Asset Allocation Viewpoints & Positioning Q2 2022

July 22, 2022

Macro Landscape

How slow will we go? What will it take to tame inflation?

- With inflation north of 8 percent, the Federal Reserve is rapidly tightening policy before high inflation expectations become entrenched. First it was a 25, then a 50, then a 75 basis points hike, marking the largest increase since 1994.

- As the Fed plays catch up, the 60/40 portfolio is on pace for its lowest return in decades. These tighter financial conditions are beginning to move beyond financial markets into the real economy.

- Housing market activity is slowing. High mortgage rates and home prices are weighing on affordability. Slowing mortgage applications, lower existing home sales, and increasing months of supply all point to lower prices.

- ISM new orders and other leading indicators show the slowdown is expanding beyond housing. However, earnings estimates have remained resilient thus far despite the headwind. We do not expect this to last much longer.

- The key question is whether the expected Fed path is enough to reduce inflation or whether further tightening will be required. It’s a race between the prospect of declining goods and shelter costs on the one hand against higher commodity prices and budding wage pressures on the other.

- Commodity markets remain historically tight with Europe on the precipice of a gas crisis. However, fears of a slowdown in developed markets have been a drag on spot prices with broad commodity indices well off their highs.

- Key risks: 1) Inflation; will anchored inflation expectations provide enough ballast; 2) Can global growth survive the loss of Russian gas supplies to Europe; 3) How far do corporations need to revise earnings expectations lower 4) Is the old playbook of stimulus via infrastructure investment enough to accelerate China’s growth amid COVID-zero policies 5) will Bank of Japan monetary policy continue to diverge from its peers or will Yen weakness be its undoing

Tactical Asset Allocation & Market Themes

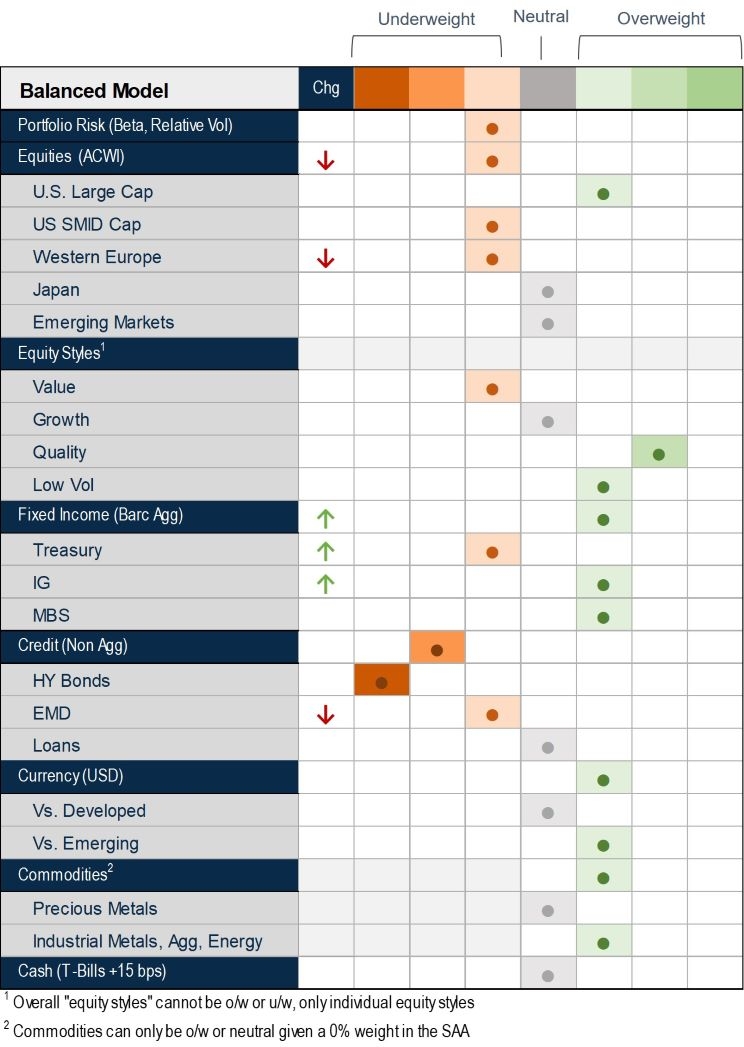

Asset Allocation Action Items:

- Move to an equity underweight with a bias towards defensive sectors; prefer Healthcare and Low Vol

- Move to underweight on Europe vs. Emerging Markets (EM), Japan, and U.S.

