May FOMC: Positioning For a Pause

May 05, 2023

Executive Summary:

- The Federal Reserve (Fed) increased the target range by 25 basis points to 5-5.25 percent, which we think marks the end of the hiking cycle as risks are piling up.

- The Fed’s assessment noted that the labor market continues to be resilient, while inflation is subsiding at a gradual pace. We think the bar for further hikes is a material acceleration in inflation, something that we think is a low probability event.

- The focus is how long can rates stay elevated. Chair Powell insisted that the Committee’s central forecast means rates will likely remain above 5 percent through 2023, however, the primary unknown is the size of the credit contraction resulting from recent bank failures.

- Our view is that the probability of a recession is a coin flip. With these odds, uncompelling valuations leave us underweight risk across our portfolios.

The End of The Road

Changes to the Federal Open Market Committee (FOMC) statement were modest and consistent with market expectations based on the limited price response. The Committee upgraded their assessment of recent trends in the labor market, noting robust gains in recent months. Non-farm payrolls increased by more than 300,000 jobs per month on average during the first quarter, although the March and April labor market data indicates softening. The FOMC offered a more definitive assessment that overall credit conditions are tighter in response to recent bank failures. Most importantly, the Committee dropped its guidance of additional policy firming in favor of evaluating whether additional rate increases will be necessary.

During the press conference, questions zeroed in on the likelihood of a pause at their next meeting. Powell noted that a realization of the Committee’s central forecast would mean no rate cuts unless inflation falls more rapidly than the gradual normalization embedded in their path. However, Powell’s response was more muddled on the possibility of additional hikes. He relied on the data dependence language that has become gospel for Committee members lately rather than talk specifically about conditions that might argue for more. The lack of clarity on the rate path stems from the Committee’s uncertainty about the substitutability of credit tightening for rate increases given recent bank failures. We expect the Committee to keep rates on hold at their next meeting given banking system concerns and the added overhang of the Debt Ceiling.

The Two Unknowns: Banks and Brinksmanship

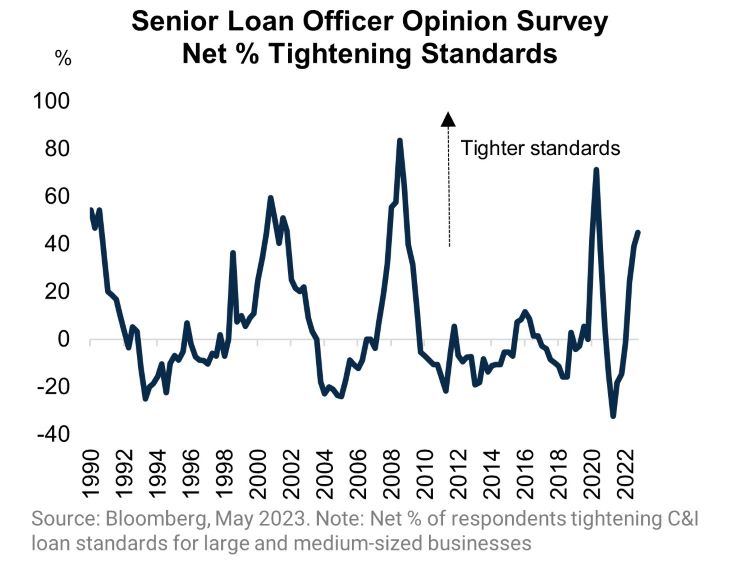

Discussion of the state of the U.S. banking system comprised much of the press conference as it likely brought this hiking cycle to a premature end. The most telling answer from Chair Powell was in response to whether he would be willing to share early insights into the Senior Loan Officer Opinion Survey (SLOOS), data scheduled to be released next week. He said that the data would not be surprising given trends in related data and Q1 bank earnings. Our read of his answer is that the SLOOS will show a further deterioration in borrowing conditions, a measure that is highly correlated with subsequent credit growth. We think this is the extent of the Fed’s knowledge at this point. Banks are going to reduce lending to the real economy and the volatility of deposits within the banking system has subsided. However, neither of these conditions must persist. Outside of a material reacceleration in inflation our view is that the Committee’s concerns about the banking system outweigh the benefits of an additional hike or two.

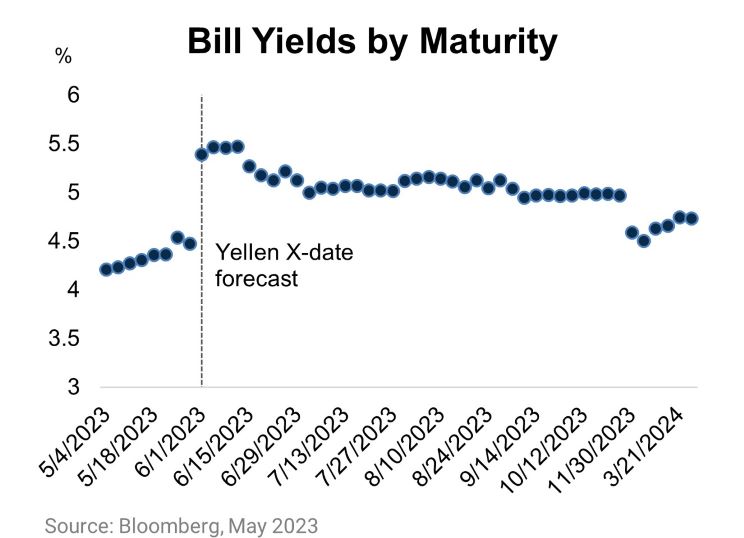

Beyond banking stress, the debt ceiling is an additional hurdle to hiking again at their June meeting. Recent guidance from Treasury Secretary Yellen and the Congressional Budget Office indicates that the government may run out of funds as early as June 1st. Markets are reflecting this concern with at-risk Treasury bills trading at a significant concession to surrounding issues. We expect negotiations to come down to the wire given narrow majorities in both Congressional bodies and partisan differences, but ultimately a deal should happen. Using June 1st as the deadline for a deal, guidance from FOMC members may be more limited this upcoming cycle as they are loathe to comment on fiscal matters and their blackout period starts June 2nd. Assuming the above allows the Committee to focus on real economic issues at their June meeting. However, in the event of a default, all options are on the table. The Fed would resort to market functioning measures and providing liquidity initially, before quickly cutting interest rates if a default persists for more than a couple of days. Daily budget deficits amount to around $10 billion per day, meaning a default results in an immediate contraction in spending worth 10 percent of GDP.

Keep On Keeping Risk Low

While we think this is the last Fed hike for this cycle, we do not think it is a signal to add risk to our portfolios. The Fed retains a hiking bias meaning the Committee is far from contemplating rate cuts in the near-term. Add to that the fact that growth is running below potential and regional banks remain under duress, we think risk is skewed to the downside as the risk of a recession is elevated. On a full portfolio basis, we are below our benchmarks’ betas (β). Within fixed income, we prefer high quality spread products, particularly Agency mortgage-backed securities where spreads have been under pressure from high interest rate volatility and concerns about sales from regional bank portfolios. Our equity portfolios continue to tilt towards quality growth names and sectors.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Beta (β) is a measurement of volatility or systemic risk of a security or portfolio relative to the market.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2887973