October CPI: Heading in the Right Direction

November 11, 2022

Executive Summary:

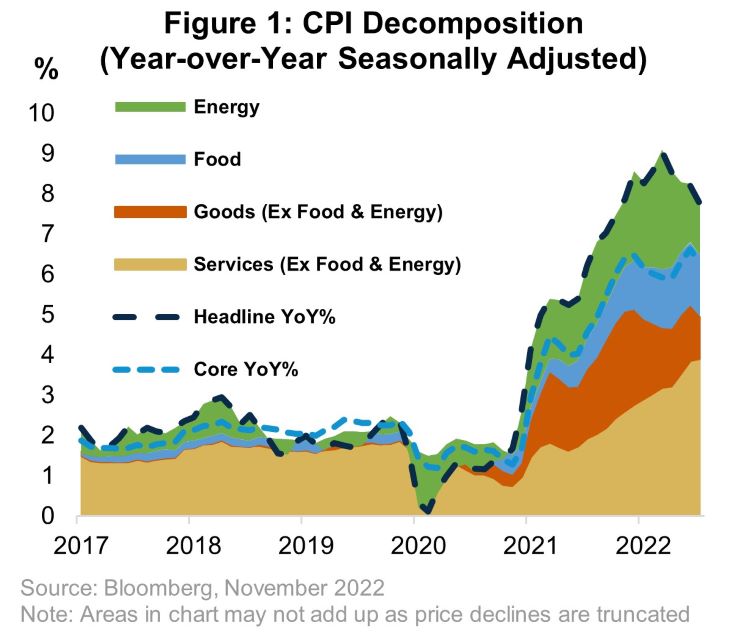

- U.S. October Consumer Price Index (CPI) data surprised to the downside with headline and core CPI falling to 7.7 and 6.3 percent, respectively. The source of the surprise largely stemmed from sectors of the economy most affected by the pandemic and the war in Ukraine: food, energy, and goods prices.

- The long-awaited deflation in goods prices arrived and we are optimistic that it will continue to provide an offset to high services inflation in the months to come as forward-looking measures indicate increasingly bloated inventories amid slowing demand.

- Rental and owner’s equivalent rent (OER) inflation decelerated somewhat; however, shelter inflation will remain elevated given the delayed pass-through of new rents to CPI.

- The notable deceleration in inflation is welcome news to the Federal Open Market Committee (FOMC) and the market. But we advise caution before overreacting, the Committee will not be taking any victory laps yet nor should you expect a material pivot in the Federal Reserve’s (Fed) path in response to one data point. Expect a 50-basis point hike in December and a more measured pace of increases in 2023.

- While lower inflation is undoubtedly a short-term positive, growth is slowing and the impact of much of the Fed’s tightening cycle is still to come. We remain cautious on risk assets and are increasingly confident that fixed income yields offer an attractive alternative.