- Maintain large underweight to credit

- Move high quality fixed income and duration to overweight

Source: Harbor MAST; Positioning as of July 2022

Equity Markets

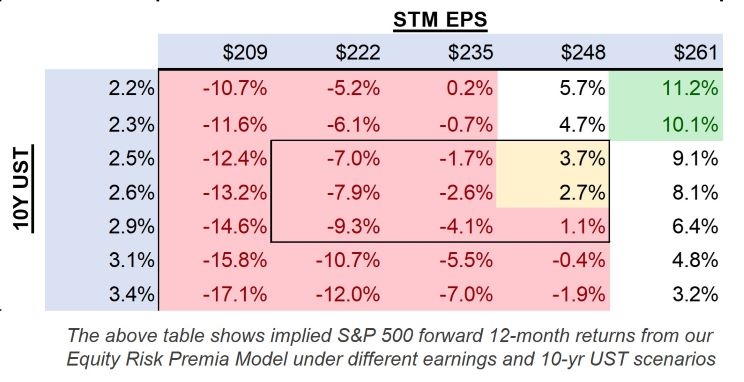

We downgrade equities to an underweight as we expect downward earnings revisions in the months to come, even despite the significant derating seen year-to-date. We also maintain our exposure to defensive sectors such as Healthcare. We are further underweight risk both within our equity portfolios, given our overweight to defensive and high-quality sectors/styles, and across our broader multi-asset portfolios given our large underweight to credit and modest underweight to equities.

Tighter financial conditions engineered by global central banks are now translating into slowing growth. We expect downward revisions to earnings estimates to come next. The first phase of the equity drawdown consisted of equity multiples derating, while risk premia rose in the second phase. We are now in the third phase of earnings downgrades; however, we are less certain about the magnitude. As a result, we have downgraded our equity positioning and are wary of European exposures due to the rising risk of a gas crisis. We are modestly overweight large cap relative to small cap companies. We continue to favor sectors with predictable and resilient profits.

The risk of a recession over the next twelve months is reasonably high, although we do not believe one is imminent. There remains a path to a soft landing, but the most likely outcome is a recession later this year or in the first half of 2023. We think risks to the global economy are tilted to the downside as geopolitical crises are colliding with high, and in many countries still rising, inflation.

Fixed Income

With increasing risks of a recession and credible inflation guidance from the Fed and other central banks, we are upgrading fixed income to an overweight. Our assumption is that the Fed won’t blink when it must make the choice between taking on the risk of a recession vs. living with higher inflation. We believe that the observed economic sensitivity to the repricing of interest rates year-to-date may be evidence in favor of lower neutral rates than feared in the U.S. economy, which supports our view that interest rates are biased lower from here.

Credit Markets

We think spreads are biased wider given the elevated probability of a recession and its implications for highly levered firms’ ability to service their debt. We believe high yield spreads will widen further from here and offset the now attractive levels of carry in the asset class.

Asset Allocation Views: The Bottom Line

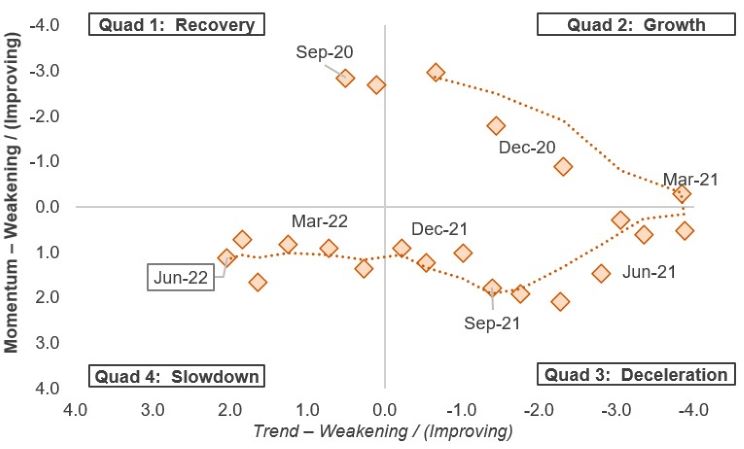

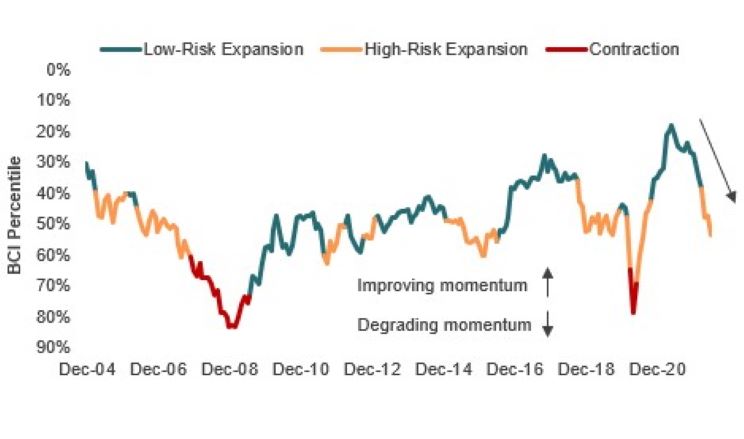

Economic momentum continues to weaken with a potential contraction on the horizon

