Quantix Newsletter Summary – January 2023

February 10, 2023

In this environment, many investors are realizing that the next decade will likely look very different to the previous decade and therefore a revised asset mix is required to optimize their portfolios. Given the realities of the next phase of the business cycle, commodities can play a vital role to help generate beneficial & diversifying returns in a number of different ways across both alpha and market-based exposures.

State of the Markets

In the Quantix 2021 year-end letter, inflation was an emerging concern for markets. I had been writing about this issue since early 2020 and warning investors that it was more serious than many, including the US Federal Reserve (“the Fed”), had thought.

Eventually, rising commodity prices, exacerbated by supply problems emanating from Russia’s invasion of Ukraine, helped drive the highest inflation prints in decades. Central bankers eventually recognized the threat and became much more aggressive in their efforts to combat inflation through rapid rate hikes and quantitative tightening. This resulted in an historic correlated collapse in equity and bond markets. At its trough the hypothetical 60/40 portfolio was down more than 21% and finished the year with the worst annual performance in real terms in almost a century.

In contrast, commodity markets rocketed in the first half of the year to new all-time highs on a spot price basis. Though they retreated in the second half of the year, they still shined as a relative outperformer with the Bloomberg Commodity Index (“BCOM”) finishing up 14%.

At the start of 2023, the focus of financial markets seems to be whether central bankers can navigate a soft-landing by putting a lid on inflation without causing a recession. While it is not clear to me if they can achieve this monumental task, the outcome doesn’t really change my opinion of portfolio construction.

My core view is that there is a disconnect between equity market performance/forecasts and the shape of the yield curve. I cannot understand how we have a steeply inverted yield curve with a buoyant equity market (up 10% from the October lows) and market pundits calling for positive returns in 2023. The only way I see rate cuts materializing this year is a rapid and serious recession, which is not my base case.

It’s almost as if some investors believe that the landing will be so hard that the Fed will immediately become so accommodative in such a way as to actually support the equity market. While this was the dynamic of the last 14 years, this scenario recurring seems highly unlikely to me. After all, the Global Financial Crisis (“GFC”) and recent pandemic were extraordinary economic shocks of an extreme nature. The accommodative policies enacted in response were unprecedented and, while they may have persisted for a prolonged period of time, I do not believe they are the norm.

Some investors seem to believe (or perhaps hope) that the Shangri-La for the 60/40 portfolio is again right around the corner, but I believe those days are over. The reality is an investing world filled with much greater uncertainty. In such an environment, it is only prudent to seek diversification through alternative asset classes.

This brings us to the implications for commodity markets. During the post GFC recovery, opportunities in commodity markets were slim and investment returns lackluster. With cheap credit and a search for yield, commodity producers were able to provide ample supply. Accommodative monetary policy made equities and bonds much better investments.

This dynamic has radically shifted over the past couple years and created a seriously underappreciated investment opportunity. The decarbonization and deglobalization themes that I have discussed in the past are structural in nature and show no signs of reversing any time soon.

Recent legislation suggests that the global commitment to net zero is as strong as ever and with risk-free rates rapidly rising, producer access to financing capital is waning for reasons beyond tepid investor appetite.

In addition, deglobalization has seriously disrupted commodity supply chains with major implications. Despite increasing exports to China and India, western sanctions on Russian oil (due to expand to products on February 5th) will inevitably lead to a decline in production levels.

