likely to be in supply deficit through the end of the year.

Precious Metals

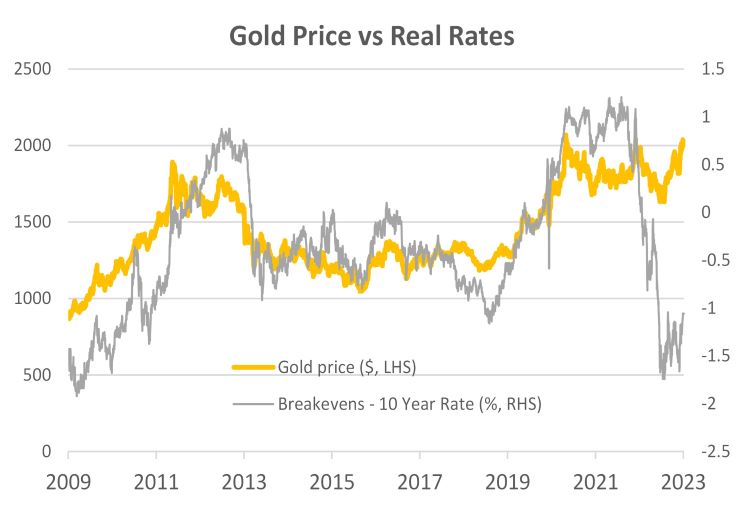

Source: Bloomberg. Date range: Apr-09 to Apr-23

Since the financial crisis, the path of real rates has been a highly reliable signal for the price of gold. As real rates rose, the price of gold fell, and vice versa.

Given the rapid nominal rate hikes witnessed in 2022, real rates rose dramatically and should have led to a precipitous decline in the price of Gold. However, that did not happen. Instead of dropping $500 (consistent with historical rate/gold relationships), gold prices remained relatively steady through the year.

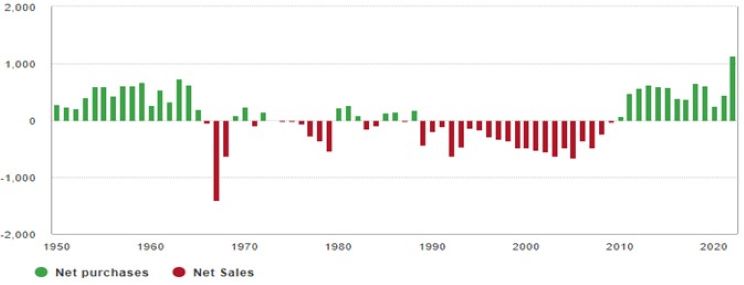

The reason for this relative strength was massive central bank demand. In 2022, these banks bought a record 1,136 tons of Gold1 worth around $70 billion, and by far the most since 1950 as can be seen below.

Central Bank Buying in 2022 was the highest on record (tons)

Source: Metals Focus, Refinitiv, World Gold Council.

In response to sanctions, Russia and China have embarked on a “de-dollarization” of their reserves and were two of the largest gold purchasers. This is further evidence of the effects of deglobalization on commodity markets and is now potentially aligned with the interest-rate cycle. As a result, we think gold prices may continue to appreciate and eventually take out the all-time highs.

Emissions

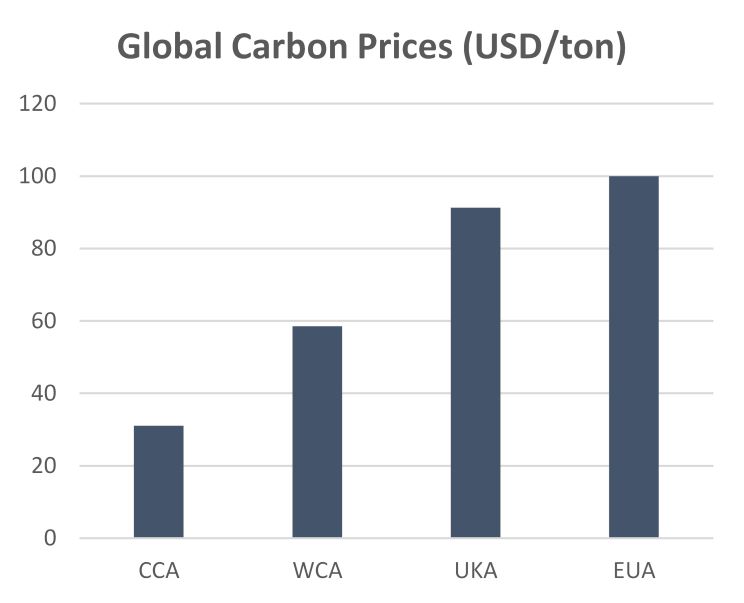

The commodity sector with the most direct impact of Decarbonization is obviously the emission markets. Governments all over the world have put a price on Carbon to achieve environmental goals, and the commitment to this cause continues to expand. Countries representing 80% of global population and 91% of global GDP have committed to “net zero” emissions targets, according to the Net Zero Tracker1, an increase from just 16% of global GDP since 2019.