Finally, Some Good News

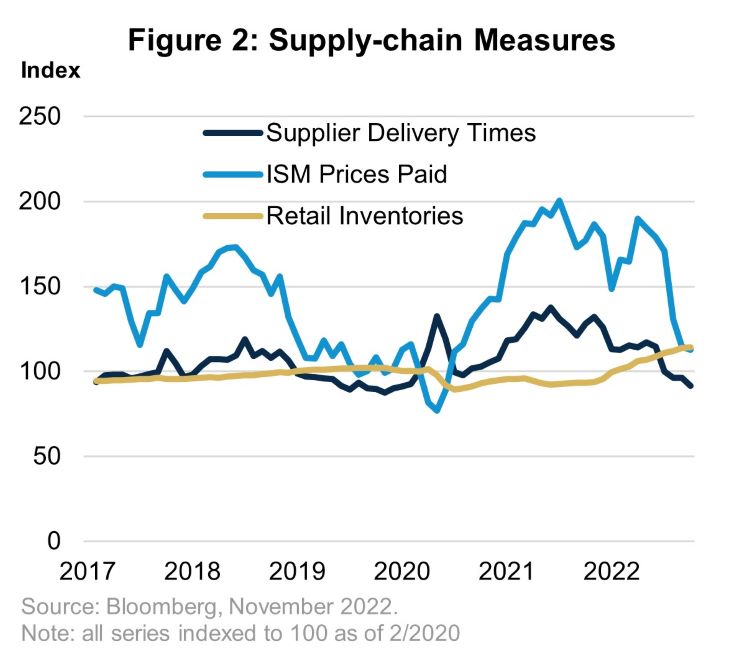

The most important revelation in the October CPI print is that goods prices, think of items like cars, TVs, and couches, are falling, which is a critical step on the path to 2 percent. Goods prices declined 0.4 percent monthover- month with vehicle prices being the largest drag. As a reminder, goods prices were the main source of what was mistakenly termed ‘transitory’ inflation as supply chains were damaged following the pandemic amidst a surge in demand given the pandemic’s effect on services consumption. In hindsight, we now know that elevated goods demand was also a sign of high aggregate demand, which is evident in the broad strength in services inflation. So, the necessary sequence for inflation to return to 2 percent entails core goods declining first as supply-side factors wane, meanwhile the FOMC’s tighter policy catches up to demand-driven inflation.

The October data confirms that core goods prices are trending lower and forward-looking indicators point to further price declines. Supply chain measures including freight costs, and supplier delivery times and prices paid are normalizing. Inventories are rising as supply chains improve, demand slows, and the other side of the bullwhip effect comes to pass. Not only is aggregate demand slowing, but demand for goods specifically has declined as consumer preferences shift back to services as the pandemic ebbs. The ultimate extent of goods deflation is uncertain, but we anticipate a rapid decline given our expectation that the U.S. economy will enter a recession in 2023. Furthermore, it is worth keeping in mind that goods deflation was the norm prior to the pandemic wherein the index of overall goods prices fell between 2010 and 2020. There may be further surprises in store for goods prices, but we are confident that services inflation will dictate the way forward for the FOMC from here.

What Slows First? Services Inflation or Aggregate Demand?

The news on services inflation was positive as well. Rental and owner’s equivalent rent inflation, the two largest components of core inflation, decelerated albeit at extremely high levels. As expected, medical care prices, which comprise a much larger share of the Fed’s preferred measure Personal Consumption Expenditures (PCE), declined and will continue to do so in the months ahead. The other services sectors were a mixed bag but offered few material surprises. After months of closing the door, the opening to a soft landing grew a bit wider following the October CPI.

The open question is whether the Fed has done enough, the right amount, or too much. Further complicating the question are the long and variable lags of monetary policy against a backdrop of elevated inflation. The latter condition forced the FOMC to adopt a risk management stance that favors doing too much rather than too little given the threat posed by high inflation to anchored expectations. Forward-looking indicators on growth and inflation point to the FOMC likely tightening too much at the expense of a recession. Meanwhile, a soft-landing requires a rapid normalization in services inflation and a resilient labor market, which would allow the FOMC to ease policy after the first half of next year.

We think the evidence supports our view that the Fed’s interest rate path will lead to a recession in 2023 rather than a soft landing. First, the U.S. economy is already slowing significantly. Final sales to domestic purchasers, a measure of underlying domestic demand, is running well below trend in 2022. While the labor market has remained resilient, anecdotal reports of layoffs and increasing pessimism among U.S. businesses suggest softer labor markets ahead. Second, the full effects of Fed tightening are still to come. Without pinning down an exact estimate of how many months or years it takes, we are confident that its longer than the 12 months that have passed since markets began pricing in a hiking cycle in earnest. Third, we do not expect services inflation to normalize quickly because of the lagged effects of past rent increases and elevated wages.

Deflation at What Cost

We are more confident today than yesterday that sustained, high inflation will not occur. With lesser confidence, we are reducing the probability of a deeper slowdown as the FOMC now has more room to maneuver than previously. However, our expectation for the most likely outcome, a recession in 2023, is little changed. With that in mind, our preference for high-quality, defensive exposures in both equities and fixed income remains. At the margin, we are upgrading our view on duration given the lower likelihood of higher terminal rate outcomes or a permanent shift in investors’ long-run inflation expectations.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2590351