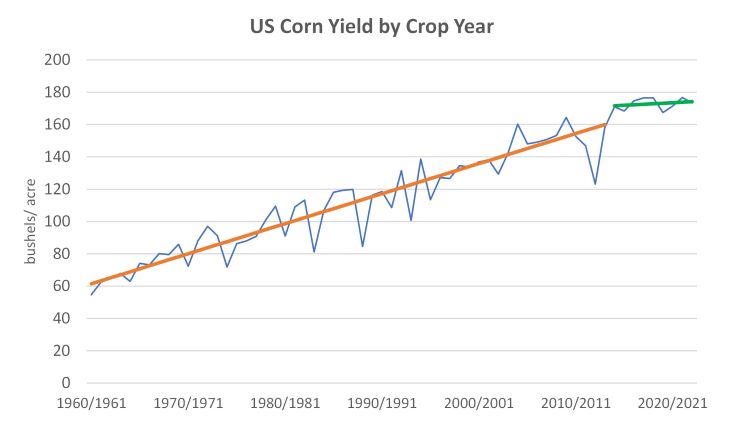

Source: Chart by Quantix Commodities, data from USDA, https://apps.fas.usda.gov/psdonline/app/index.html#/app/advQuery

The projected deficits are not just confined to the petroleum sector. Many commodity markets are now in deficit and likely to remain so. For example, Quantix believes that corn production will struggle to attain minimum pipeline inventories in the upcoming crop year.

As seen in the chart, the advances in yield that have come from GMO (genetically modified seeds) over the last 60 years have started to taper off, longer-term trendline yield growth projections seem overly optimistic relative to recent observations.

Amazingly, the lack of investor capital flow has not just been to commodity producers but also the commodity markets themselves. One would think that shortages created for the reasons above would lead investors to see the potential for higher commodity prices as demand exceeds supply. In fact, the opposite has occurred! Investor positioning in commodity markets has shrunk across all investor market segments.

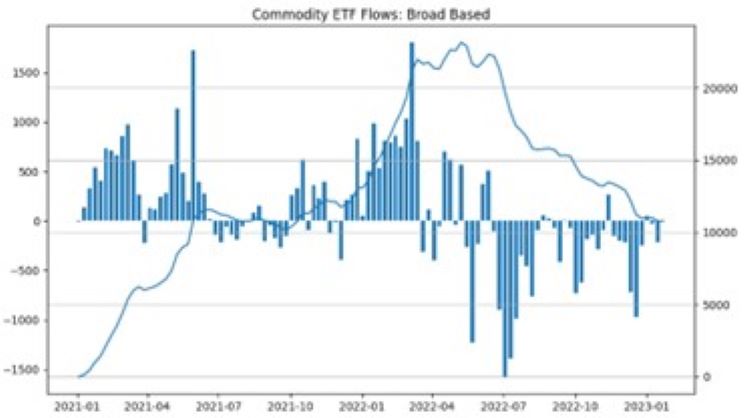

Source: Calculations by Quantix Commodities, data from Bloomberg. Bar chart: left hand axis, USD mm.

In the retail segment, the chart evidences significant outflows in commodity retail products (ETFs) with a net outflow of USD10bn in the second half of 2022.