We remain in a Slowdown as growth activity degrades

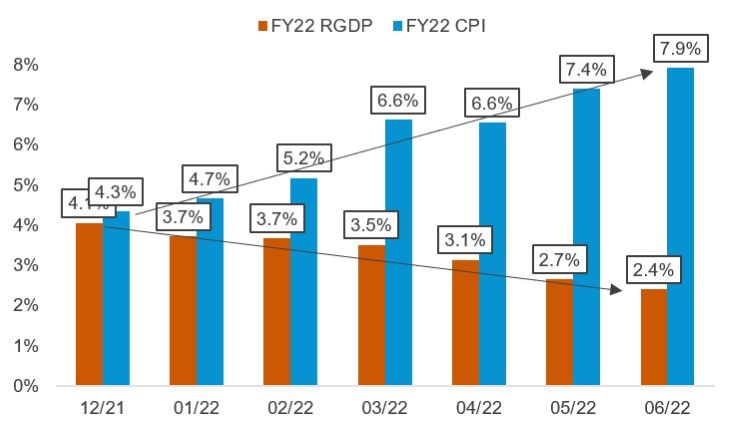

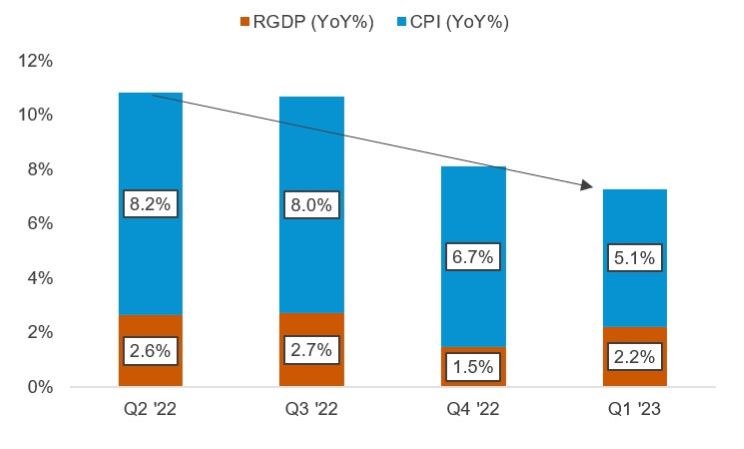

Inflation expectations have continued to rise while Real GDP growth expectations have fallen

Consensus sees CPI inflation elevated through the remainder of this year and into ‘23

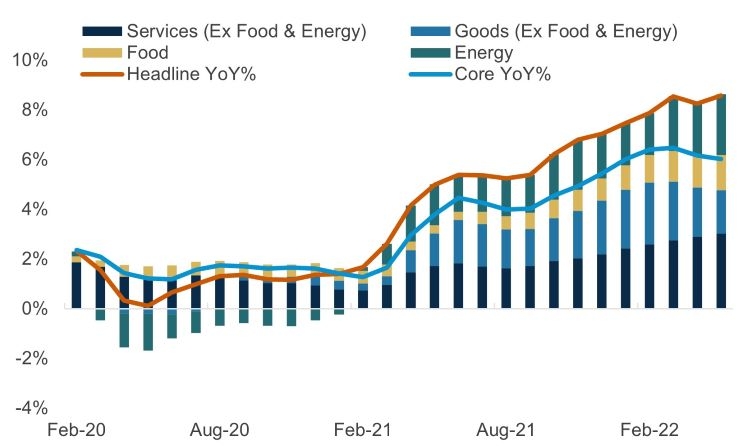

Inflation drivers have started to broaden out with a large contribution now coming from services