Government sponsored carbon markets have been put in place to help achieve these goals. European carbon markets are the most mature and have sustained $90-$100 prices even amidst the Ukraine war and the associated historic spike in energy prices.

However, carbon prices in the more nascent US carbon markets have significantly lagged Europe due, in our view, to an oversupply of carbon credits partly because demand for carbon credits undershot regulators expectations during the pandemic. This has contributed to structural oversupply in the program, as historical issuance weighs on current prices. In recognition of that oversupply, the California Air Resources Board (which oversees the Carbon Cap and Trade (CCA) market) is making reforms to tighten supply and raise prices, expected to be approved in 2024 and take effect in 2025. Quantix expects similar reforms in other US markets.

Source: Bloomberg, Broker Quotes. As of 30-Mar-23

In many regards, U.S. Carbon markets are following the path of their predecessors in Europe. European Union Allowances (“EUAs”) initially crashed in price as the 2008 recession killed demand amidst excessive supply. The EU implemented reforms to restore the price signal by tightening supply, leading to a multi-year rally which took prices to a peak of $110 in February 2022. Europe’s emission reduction targets are similar to the targets in the U.S., suggesting there is potential for convergence at $100.

Natural Gas

I have previously discussed the perils of natural gas as an investible commodity yet there is obviously a large segment of the market that has not gotten this message. Perhaps attracted by the perceived asymmetric return possibilities of a commodity which is currently $2/MMBTU, after nearly reaching $10/MMBTU as recently as last August, investors piled into Natural Gas ETFs at an astounding pace in the first quarter of 2023, with many using ETFs to express this “buy the dip” view.

What these investors appear to be missing is the fact that they not only have exposure to spot prices through ETFs, but also the cost of carry. This critical feature of commodity futures markets—rolling futures forward to maintain exposure—is ignored by most investors.

Natural Gas is an extreme case of this effect; the commodity typically has a very negative roll yield which occurs when a market is in contango or when the future price of the asset is above the expected future spot price, and so an investor will likely lose money when rolling contracts – significantly eroding price returns. To continue the soft-landing analogy, exposing yourself to this risk is the equivalent of jumping out of the plane without a parachute. This is just one example of the many nuances of commodity markets and highlights the risk of taking a simplistic and naïve approach to the asset class. Quantix believes that commodity investors are better served by strategies that are designed to take an informed, flexible, intelligent, and long-term approach.

Like the aforementioned ETF investors, Quantix believes that Natural Gas prices will eventually rebound as producers are forced to cut unprofitable production and greater Liquefied Natural Gas (LNG) export capacity comes on-line. However, a price move is not the only component of investor returns and may be meaningfully eroded by the cost of rolling contracts forward. An investment in nearby futures may not fully capture a rebound in prices, as the forward contracts are already significantly more expensive.

Conclusion

In this and previous shareholder letters, I have argued that investors should deploy a longer-term perspective to drive investment decisions relating to commodities. This remains true even as the recent rapid interest-rate hikes have created a challenging short-term investing environment.

Events of the first quarter have proven that the flight path to a soft-landing continues to remain unclear. The recent decision by US regulators to provide emergency liquidity to stabilize regional banks may have avoided a crash landing, but in doing so we believe it simultaneously ensured more “circling of the airfield” in continuing hazardous conditions.

It is only natural for investors to fixate on every bump on this flight. However, Quantix believes the best opportunity will be revealed by stepping back and focusing on what the environment will look like once markets deplane. We believe the structural themes of Deglobalization and Decarbonization will be present wherever and whenever the plane touches down and will be supportive for commodity markets for the foreseeable future.

Important Information

1 Goldman Sachs Investment Research, “Pricing Power and the OPEC Put”, 9 January 2023

All investments involve risk including the possible loss of principal.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Commodity Risk: The Fund has exposure to commodities through its and/or the Subsidiary’s investments in commodity-linked derivative instruments. Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Commodity-Linked Derivatives Risk: The Fund’s investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Spot price refers to the price at which the commodity is being traded at the current time in the marketplace.

Net-specs refers to net speculative positions.

Net Zero refers to the balance between the amount of greenhouse gas produced and the amount removed from the atmosphere.

MMBTU is 1 Million British Thermal Units – A thermal unit of measurement for Natural Gas.

Indices listed are unmanaged, and unless otherwise noted, do not reflect fees and expenses and are not available for direct investment.

Quantix Commodities LP is the subadvisor for the Harbor Commodity All-Weather Strategy ETF and the Harbor Energy Transition Strategy ETF.

2881346