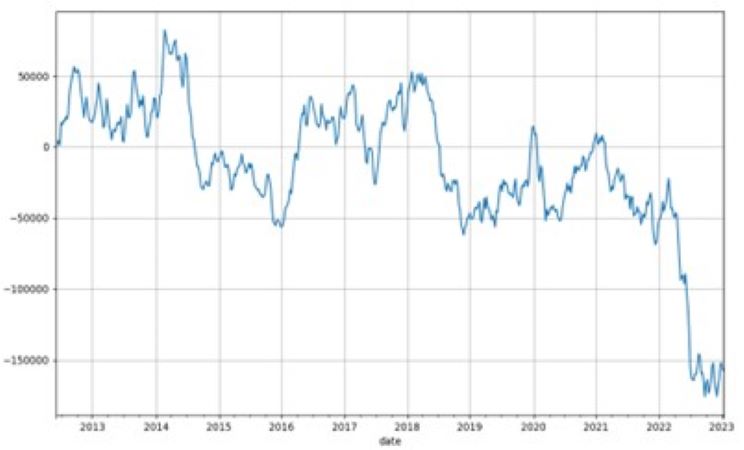

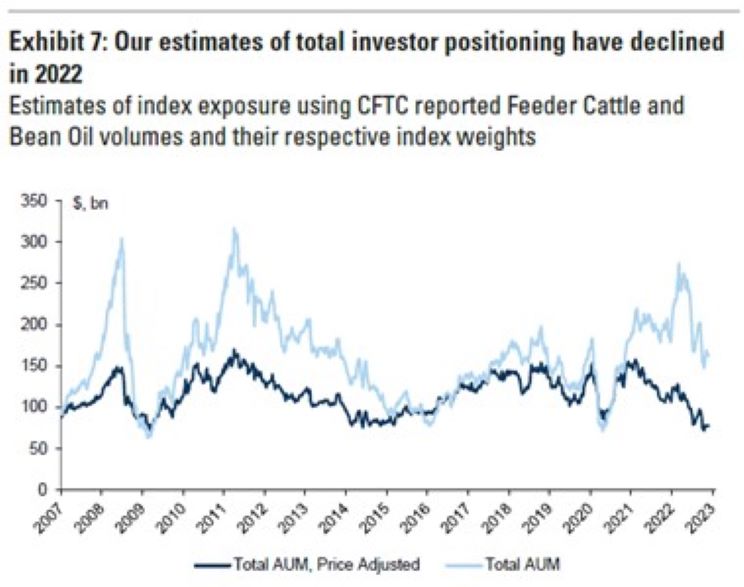

The flows were even more pronounced in other client segments. Market specialists (Commodity Futures Trading Commission net-specs) took over USD100bn out of commodity markets in 2022 and passive institutional investors (estimated commodity index length) are at their lowest levels in over 15 years.

Cumulative Week-on-Week Change in Net Spec Positioning

Source: Calculations by Quantix Commodities, data from Bloomberg and CFTC. Left hand axis, USD mm.

Source: Goldman Sachs Global Investment Research “2023 Commodity Outlook_ An underinvested supercycle” 14-Dec-22, Bloomberg, CFTC

Given this data, it is impressive that commodity markets still had positive returns in 2022. Think what the potential returns and price levels, with all the relevant implications for inflation, may have been if we had not seen this outflow from the markets.

With the context of these flows, this also points to the strength of the underlying fundamentals and suggests any shift in investor sentiment may trigger the potential for substantial gains.

Conclusion

Alternative asset classes will naturally draw more attention in periods of poor returns for the biggest asset classes, such as equities and bonds. Quantix strongly believes that commodity markets can provide diversifying value to investor portfolios, particularly in these more challenging times.

Important Information

All investments involve risk including the possible loss of principal.

The views expressed herein may not be reflective of current opinions, are subject to change without prior

notice, and should not be considered investment advice.

Commodity Risk: The Fund has exposure to commodities through its and/or the Subsidiary’s investments in commodity-linked derivative instruments. Authorized Participant Concentration/Trading Risk: Only authorized participants (“APs”) may engage in creation or redemption transactions directly with the Fund. Commodity-Linked Derivatives Risk: The Fund’s investments in commodity-linked derivative instruments (either directly or through the Subsidiary) and the tracking of an Index comprised of commodity futures may subject the Fund to significantly greater volatility than investments in traditional securities.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

60/40 portfolio refers to an investment portfolio made up of 60% stocks and 40% bonds.

Spot price refers to the price at which the commodity is being traded at the current time in the marketplace.

Net-specs refers to net speculative positions.

Net Zero refers to the balance between the amount of greenhouse gas produced and the amount removed from the atmosphere.

Alpha and market-based exposures refers to actively managed and passively managed strategies, respectively.

The Bloomberg Commodity TR USD Index measures the performance of future contracts on physical commodities which traded on US exchanges and London Metal Exchange. The commodity weightings are based on production and liquidity, subject to weighting restrictions applied annually. The FTSE Nareit All Equity REITs TR USD index measures the performance of all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria. A REIT is a company that owns, and in most cases, operates income- producing real estate.

Indices listed are unmanaged, and unless otherwise noted, do not reflect fees and expenses and are not available for direct investment.

Quantix Commodities LP is the subadvisor for the Harbor All-Weather Inflation Focus ETF and the Harbor Energy Transition Strategy ETF.

2739054