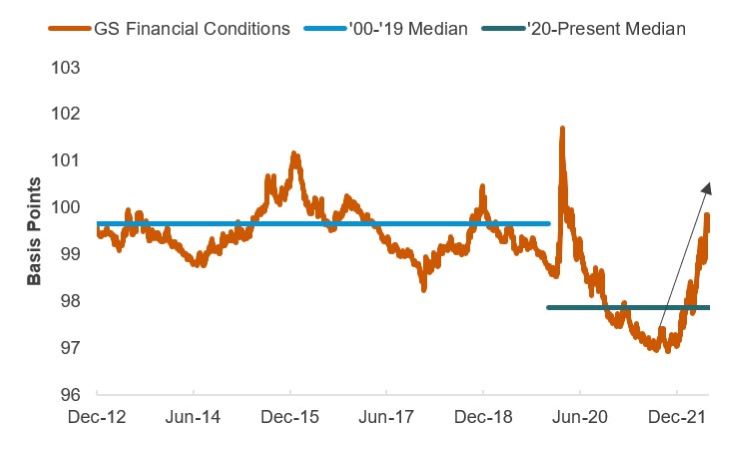

… though financial conditions have tightened dramatically from post-COVID levels

... and we’re starting to see signs of slowing in previously overheating parts of the economy…

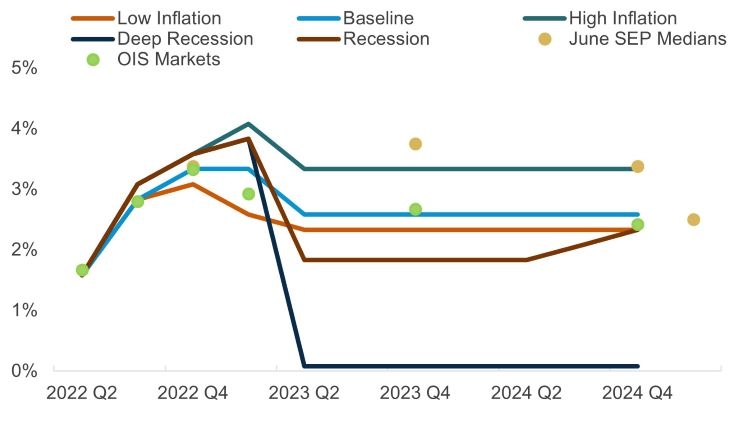

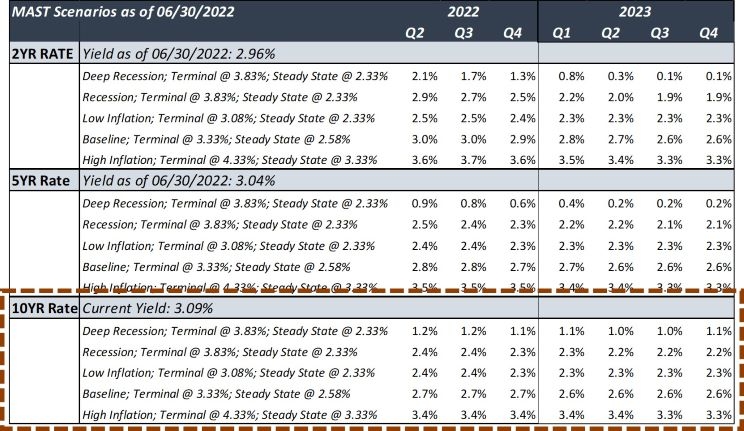

We continue to expect an aggressive Fed hiking cycle through the end of this year…

Increasing the odds of a Fed cut next year

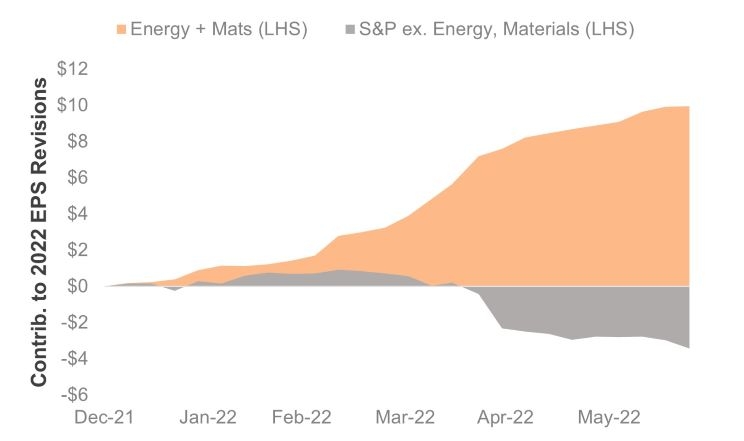

Upward revisions to commodity businesses have masked the downward revisions to everything else…

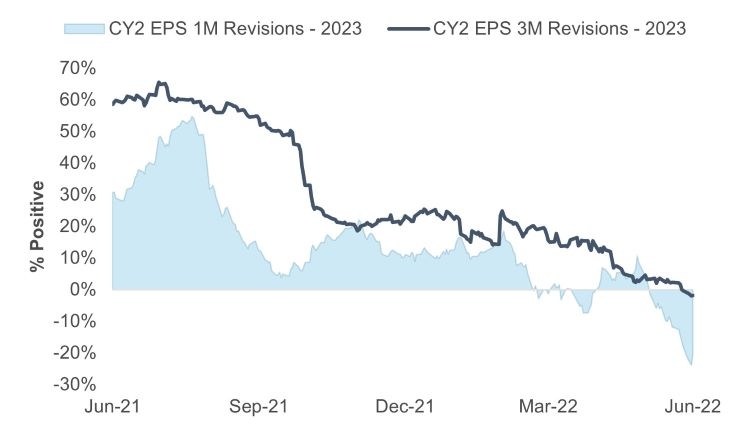

… and recently we’ve seen S&P EPS revision breadth go negative, a leading indicator for index level EPS

… therefore, it’s likely there is downside risk to EPS

Source for all charts: Harbor MAST, Bloomberg L.P., Factset; Data as of June 2022

Key Macro Views and Portfolio Implications

- The Fed will reduce inflation, even if a recession is the cost

- Tight financial market conditions will meaningfully slow the real economy, as weakness in the housing market is beginning to demonstrate

- Inflation and the labor market appear to be cresting; although it remains to be seen how much damage the latter will require to slow the former, we are confident there must be at least some

- Earnings revisions have remained resilient, but are starting to show signs of weakness; we expect meaningful downward earnings revisions from here

- With downward revisions coming, risk/reward favors an underweight to equities and a focus on profitability

- Confidence in the Fed’s pursuit of its inflation goal favors an overweight to fixed income as recession risks combine with lower inflation expectations to drive yields lower

- Credit spreads have more room to rise as growth concerns give way to debt sustainability concerns

- The possibility of an end to Russian gas exports to Germany heightens the risk of a severe recession in Europe and leaves us underweight

- Clearer signs of stimulus in China is a reason for optimism; however, the continued use of COVID-zero policies make it difficult to assess the sustainability of their recovery

Important Information

The views expressed herein are those of the Harbor Multi Asset Solutions Team at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. These views are not necessarily those of the Harbor Investment Team and should not be construed as such. The information provided is for informational purposes only.

Past performance is no guarantee of future results.

All investments are subject to market risk, including the possible loss of principal. Stock prices can fall because of weakness in the broad market, a particular industry, or specific holdings. Bonds may decline in response to rising interest rates, a credit rating downgrade or failure of the issue to make timely payments of interest or principal. International investments can be riskier than U.S. investments due to the adverse affects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets.

Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the value of an investment may go down. This means potential to lose money.

As interest rates rise, the values of fixed income securities are likely to decrease and reduce the value of a portfolio. Securities with longer durations tend to be more sensitive to changes in interest rates and are usually more volatile than securities with shorter durations. Interest rates in the U.S. are near historic lows, which may increase exposure to risks associated with rising rates. Additionally, rising interest rates may lead to increased redemptions, increased volatility and decreased liquidity in the fixed income markets.

Harbor MAST BCI Index Sources: Harbor MAST, Bloomberg, Institute of Supply Management, Federal Reserve, Bureau of Labor Statistics, Commodity Research Bureau, National Federation of Independent Business (NFIB), Caixin, European Commission, Japan Machine Tool Builder’s Association, Association of American Railroads, American Iron and Steel Institute, Department of Labor, Conference Board, University of Michigan, Redbook Research, National Association of Homebuilders, Mortgage Bankers Association

Harbor MAST BCI and Rate of Change Index Sources: Harbor MAST, Bloomberg, Institute of Supply Management, Federal Reserve, Bureau of Labor Statistics, Commodity Research Bureau, National Federation of Independent Business (NFIB), Caixin, European Commission, Japan Machine Tool Builder’s Association, Association of American Railroads, American Iron and Steel Institute, Department of Labor, Conference Board, University of Michigan, Redbook Research, National Association of Homebuilders, Mortgage Bankers Association.

Certain forecasts, estimates and returns are based on hypothetical assumptions. It is for informational and illustrative purposes only. This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy. The forecasts, estimates and return presented do not represent the results that any particular investor may actually attain. Actual performance results will differ, and may differ substantially, from the hypothetical information provided.

Indices listed are unmanaged, and unless otherwise noted, do not reflect fees and expenses and are not available for direct investment.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2315842